India’s sugar production in 2025-2026 sugar season is seen as lower than expected, despite the industry-wide stance on a good sugar production season.

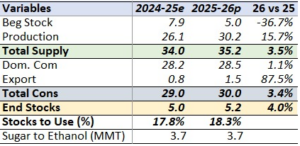

AgriMandi.live, the research arm of JK India eAgriTech, has estimated India’s total sugar production for the 2025-2026 season at 33.9 million metric tonnes (MMT). With around 3.7 MMT expected to be diverted toward ethanol production, net sugar availability is projected to remain at approximately 30.2 MMT.

The total estimated sugar availability for the season is projected at 35.2 MMT, which includes a carry-forward stock of 5.0 MMT. For the 2025–26 sugar season, AgriMandi.live projects the closing stock at around 5.2 MMT, factoring in domestic consumption of approximately 28.5 MMT and sugar exports estimated at 1.5 MMT.

AgriMandi.live believes that the deficit in sugar production is likely due to excessive rainfall in the early stage of growing sugarcane, causing premature flowering, particularly in Maharashtra and Karnataka. Traditionally, early flowering leads to lower sugar recovery rates, and this year has been no different.

In Maharashtra, the production outlook is further constrained by the likelihood of an early closure of the crushing season. Market feedback suggests that several sugar mills in the state may begin winding down operations from February 2026 onwards, owing to lower cane availability and weaker ratoon performance. An earlier-than-usual end to crushing would directly cap sugar output from one of India’s largest producing states, adding another layer of tightness to the overall supply balance and reinforcing the bullish undertone in prices.

The bad weather is compounded by a lack of uniformity in rainfall. Some areas experienced waterlogging, while others saw postponement of plantings and patchy ratoon performance because of delayed rains. The result is that the sugarcane harvest overall will be structurally weaker this time, both in acreage and recovery.

In particular, the market is making a little headway as the supply picture starts to lose all its earlier sense of abundance. After months of softening, prices in sugar seem to have become relatively stable.

The M-grade sugar is being sold in Muzaffarnagar (Uttar Pradesh) at ₹3,980 to ₹4,100 per quintal, while in Kolhapur (Maharashtra), the S-grade sugar is at ₹3,600 to ₹3,660 per quintal.

Market tones also recognise that production might not be able to comfortably outweigh consumption and diversion, and closing stocks are unlikely to be as padded as they were last year.

A pattern emerged for the 2025-2026 season. The sugarcane tale is increasingly susceptible to the vagaries of the climate.

Inclement weather, irregular monsoons, high temperatures, etc., are no longer isolated events. They carry structural risks that should be factored into both production planning and policy-making frameworks.

For the policymakers, the season represents yet one more tightrope walk between tightening policy and easing to get sugar mills better liquidity.

If the closing stocks for 2026 turn out to be closer to the AgriMandi.live’s forecasts, the Government would have little room to manoeuvre, as it has already made export commitments, and diverting sugar into ethanol is necessary.

For millers and farmers, the emphasis is now on ratoon management, fertiliser optimisation and regulation of water.

India is not seeing a shortage; it’s definitely moving into a tighter comfort zone. In all of this season, this sugar market is still entrenched in a state of inflexion as crops have fallen short, policies have grown more cautious, and some other world forces have turned into market signals in an unexpected manner.

The narrative of boom that defined the early months of the season is giving way to increasingly stringent policies, and it will be interesting to see how the government and industry touch the right chords to maintain the pitched note of developments and farmer welfare.

For further inquiries or to contact Uppal Shah, Editor-in-Chief, please send an email to Uppal@chinimandi.com.