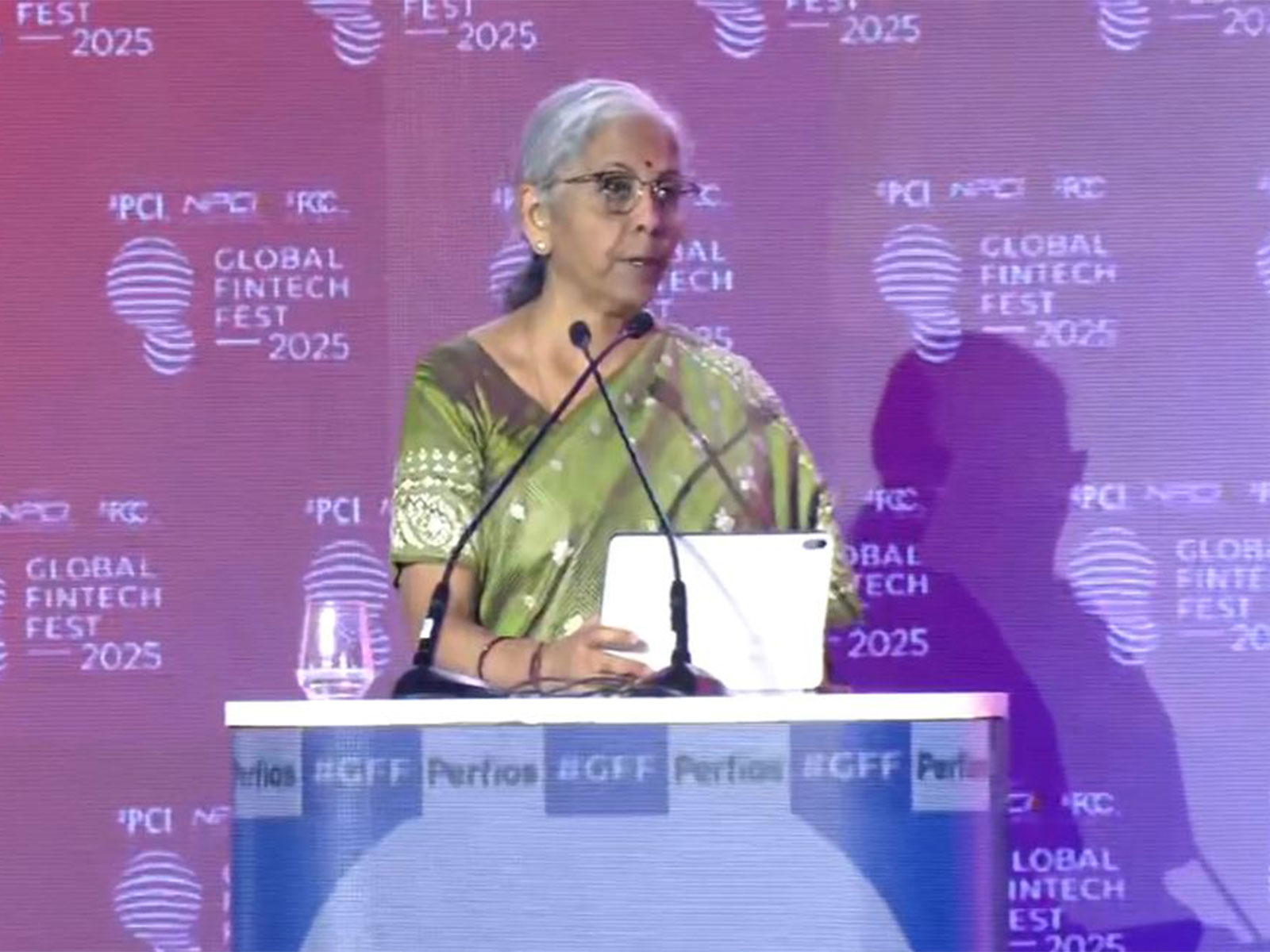

Mumbai (Maharashtra): Union Finance Minister Nirmala Sitharaman announced the launch of the Foreign Currency Settlement System (FCSS) at Gujarat International Finance Tec-City (GIFT City) on Tuesday.

Speaking at the inaugural speech at Global Fintech Fest (GFF) 2025 in Mumbai, Sitharaman said it is a significant step in India’s journey toward becoming a global financial and fintech hub.

The system will allow real-time settlement of foreign currency transactions within the International Financial Services Centre (IFSC), reducing the existing lag of up to 48 hours, she added.

Sitharaman described the initiative as “a forward-looking step” that places GIFT-IFSC among select financial centres such as Hong Kong, Tokyo, and Manila with localised foreign currency settlement systems.

She said that the new system will enhance liquidity management, improve operational resilience, and ensure compliance under the Payment and Settlement Systems Act.

Sitharaman noted that the launch of the FCSS complements India’s broader mission to strengthen its fintech ecosystem through innovation, regulation, and infrastructure.

“Together, these initiatives illustrate how the Government of India has laid the groundwork for a vibrant, inclusive, and forward-looking fintech ecosystem,” she said.

The FM highlighted the government’s efforts to boost India’s AI talent pool through the “India AI Mission,” positioning the country as a global hub for artificial intelligence-driven innovation.

She stated that India contributes 16 per cent of the global AI talent and ranks among the top three AI talent markets globally. By 2028, AI-enabled Global Capability Centres (GCCs) are expected to contribute 30-35 per cent of India’s AI services revenue, she added.

The minister urged fintech companies to leverage AI, blockchain, and intelligent finance to design better, more transparent, and risk-predictive products. However, she also cautioned about AI’s potential misuse, citing her own experience with deepfake videos.

“The new generation of fraud is no longer about breaching firewalls, it’s about hacking trust,” she cautioned.

Commending SEBI and NPCI’s initiatives like the ‘@valid’ UPI handle for verified payments and the ‘SEBI Check’ system to verify intermediary credentials. Sitharaman emphasised the need for responsible technology use and cybersecurity safeguards in the fintech sector.

Delivering four key messages, Sitharaman urged fintech firms to prioritise fundamentals such as profitability, compliance, and innovation. Prioritise safety and trust as fintech revenues globally approach USD1.5 trillion by 2030. Embrace responsible regulation, address financial inclusion gaps for MSMEs, women, and gig workers, and promote green finance for sustainable growth.

Concluding her address, Sitharaman reflected on India’s technological journey, from the first mobile call in 1995 to the present day’s digital revolution, and urged collective action against emerging threats, such as deepfakes and AI-based fraud.

“Our national mission must be to create a system that is not only the most innovative and inclusive but also the most trusted and resilient,” she said. (ANI)