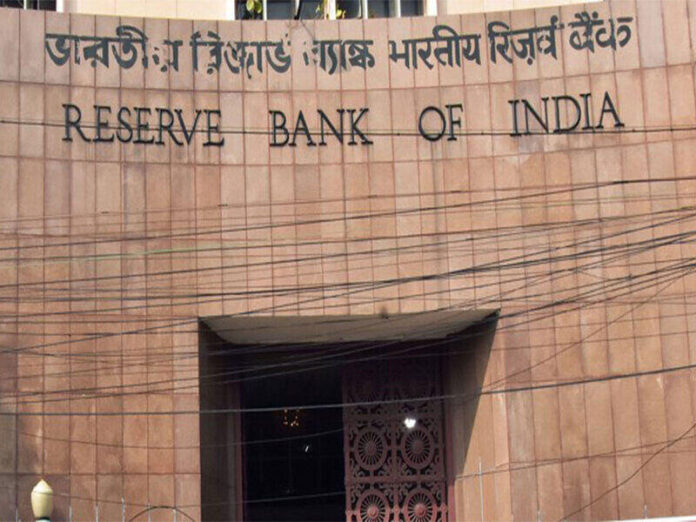

Mumbai (Maharashtra) : The Reserve Bank of India (RBI) is expected to maintain the repo rate at 5.50 per cent in its upcoming monetary policy announcement on Friday, according to a report by Bank of Baroda.

The report said the central bank is likely to retain its current neutral stance as well.

It stated, “We expect the RBI to keep the repo rate steady at 5.50 per cent in its Dec’25. The stance is also expected to be maintained at neutral”.

The report noted that India’s economic performance has remained strong, with GDP growth coming in at 8.2 per cent in the second quarter of FY26, surpassing market expectations.

The momentum is likely to have continued in the third quarter as well, supported by improved urban consumption and resilient rural demand. The report also pointed out that private investment is showing signs of recovery, aided by a pickup in credit demand.

On the inflation front, the report highlighted that price pressures have eased considerably. CPI inflation dropped to a series low of 0.25 per cent in October 2025, mainly due to a sustained decline in food prices. Inflation is expected to moderate further and could fall below the RBI’s own estimates.

The report also attributed the improved food inflation outlook to ample rainfall, timely supply-side measures, and better production trends.

While core inflation remains above 4 per cent, the report said this is largely due to higher gold prices rather than strong demand. The impact of this has been partially offset by the benefits of lower GST rates.

Despite the space opening up for a possible rate cut, the report stated that the RBI is likely to remain cautious in the upcoming meeting, especially as growth continues to remain robust.

The report also mentioned that the need for further monetary support could arise later, particularly if the current tariff-related challenges persist, it added. Maintaining the current rate will also allow more time for the effects of previous rate cuts to be fully transmitted through the system.

Given the recent economic indicators, the report expects the Monetary Policy Committee (MPC) to revise its growth projections upward. At the same time, inflation projections are likely to be revised downward.

In the October policy meeting also the committee of RBI kept the policy repo rate unchanged at 5.5 per cent in a unanimous decision.

The MPC meeting is scheduled for 3rd December to 5th December, while the policy decision will be announced on 5th December, with RBI Governor Sanjay Malhotra making the announcement at 10 AM. (ANI)