Dwarikesh Sugar Industries Ltd., announced its unaudited financial results for the quarter and six months ended September 30, 2025.

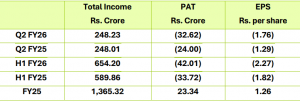

In Q2 FY26, the company reported a Loss After Tax (LAT) of ₹ 32.62 crore, compared to a LAT of ₹ 24.00 crore in Q2 FY25. For H1 FY26, the company reported a LAT of ₹ 42.01 crore, as against ₹ 33.72 crore in the corresponding period of the previous financial year.

Company’s sugar sales during Q2 FY26 stood at 6.03 lakh quintals, marginally higher than 5.97 lakh quintals recorded in the corresponding quarter of the previous year. The average realization on domestic sugar sales improved to ₹ 3,963 per quintal during the quarter, as against ₹ 3,767 per quintal in the same period last year.

Dwarikesh’s sugar sales during H1 FY26 stood at 12.65 lakh quintals, marginally lower than 12.72 lakh quintals sold in the corresponding period last year. The average realization on domestic sugar sales improved to ₹ 3,963 per quintal during H1 FY26, compared to ₹ 3,802 per quintal in the corresponding period of the previous year.

Sugar inventory as on 30th September 2025 stood at 3.68 lakh quintals, significantly lower than 5.59 lakh quintals as on 30th September 2024.

Industrial alcohol sales during Q2 FY26 were nil, while sales during H1 FY26 stood at 21,649 KL, as against 3,154 KL and 15,512 KL, respectively, in the corresponding periods of the previous year.

As on 30th September 2025, the company’s outstanding long-term borrowings stood at ₹ 111.36 crore, entirely pertaining to the distillery project at the DD unit. These borrowings are availed at a concessional rate of interest. The company enjoys long term rating of (ICRA) AA-(pronounced as AA minus). ICRA has also retained the highest rating of A1+ for the company’s CP program of Rs. 300 crores.

The results for the quarter and half year under review were adversely impacted due to a sharp decline in operational activities, as there were virtually no crushing operations during the period. The significantly reduced scale of operations resulted in under-absorption of fixed overheads. Further, the Company sold high-value inventory during the quarter, unlike the corresponding period of the previous year, which led to lower contribution and consequently impacted profitability.

Crushing operations for SS 2025-26 are expected to commence on 7th November 2025 at the Dwarikesh Nagar and Dwarikesh Puram units in Bijnor district, and on 10th November 2025 at the Dwarikesh Dham unit in Bareilly district. The Company remains optimistic about the forthcoming season, with expectations of improved crushing volumes and a more diversified varietal mix. Continuous efforts in crop protection and varietal development are helping mitigate challenges related to adverse weather conditions and red-rot infestation. With satisfactory progress on these fronts, the upcoming season is anticipated to deliver meaningful improvements in both crushing performance and sugar recovery, thereby supporting overall operational efficiency.