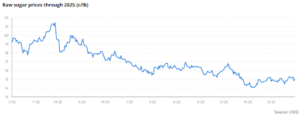

“Sugar prices remained under pressure in 2025 due to abundant supply from Brazil and other major producers, while India, despite weaker production in 2024/25, offered only limited support to global sweetener prices.

In 2025/26, India’s production accelerated sharply, reinforcing the global downtrend, although high domestic prices and a likely increase in MSP will restrict the viability of exports. Meanwhile, the stronger off-season and the stable outlook for cane and sugar in Brazil further limit any short-term upside,” says Lívea Coda, sugar analyst at Hedgepoint.

Indian production exceeds expectations

India’s 2024/25 production was lower than expected, with 26.1 Mt of net production after diverting 3.4 Mt to ethanol. The country exported 800,000 tons, with around 200,000 tons remaining to be loaded for 2025/26.

For the 2025/26 harvest, the results are significantly more positive:

-16 Mt produced between October/25 and January 15/26 (+20% on the previous year).

-176.4 Mt of cane crushed, up from 148.4 Mt in 2024/25, during the period.

-Increase in industrial efficiency to 9% (vs. 8.8%).

-Estimated net production of 31.8 Mt, with 3.7 Mt going to ethanol.

“The recovery in Indian production is strong and consistent. The improvement in crushing, yields and the pace of the harvest reinforces the bearish bias of the global market at the start of the year,” he explains.

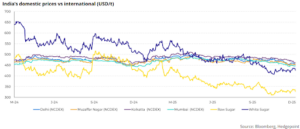

Exports: domestic prices close the arbitrage

Despite robust production, India’s export capacity remains limited:

-The government has already authorized 1.5 Mt in exports.

-There is potential for another 500,000 tons, but only if global prices become more competitive.

-The export parity is approximately 18.5 c/lb (raw sugar) and US$ 445/t (white sugar), levels that make new business unfeasible given the depressed international prices.

“The difference between domestic and international prices completely closes off arbitrage. Today, there is no economic incentive for Indian producers to export additional volumes,” he points out.

Possible increase in MSP could restrict exports

The Minimum Selling Price (MSP) has remained at 31 Indian rupees per kilogram (₹31/kg) since 2017, but both ISMA and NFCSF are pushing for an adjustment. The most discussed proposal suggests a rise to 41 Indian rupees per kilogram (₹41/kg), in line with rising production costs and the Fair Remunerative Price (FRP), which has risen significantly in the last six years.

“Any increase in the MSP further strengthens the domestic price and makes exporting even more difficult at current global levels. In other words, even when there is strong supply, the flow to the international market may remain restricted,” says the analyst.

Abundant global supply reduces India’s influence in the short term

Traditionally, the market would react more strongly to the advance of the Indian crop and the closed export parity. However, in 2025/26, Brazil is going through an off-season far from tight:

-Current estimate for the Center-South: 610 Mt of cane (up from the previous forecast of 605 Mt).

-Resilient productivity and the prospect of continued good performance next season.

This dilutes any bullish impact that India could have. In addition, macroeconomic factors also limit increases:

-Rupee devaluation may offset stronger domestic prices.

-Global oversupply reduces the market’s sensitivity to bullish news.

“International dynamics are working against a price recovery. Even potentially bullish news ends up having a moderate effect because the global fundamentals are still in ample supply,” he says.