Opinion Focus

Supply chain issues are still snarling the food and beverage supply chain. Food processing equipment manufacturers are warning of lingering procurement delays and substantial order backlogs. Food and beverage processors will need to stay nimble and work closely with suppliers.

Food manufacturers have been dealing with several issues in the past two years. They have grappled with logistics bottlenecks, rising prices and a scarcity of key agricultural inputs. But now an extra layer is adding to the complexity as crucial equipment manufacturers warn of issues sourcing their components.

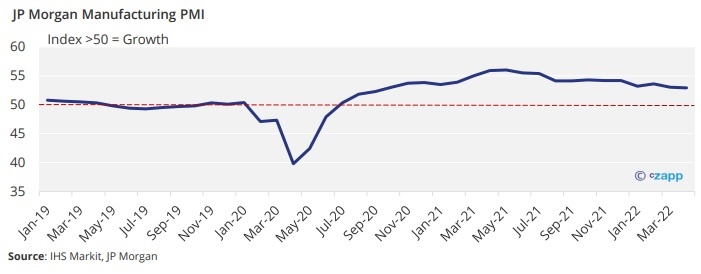

PMI Numbers Signal Manufacturing Slowdown

JPMorgan’s Global Manufacturing PMI for April posted 52.2 – a lower level than the 52.9 recorded in March and a level that only just signals growth. Business optimism was at a 19-month low, according to the report.

However, the report added that “capacity constraints across several pockets of the global economy combined with ongoing supply and distribution issues meant current demand was still sufficient to cause backlogs of work.”

So why is this important for food and beverage companies? The vast majority of the food we consume requires processing in some way. Even if the food isn’t processed, it is most likely packaged using manufacturing equipment.

Food processing equipment not only includes large processing machinery, but it also incorporates smaller, critical components including precision controls, pressure gauges, scales and weighing systems, thermometers and timers. And as equipment evolves and becomes smarter, microchips are becoming more and more important.

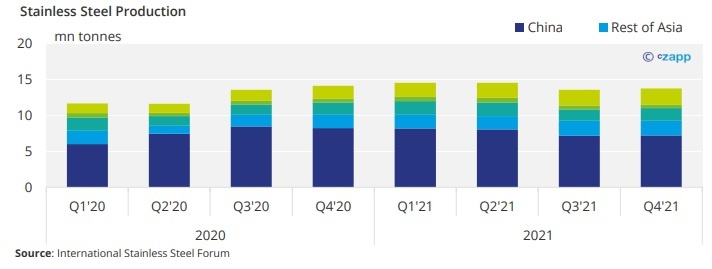

Stainless Steel Supply Under Pressure

Food processing equipment is most commonly made using stainless steel due to its strength, durability, temperature resistance, low maintenance and resistance to corrosion.

Availability of stainless steel has become a major issue for equipment manufacturers. Most stainless steel is manufactured in China, followed by the rest of Asia and Europe. According to the International Stainless Steel Forum, Asia as a whole accounts for almost 70% of global stainless steel production.

Chinese steel mills are now facing their own raw materials shortages. Chinese metals information provider Shanghai Metals Market (SMM) said in a report that a shortage of nickel, high costs and transportation limitations are forcing stainless steel mills to either stop or roll back production. Russian mining giant Nornickel has been caught in the crossfire of Russian sanctions, pressuring supply even more. The outlet expects May production to continue to decline.

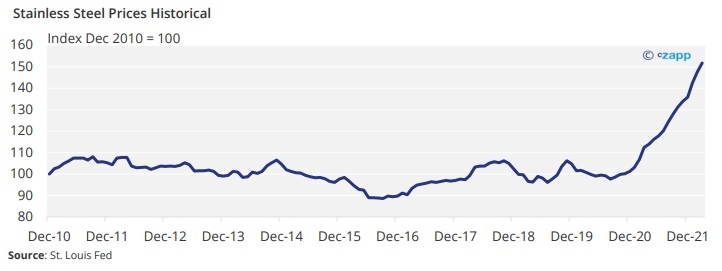

Since the end of 2020, stainless steel prices have consistently risen as a result of these raw materials shortages.

Microchips Add Extra Dimension for Manufacturers

As automation and digitization increases, equipment becomes more and more reliant on components such as microchips. The automotive industry has made noise about a chip shortage for several years but equipment manufacturers are also feeling the pressure.

As of March, lead times for semiconductor delivery reached a high of 26.6 weeks from 16 weeks a year earlier.

![]()

A Deloitte report published in December predicts that the semiconductor shortage will persist throughout 2022 and into 2023, when lead times will stabilise to between 10 weeks and 20 weeks.

For Swedish heavy equipment manufacturer Alfa Laval, one of the main risk factors for the group are the price development of metals. It says that, despite business continuity plans, sub-suppliers have experienced shortages of semiconductors for control panels and electronics for engines.

In its 2021 annual report, German food and beverage engineering corporation GEA said it experienced weak production growth “due to the shortage of raw materials and intermediate products such as semiconductors.” It adds that many machine manufacturers have been unable to process orders at the usual pace.

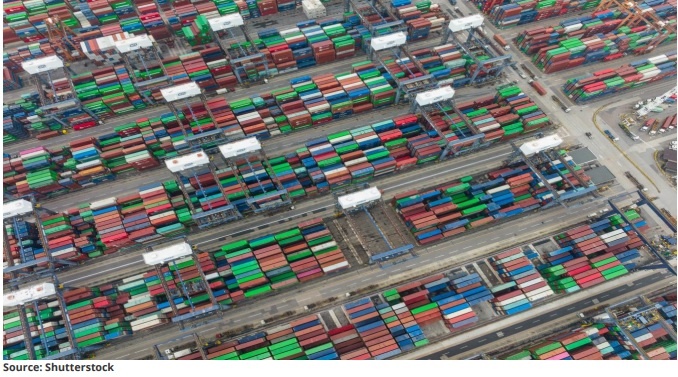

China’s Logistics Logjams Tie up Components

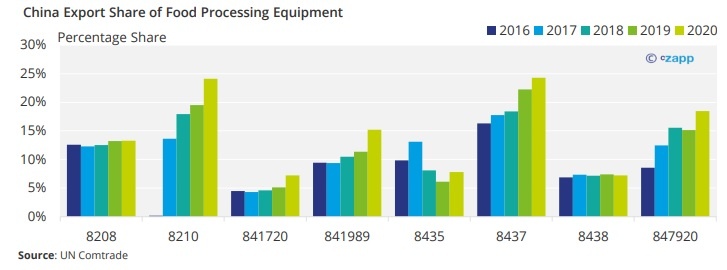

China is a major manufacturer. Among the components manufactured and exported are several items that are key to the food processing industry. As of 2020, China supplied about 12% of key global food processing equipment exports.

In S&P Global’s Asia Sector PMI reading for April, machinery and equipment posted a second successive monthly output decline. The rate of the decline was the fastest since February 2020 and the number of supplier delays were the second worst on record.

This means the current logistics logjams in China due to Covid-19 lockdowns are putting even more pressure on food and beverage processors seeking equipment.

“Due to lockdowns in mainly Shanghai in China related to COVID19 and the ongoing war in Ukraine, the risk for continued material and freight constraints is large,” says Alfa Laval in its most recent earnings report.

Food & Beverage Processing Order Backlogs Build Up

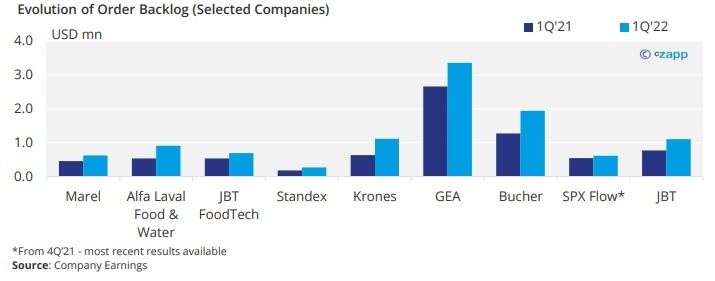

Order backlogs across the major food and beverage processing equipment suppliers have increased significantly in the first quarter of 2022.

Privately-owned Tetra Laval, which owns food and beverage packager Sidel, milking equipment manufacturer DeLaval and food processing and packaging firm Tetra Pak, acknowledged record orders received. Sidel’s order intake was up 42% year on year, while Tetra Pak’s processing division secured “all-time high” orders..

GEA has a significant order backlog of EUR 3.18 billion (USD 3.35 billion) at the end of the first quarter, up from EUR 2.5 billion at the end of 2021. At this point, the company was predicting lead times of 3.7 months for Farm Technologies, and as much as 9.3 months for Liquid & Powder Technologies.

Global technology group Bucher Industries said its order backlog continued to rise despite record levels at the end of 2021. “Even after deducting cancelled orders from Russia and Ukraine, the order backlog was extremely high at around CHF 50 million (USD 50.4 million),” it said. Bucher Industries manufactures agricultural equipment, as well as equipment for the production of wine, fruit juice, beer and instant products.

For global food processing machinery corporation John Bean Technologies (JBT), there is now a record backlog of $1.1 billion as of the first quarter of 2022.

German packaging and bottling machine manufacturer Krones’ order intake has grown 30.5% to a record high of EUR 4.3 billion but it added that materials are in short supply and prices have risen significantly.

Increased Spending Needs Impact Bottom Lines

In the short term, Icelandic multi-national food processing company Marel says revenue expansion expectations have been constrained. “Revenues are increasing, although below expectations mainly due to inefficiencies in availability of parts and absenteeism at an all-time high in the beginning of the quarter,” it said.

However, it is addressing the logistics problem by building up inventories to ensure timely delivery. At the end of the first quarter, the group had EUR 27.6 million in inventory built up – but this also ties up capital and cash flow. “Current supply chain challenges are resulting in inefficiencies in manufacturing and higher costs associated with timely delivery,” the group said.

US process technologies company SPX Flow estimates USD 14 million in revenue was delayed due to supply chain issues including lack of availability of component parts for the company’s finished goods and inefficient freight logistics.

The company has also increased spending to meet client needs, incurring an additional $1 million of premium freight expense and $1 million of costs for COVID-related labour inefficiencies. “In addition to these operational headwinds and the resulting incremental costs in the period, the company also incurred discrete expenses.

related primarily to adjustments to working capital accounts of $2 million and a $1 million last in, first out (LIFO) charge as a result of rising raw materials costs,” it said.

GEA expects EUR 120 million in cost increases in 2022 related to purchasing and procurement, which equates to between 2.5% to 2.9% of revenue.

US multinational manufacturer of food service equipment Standex expects a revenue decrease in the three months ended June 2022, but an increase in full-year earnings. This is mainly due to a $7 million to $9 million sales deferral due to the impact of China’s Covid lockdowns, although the realisation of these sales will depend on how the pandemic progresses.

And although Krones was able to avoid significant production downtimes the company says it faces internal challenges with procurement that it does not expect to be resolved soon. It says capital has been tied up and free cash flow declined year over year.

Companies Warn of Lingering Supply Challenges

As a result of all these factors, the companies making the food processing machinery are warning of long-term issues that could impact the entire food processing supply chain.

Tetra Laval Chairman Lars Renstrom (pictured above) said its 2022 results are difficult to predict due to supply issues and price rises. “The consequences of lack of semi-conductors, higher raw material prices and inflation makes it impossible to fully determine but the impact on customer demand and supply chains will be material,” he said.

Buhler, a supplier of grain augers, snowblowers, mowers and compact implements, was faced by “ongoing delays in new inventory shipments because of significant constraints caused by capacity limitations experienced by some of the key suppliers as well as innumerable delays of the component deliveries” during 2021 according to President of the company Marat Nogerov.

He adds that the group is working closely with its supply chain to ensure production lines continue to operate but warns issues will continue to impact operations well into 2022.

Krones’ outlook is cautious. “With a very large order backlog and production operating at full capacity, completing the machines and lines on time for our customers’ demands considerable effort from our workforce,” it said in its first quarter results. “That will not be easy, given the tight situation on procurement markets and in supply chains, which is expected to continue in 2022.”

Bucher acknowledged increasing difficulties in the supply chain and logistics as well as staff shortages. “The supply chain and logistics problems were accentuated, making production processes and delivery to customers more difficult.”

And although Tetra Laval envisions “good top-line growth” in 2022, it warns of challenges ahead. “Key supply shortages such as for semiconductors create uncertainty and require us to be far more agile to address customer demand,” it said in its 2021-22 annual report.

Concluding Thoughts

- Many companies that manufacture food and beverage processing equipment had to interrupt production in 2021 due to material shortages.

- Others are experiencing lower free cash flow due to higher inventory requirements.

- Increasing automation and digitalisation in the food processing industry means vulnerability to global supply chain disruption.

- Issues in China, as well as price rises and materials shortages, will continue to plague food and beverage processors throughout 2022.

- Machinery processors must ensure nimble procurement processes and diversified supply chains.