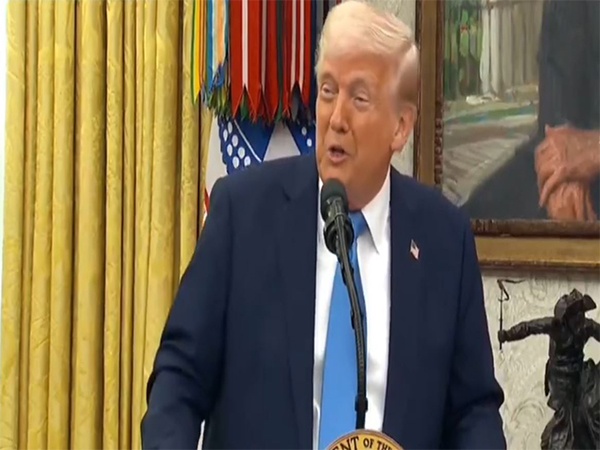

Two key House committees released draft proposals on May 12 for portions of a reconciliation budget package that President Donald Trump has referred to as the “big, beautiful bill.” The proposed legislation includes significant changes to clean fuel tax credits and funding for biofuel programs established under the Inflation Reduction Act (IRA), reports Ethanol Producer Magazine.

The House Ways and Means Committee’s proposal includes a number of changes to the Section 45Z clean fuel production credit. One key revision would limit eligibility for the credit to fuels made from feedstocks produced or grown within the United States, Mexico, or Canada. It also proposes changes to how greenhouse gas emissions are calculated, removing emissions linked to indirect land use changes from consideration.

For fuels made using animal manure, the proposal outlines that each type of manure—such as from dairy, swine, or poultry—would be assigned its own emissions rate for credit qualification.

The committee also proposes extending the 45Z credit through 2031, pushing back its current expiration date of December 31, 2027. In addition, the draft bill would block foreign and foreign-influenced entities from claiming the credit.

Meanwhile, the House Committee on Energy and Commerce has proposed repealing Section 60108 of the IRA. This section allocated funding to the U.S. Environmental Protection Agency (EPA) for work related to the Renewable Fuel Standard (RFS). The committee’s proposal would rescind any of that funding that has not yet been spent.

Under Section 60108, the IRA set aside $5 million to help the EPA develop tests and gather data to evaluate the environmental and health impacts of fuels and additives. Another $10 million was earmarked for grants and related activities to support investment in advanced biofuels. The Energy and Commerce Committee emphasized that the funds were not meant for EPA’s routine administration of the RFS but rather for data collection and research on greenhouse gas emissions and biofuel impacts.

The House Agriculture Committee is expected to release its draft portion of the reconciliation bill early this week. All three committees are scheduled to begin markup sessions on May 13, where members will debate and revise the proposals.

The proposed changes to the 45Z credit have drawn support from biofuel industry groups.

Geoff Cooper, president and CEO of the Renewable Fuels Association (RFA), said the extension of the 45Z credit and restoration of key tax benefits would help fuel domestic energy production and boost rural economies. “These tax policies can help support expanded production of American energy, accelerate technology innovation, and boost rural economies by creating manufacturing jobs and opening new markets for America’s farmers,” Cooper said.

Emily Skor, CEO of Growth Energy, echoed that support. “The 45Z tax credit is a critical piece of this puzzle, and we’re glad to see that lawmakers on the House Ways and Means Committee recognize its importance,” she said. Skor added that the proposal provides biofuel producers with the certainty needed to innovate and invest in long-term growth. She urged lawmakers to stay focused on ensuring that farmers and fuel producers have a stable policy framework moving forward.