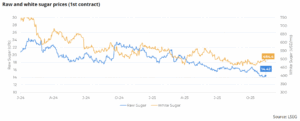

Sugar prices have been on a downward trend in recent months, experiencing a sharp drop between October and November. The March/26 raw contract reached its lowest level in five years in recent days, at 14.04 c/lb, while the December/25 white contract reached levels of 406 USD/Mt on Monday (10), the lowest level since December 2020.

Both contracts have seen a modest recovery since then, mainly focused on the macroeconomic scenario as the US nears the end of its longest government shutdown. Early last week, the Senate managed to pass a new funding package, confirmed by the House of Representatives on Wednesday (12), ending the 43-day shutdown. The resumption of government activity on Thursday (13) also gave some support to stocks and some commodities, such as sugar.

Brazil and India

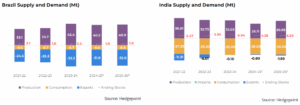

However, macroeconomic support tends to be short-lived, as sugar fundamentals remain bearish, with a surplus expected on 25/26. One of the main drivers for this is the better-than-expected production of the Brazilian crop after July.

“Although ATR (total recoverable sugar) remained below average levels, sugar crushing recovered after July, which led us to maintain our expectations of a total crushing of around 605 Mt of sugarcane, slightly lower than 24/25. As the mix also continued at higher levels – with a record in the first half of August – the accumulated sugar production for the 25/26 cycle surpassed the 24/25 levels at the end of September and should end the harvest on a high note,” says Laleska Moda, Coffee Market Intelligence analyst.

“Even with current parity levels favoring ethanol production, it is unlikely that the accumulated sugar mix will change significantly this cycle, due to the higher levels of previous months and the recent drop in oil prices. There may be some deviation in the states of Goiás, Mato Grosso and Mato Grosso do Sul, but this doesn’t tend to affect the overall sugar figures on 25/26, with our expectations around 40.9 Mt of supply,” says Carolina França, market intelligence analyst at Hedgepoint Global Markets.

But, according to analysis carried out by Hedgepoint Global Markets, Brazil will not be the only country to contribute to global supply as we approach the harvest season for the Northern Hemisphere. In the region, expectations remain positive for the main producers. “In Thailand, favorable weather conditions during the development of the crop reinforce our sugar production estimate of around 10 Mt. However, the weather continues to be monitored, as well as the intensity and possible effects of the La Niña phenomenon, especially with regard to the pace of the harvest,” says Laleska.

The outlook is also positive for India. According to recent ISMA estimates, the country is expected to produce 30.95 Mt of sugar, taking into account a 3.4 Mt detour to ethanol. As the planted area showed a marginal increase of 0.4%, the good production outlook is due to the development of sugar cane in the country’s main producing regions. Adequate rainfall and good reservoir levels have contributed to this expectation, in addition to other factors such as the greater volume of cane planted in Maharashtra, the slight increase in the area cultivated in Karnataka and the substitution of varieties in Uttar Pradesh.

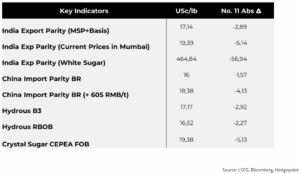

As for exports, the Indian government has authorized 1.5 Mt for the 25/26 cycle, in line with our expectations. Any changes in this volume could result from a change in the export regime, influenced by current international sugar prices and parity. However, domestic prices remain a relevant factor and could weigh on any adjustment.

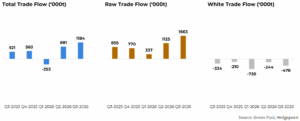

“Thus, we project a robust supply of sugar, something that is already reflected in the trade flow of the sweetener, with increased availability from other sources, such as India, probably offsetting the restrictions resulting from the Brazilian off-season in the coming months. As such, the market consensus points to a surplus scenario in the 25/26 cycle, which tends to limit significant price gains, considering the current context,” says Carolina.

Hedgepoint Global Markets is a company specializing in risk management, market intelligence and hedge execution for the global commodities value chain, with extensive experience in the agricultural and energy markets. It is present on five continents and offers clients hedging products based on technology and innovation, keeping the client at the center of all processes.