India’s sugar sector has made steady progress so far in the 2025–26 season, supported by adequate sugarcane availability, improved field-level productivity, and smoother operations across major producing regions.

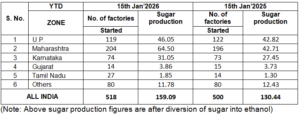

As of 15 January 2026, all-India sugar production has reached 159.09 lakh tonnes, showing an increase of nearly 22% compared to 130.44 during the same period last year. The number of operational sugar mills has also edged up slightly, with 518 mills currently crushing, compared to 500 mills at the corresponding stage of the previous season, according to the Indian Sugar & Bio-energy Manufacturers Association (ISMA) data.

Uttar Pradesh has produced 46.05 lakh tonnes of sugar, reflecting an increase of 3.23 lakh tonnes (around 8%) over last year by the mid of January.

Maharashtra has reported higher crushing rate this season, with sugar production reaching 64.50 lakh tonnes, representing a substantial improvement of approximately 51% over the same period last season. The state currently has 204 mills in operation, compared to 196 mills at the same time last year.

Karnataka has also recorded improved crushing momentum, with sugar production rising by about 13% compared to the corresponding period of the previous season.

Overall, the season so far reflects stable operational progress and a cautiously optimistic outlook for the industry.

The table below presents a state-wise comparison of sugar production for the current season vis-à-vis last year:

According to ISMA, following the increase in sugarcane prices by the Governments of Uttar Pradesh, Karnataka, Uttarakhand, Punjab, and Haryana, the Government of Bihar has also recently raised the Agreed cane price by ₹15 per quintal to Rs. 380 per quintal (For early variety). While these revisions support farmers, the widening gap between rising cane and sugar production costs and declining ex-mill sugar realizations is placing increasing pressure on mill finances and cane payment cycles. At present, ex-mill sugar prices in Maharashtra and Karnataka have further declined to around ₹3,550 per quintal, which is significantly below the current cost of production of sugar.

As the season advances and sugar inventories continue to build, indications suggest that cane payment arrears have begun to increase and may rise further if the current market conditions persist. The industry is experiencing mounting operational and cash-flow stress due to the continued mismatch between cane prices and sugar realizations. In this context, an early revision of the Minimum Selling Price (MSP) of sugar, aligned with rising production costs, would be critical to restoring financial viability, ensuring timely cane payments to farmers, and maintaining market stability—without imposing any additional fiscal burden on the Government, the sugar body further added.