The shares of the prominent ethanol producer hit 20 percent upper circuit in today’s trading session after the company demonstrated strong performance in Q4 FY25.

Godavari Biorefineries Limited (GBL), a leading producer of ethanol and a pioneer in ethanol-based chemical manufacturing in India, demonstrated strong performance in Q4 FY25, with an EBITDA margin of 21.0% and a PAT margin of 16.6%, reflecting operational efficiency and strategic execution.

The shares of Godavari Biorefineries Ltd were trading at Rs 228.79 per share, increasing 20 percent as compared to the previous closing price of Rs 190.66 apiece.

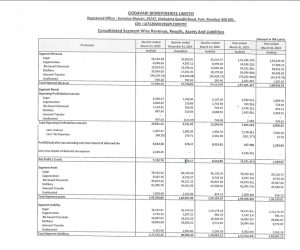

Revenue from operations stood at Rs 579.5 crore in Q4 FY25, compared to Rs 615.2 crore in Q4 FY24. EBITDA was Rs 121.7 crore, and Profit After Tax (PAT) Rs 96.4 crore.

Godavari Biorefineries continues to strengthen its bio-based portfolio and enhance operational capabilities. Strategic initiatives include:

- Over 2x EBITDA growth in Bio-based Specialty Chemicals

- Progress on 200 KLPD grain/maize-based distillery (Q4 FY26 commissioning)

- Record cane crushing of 24.65 lakh tonnes in SS 2024-25

- Multi-feedstock flexibility and product debottlenecking

Commenting on the Results, Samir Somaiya, CMD said, “FY25 was a defining year for Godavari Biorefineries, showcasing our agility, disciplined execution, and strategic progress. Our Bio-based Chemicals segment delivered over 2x growth in EBITDA, propelled by our shift toward high-value, sustainable solutions and enhanced operational efficiencies. We also achieved a record cane crushing of 24.65 lakh tonnes for sugar season 2024-25 at our Sameerwadi facility. The restoration of the ethanol blending programme using sugarcane juice enabled us to better utilize our ethanol capacity during the crushing season. Looking ahead, our 200 KLPD grain/maize distillery is progressing as planned and is expected to be commissioned in Q4 FY26. We are also exploring multi-feedstock options for greater flexibility, while undertaking debottlenecking and expansion initiatives focused on specialty products. FY25 has laid a solid foundation for future growth, and we remain committed to delivering value through innovation, sustainability, and disciplined growth.”