The sugar market went through another uneventful week, with little news to boost activity, especially on the bullish side. By the end of last Friday (6), raw sugar prices had fallen more than 3%, settling at 16.49 c/lb, a level not seen since June 2021, when prices were still recovering from the impacts of COVID-19 and a broader downtrend after years of surplus, according to analysis by Hedgepoint Global Markets.

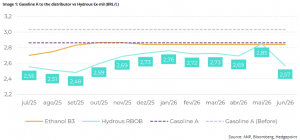

The downward correction began on Monday, June 2, after Petrobras announced a 5.6% reduction in the price of gasoline, effective the following day. As a result, the purchase price for distributors in Paulínia, for example, fell from just over R$3.00 to R$2.86.

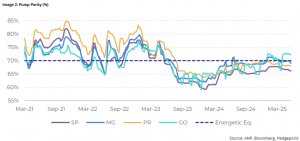

“This movement directly affects ethanol price expectations. As biofuel has around 70% of the energy content of gasoline, its price is closely linked to that of its fossil fuel counterpart. Lower gasoline prices therefore end up limiting ethanol’s upside potential, since reaching the equivalent energy price limit more quickly would cause consumer preference to return to gasoline, which is now cheaper,” explains Lívea Coda, Market Intelligence Coordinator at Hedgepoint Global Markets.

For the analyst, in terms of parity with sugar, ethanol remains subdued. At 14.75 c/lb, the sweetener continues to pay a premium over hydrous, at least in São Paulo. Although some other regions may have come close to an opening, no major impacts on the sugar mix are expected during the current season, especially since many exporters are already hedged at a level above current sweetener prices.

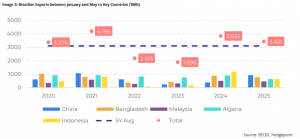

SECEX, Brazil’s foreign trade agency, released export data for May, showing a reasonable performance. The Center-South region exported 2.1 million tons (Mt), slightly above the historical average. When combined with the figures for the North-Northeast (NNE), total Brazilian sugar exports reached approximately 2.25 million tons in the month. Export volumes are expected to accelerate in June, contributing to supply availability in the short term.

“With regard to the main destinations, despite the ongoing discussions about slowing down the pace of purchases from China during the 2024/25 season, it is clear that Chinese purchases have still taken place, acting only when prices are extremely favorable, which may continue to be the case. On the other hand, Algeria, Indonesia and Bangladesh have reduced their purchases compared to last year. These volumes remain below typical levels, except for the years 2022 and 2023, when Brazilian supply was notably limited during the period from January to May,” analyst says.

Asia is also contributing to the fall in prices. Although heavy rains in India have raised concerns about possible delays in planting the 25/26 crop, no official agency has revised its forecasts. “In fact, recent reports suggest that India is likely to achieve a sugar surplus for at least two consecutive seasons. The prevailing consensus continues to project a net sugar availability of over 30 million tons for 25/26,” Lívea Coda notes.

Meanwhile, continued sugar exports from Thailand are increasing the downward pressure on the market, preventing any significant recovery in prices in the short term.

For Lívea Coda, in this sense, sugar prices continue to show weakness. Increased availability in the Northern Hemisphere and lower ethanol parity in Brazil are the main factors behind the prevailing bearish sentiment.

However, there may still be room for an upward push, especially in the run-up to the next UNICA report. The next release is expected to shed light on the pace of the harvest, especially since the number of crushing days lost in May was close to the seasonal average. “That said, as far as productivity performance is concerned, more reliable information is likely to emerge in June,” she concludes.

Lívea Coda is the Market Intelligence Coordinator at Hedgepoint Global Markets. She has been working in the agricultural commodities sector for over 5 years, especially with quantitative and fundamentalist research on the sugar and ethanol markets.