• Sugar prices recovered on the back of technical and demand signals, easing concerns about ethanol detour in Brazil and possibly reducing buying interest from China.

• Despite this, the fundamentals remain bearish, and macro risks, such as new US tariffs and the devaluation of the real, could put pressure on the market.

• Good prospects in the Northern Hemisphere, especially regarding the development of planting in India, which increases pressure on long-term contracts.

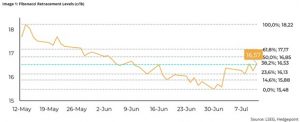

Sugar prices recovered last week, supported by data released on demand (Pakistan and the Philippines) in the latest Única report, and by broader fundamentals that suggest that the drop to 15.5 c/lb may have been an overreaction. Technical indicators such as the RSI and MACD have changed, pointing to a more bullish trend. Raw sugar prices rose back above the 38.2% Fibonacci retracement level for the first time since June, potentially signaling renewed buying interest.

“However, the fundamentals remain weaker than in the last three or four seasons, with the stock-to-use ratio starting to rebuild. While we agree that prices should be trading at higher levels (at least 17-18 c/lb), there are clear limits, making a return to the 2023-2024 highs unlikely,” notes Lívea Coda, Market Intelligence Coordinator at Hedgepoint Global Markets.

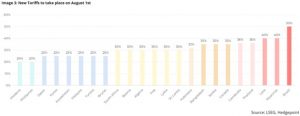

The analyst also points out that looking to the future, the macroeconomic scenario will be an important factor. Last Wednesday (9), the US government issued tariff notices to 23 countries, with rates ranging from 20% to 50%. The immediate effect on the dollar index was to rise.

The inflationary outlook, together with the strong labor market data released the previous week, shattered expectations of monetary easing, supporting the US currency in the short term. As a result, the dollar index remained firm, ending the week at 97.9, up 0.8% on the previous week.

On the other hand, the real weakened due to the high tariff imposed on Brazil and the fact that the US will account for 12% of Brazilian exports in 2024, falling back to the 5.57 level on Wednesday and to 5.54 at the end of the week, after the market had digested the announcement.

The analyst notes that, in the meantime, the combination of tariffs and political uncertainty has increased the market’s perception of risk in relation to the US. This could put additional pressure on the dollar index in the medium and long term, keeping it below the levels seen in previous years and potentially impacting the broader commodities market and supporting the appreciation of the real.

“Although tariffs have a limited impact on the sugar market, a devaluation of the real could be seen as bearish for sugar, as it could encourage higher export volumes from Brazil. This trend affected the momentum of the sweetener, which lost part of its gains on Thursday. However, most of the 2025/26 harvest has already been priced, limiting the impact of exchange rate movements on the short-term sugar contract,” she explains.

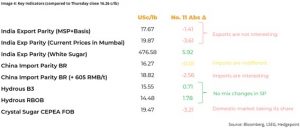

For the analyst, the recent recovery in raw sugar prices is particularly relevant. Previous concerns about a shift in the mix from sugar to ethanol in Brazil’s Center-South have diminished, especially after prices recovered above 16 c/lb, increasing their advantage against hydrous in the state of São Paulo. “Although some marginal adjustments may still occur in Goiás and Mato Grosso, their combined share of cane volume is around 13%, and they already operate with a lower sugar mix, restricting their impact on the aggregate mix,” she says.

Lívea Coda explains that the recent recovery in sugar prices has made the sweetener a little less attractive to Chinese buyers, who have been active since May, taking advantage of previously low prices. “Although this doesn’t rule out new imports, Chinese buyers, known for their cautious approach, may choose to postpone new purchases, especially as harvest prospects in the Northern Hemisphere continue to improve,” she says.

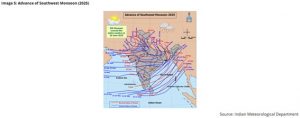

The monsoons have progressed well across India, and water reservoir levels remain healthy. The country has recorded higher plantings compared to last season and sugar production is expected to recover. However, export volumes remain dependent on government decisions and may only be authorized during the course of the season.

“Although we maintain a conservative export estimate of 500 kt, there is potential for volumes to reach up to 1.5 Mt, a result that would contribute to an even more bearish outlook for the global sugar market, increasing pressure on the March 26 contract,” she says.

Lívea Coda is the Market Intelligence Coordinator at Hedgepoint Global Markets. She has been working in the agricultural commodities sector for over 5 years, especially with quantitative and fundamentalist research on the sugar and ethanol markets.