TruAlt Bioenergy Limited, one of India’s largest biofuels producers and the country’s largest ethanol player by installed capacity, announced its financial results for the second quarter and first half of the financial year ended September 30, 2025 (Q2 and H1 FY 2025–26). The consolidated unaudited results have been prepared in accordance with IndAS as notified under the Companies Act, 2013.

Operational Update: A Quarter of Planned Transition

Q1 and Q2 FY26 marked an intense phase of transformation across TruAlt’s ethanol platform. The Company progressed its dual-feed integration initiative across 1,300 KLPD out of its 2,000 KLPD installed capacity, covering three of its five manufacturing units in Karnataka. These integrations required a series of planned, safety-driven shutdowns, resulting in temporarily lower capacity utilisation and production volumes.

The quarter also saw commissioning pauses, equipment realignments and process stabilisation, all of which formed critical steps in shifting from a mono-feed, season-linked operating model to a year-round, near-continuous operations model. Despite having installed capacity, OMC allocations and assured feedstock, the temporary shutdown was a deliberate strategic call to break out of seasonality. Expanding from 140 to 300–330 operating days, TruAlt is increasing its uptime by 114 to 136%.

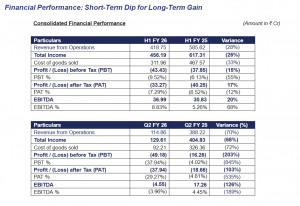

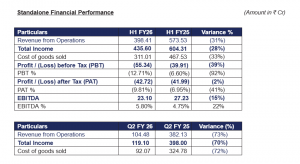

Despite undertaking a 3.5-month planned shutdown for dual-feed integration, TruAlt delivered a stronger H1 bottom line than the previous year’s first half, reaffirming the strength and continuity of our core platform. The CBG vertical, meanwhile, emerged as a clear outperformer, delivering breakout growth with H1 FY26 income of Rs. 20.70 crore and PAT of Rs. 9.71 crore, a 659% surge year on year. EBITDA rose to Rs. 13.89 crore, marking 286% growth, while EBITDA margins expanded to an exceptional 68.29 percent, up 130%, establishing CBG as one of TruAlt’s most compelling value-accretive businesses.

With dual-feed configuration now completed and feedstock accessibility widening across the network, TruAlt is structurally repositioning itself to operate closer to 330 days annually, compared to ~140 days under the earlier model.

Commenting on the Company’s financial and operational performance, Vijay Nirani, Managing Director, TruAlt Bioenergy, said: “Q2 and the first half of FY 2025–26 must be seen as the investment phase in TruAlt’s long-term transformation. We chose to build for a sustainable future rather than perform for the moment, and prioritised undertaking safety-driven shutdowns and commissioning activities across three of our largest units as part of the 1,300 KLPD dual-feed integration. These choices naturally impacted utilisation, throughput and profitability for the quarter, but they were deliberate, necessary and fully aligned with our long-term operating model. Once stabilised, these capacities will materially improve our feedstock flexibility, smoothen quarterly performance and take TruAlt closer to 330 operating days annually.

As these capacities throughput in Q3 and Q4, we expect sequential improvement in volumes, margins and cash flows. We remain firmly on track to deliver a more resilient model that is not tied to the monsoon or the sugarcane cycle. Our transformation is anchored in long-term value creation. We continue to support our ecosystem of farmers, partners and customers while strengthening our role in India’s clean energy transition.”

Strategic Partnerships and Growth Pipeline

Despite a transition-heavy quarter, TruAlt continued strengthening its long-term growth platform through strategic initiatives and partnerships.

Sumitomo JV Progress: TruAlt advanced its partnership with Sumitomo Corporation during the quarter, following the execution of the Share Purchase Agreement for the CBG joint venture. This collaboration establishes a long-term platform to build a national CBG network, beginning with four commercial plants under development and additional locations outlined in the JV framework.

Sumitomo is also supporting downstream CBG marketing and sales channels, enabling TruAlt to integrate larger CBG volumes into mobility and industrial markets. As this network scales, the CBG vertical is expected to become a meaningful contributor to medium-term earnings. Over the long term, both partners intend to explore opportunities across the broader biofuels landscape, including ethanol and Sustainable Aviation Fuel (SAF).

SAF Roadmap Strengthening

TruAlt is strengthening its SAF strategy by entering into an MOU with the Andhra Pradesh Economic Development Board (APEDB), Government of Andhra Pradesh, for a proposed Rs. 2,250 crore investment to develop a dedicated ethanol-to-SAF facility in the state. This step advances TruAlt’s presence in the emerging SAF value chain and reinforces its commitment to building a premium, future-ready biofuels portfolio aligned with global and national decarbonisation goals.