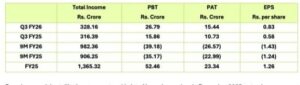

Dwarikesh Sugar Industries Ltd., today announced its unaudited financial results for the quarter and nine months ended December 31, 2025.

In Q3 FY26, the company reported Profit before tax (PBT) of Rs. 26.79 crore and Profit after tax (PAT) of Rs. 15.44 crore as compared to PBT of Rs. 15.86 crore and PAT of Rs. 10.73 crore reported during Q3 FY25.

Vijay S. Banka, Managing Director, Dwarikesh Sugar Industries Ltd., said that based on special satellite imagery captured in late November and early December 2025 to track sugarcane growth across various states, ISMA has maintained its gross sugar production estimate at 34.3 million tons with net production in excess of 30 million tons. However, these estimates remain subject to revision, as recent trends indicate lower yields across the country, leading to reduced cane availability and, consequently, lower sugar production.

Banka said that weather conditions play a crucial role in influencing both yield and recovery.

“At the start of the quarter, sugar prices were hovering around Rs. 4,100 per quintal. However, as the quarter progressed, prices softened and for a period fell below the Rs. 4,000 per quintal mark. Prices have since rebounded, with ex-factory sugar currently quoted at around Rs. 4,050 per quintal. Going forward, sugar prices are expected to remain firm,” he said.

He said that the sugar sales during Q3 FY26 amounted to 5.20 lakh quintals, compared to 4.99 lakh quintals in the corresponding quarter of the previous year. The average realisation from domestic sugar sales improved to Rs 4,013 per quintal during the quarter, as against Rs 3,772 per quintal in the same period last year.

For the nine months ended FY26 (9M FY26), sugar sales stood at 17.85 lakh quintals, marginally higher than 17.71 lakh quintals recorded in the corresponding period of the previous year. The average realisation on domestic sugar sales during 9M FY26 increased to Rs 3,977 per quintal, compared to Rs 3,793 per quintal in the corresponding period last year.

The company said that the sugar inventory as of 31 December 2025 stood at 8.21 lakh quintals, slightly lower than 8.27 lakh quintals as of 31 December 2024.

Industrial alcohol sales during Q3 FY26 were 12,432 KL, while sales for 9M FY26 stood at 34,081 KL, compared to 14,958 KL and 30,470 KL, respectively, in the corresponding periods of the previous year.

Banka said that while the company expects to conclude the season with improved recoveries, the overall cane availability, cane crushed, and consequent sugar production will largely depend on the yield of the plant cane crop.

“Both our distilleries are currently operating using B heavy molasses as feedstock. Continuous efforts in crop protection and varietal development are being undertaken to mitigate challenges arising from adverse weather conditions and red-rot infestation. With these initiatives beginning to show results, we are confident of regaining operational momentum by the 2026–27 season. We remain steadfast in our commitment to continually enhance operational efficiencies and maintain rigorous cost controls. Despite the inherent challenges posed by factors beyond our control, our dedication remains resolute in optimising operations and ensuring sustained performance,” Banka stated.