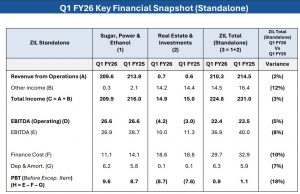

Zuari Industries Limited announced its audited financial results for the quarter ended June 30, 2025. On a standalone basis, the Company reported Revenue from Operations of ₹210.3 Cr, and Operating EBITDA of 22.4 Cr. Standalone Profit Before Tax (PBT), before exceptional items, was ₹0.9 Cr. On a consolidated basis, the Company posted Revenue of ₹ 267.6 Cr, a 10.5 % increase over Q1F25. The Consolidated Profit After Tax (PAT) stood at ₹0.5 Cr against a loss of ₹ 33.6 Cr Q1 FY25.

During the quarter, the Company’s sugar operations were affected by an early mill closure following a region-wide cane shortage. Domestic sugar sales stood at 3.6 lakh quintals, slightly lower than 3.8 lakh quintals in Q1FY25, mainly due to a reduced sales quota allocation. The sugar realisation improved by 4% to ₹4,036 per quintal, supported by robust demand and stable prices. Ethanol sales saw a marginal increase to 9,757 KL from 9,672 KL, accompanied by higher average realisations of ₹60.7 per litre compared to ₹58.9 per litre in the previous year. Power exports, however, were lower owing to the early mill closure. Demonstrating its commitment to farmers, the Company prioritised and cleared 100% cane dues in May 2025. In the real estate segment, the Company slowed land sales in view of an unfavourable local macroeconomic environment. The Company also reduced its cost of borrowing by 73 basis points yearon-year basis. The infrastructure subsidiary of the Company, Zuari Infraworld India Ltd (ZIIL), reported an EBITDA of ₹21.7 crore in this quarter, up 58.4% year-on-year basis. The Company is planning to build a robust business development pipeline of development management services in Bangalore, Hyderabad, Kolkata and Dubai which are identified as its key target markets. Meanwhile, the St. Regis Dubai project continued to progress ahead of schedule, with completion targeted for February 2026.

The financial services arm of the Company, Zuari Finserv Ltd (ZFL), reported an EBITDA of ₹2 Cr, up 17.6% year-on-year basis .The Insurance & Broking subsidiary of the Company, Zuari Insurance Brokers Ltd (ZIBL) reported an EBITDA of ₹3.2 Cr, up 33.3% year-on-year basis.

The engineering arm of the Company, Simon India Ltd (SIL), secured new orders worth ₹100 Cr during the quarter. Projects of ₹0.8 Cr were completed during the quarter, while projects of ₹148 Cr are currently in progress, with efforts directed towards timely execution.

In the Bioenergy segment, Zuari Envien Bioenergy Pvt Ltd (ZEBPL) a 50:50 joint venture between Zuari Industries Limited and Envien International reported steady progress on its 180 KLPD bioethanol project, which remains on track for completion in Q2 FY26.

Commenting on the results, Athar Shahab, Managing Director, Zuari Industries Ltd, said: “The first quarter is typically a quieter period for our Sugar, Power & Ethanol division due to the seasonality of the sugar business. Despite this, we achieved better realisations and higher ethanol output. The St. Regis Residences project in Dubai is progressing ahead of schedule, and Simon India has strengthened its order book while pushing forward with its digital transformation plans. Our upcoming bioethanol plant through our joint venture is moving towards completion as planned. The financial services businesses are also expanding their offerings and customer reach. We remain committed to growing our key segments – Sugar, Power & Ethanol, Real Estate, and Bioenergy -while focusing on land monetisation, operational efficiency, and cost optimization. Looking ahead, we see this year as one of disciplined execution and strategic expansion. We will continue to build leadership in our core sectors, scale promising businesses, and invest in sustainability and digitalisation to create long-term value for all stakeholders.”