The Niti Aayog Report talks about the investment challenges and financing gaps in realising the full potential of the green movement in the country.

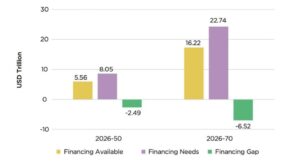

In “Scenarios towards Viksit Bharat and Net Zero: Financing needs”, the policy think tank mentioned that “India’s transition to Net Zero by 2070 requires USD 22.7 trillion in cumulative investment. However, current projections show only USD 16.2 trillion in available financing, leaving a USD 6.5 trillion gap”.

The financing gap grows from USD 2.5 trillion by 2050 to USD 6.5 trillion by 2070, signalling the rising cost of advanced, hard-to-abate sector decarbonisation in the post-2050 period.

Financing gaps: Sectoral breakdown

Power sector – 82% of the gap, driven by the need for large-scale renewable integration, grid upgrades, long-duration storage, and emerging clean technologies.

Industry – 13%, reflecting capital-intensive decarbonisation needs in steel, cement, and chemicals.

Transport – 5%. The report said that, despite being relatively smaller, this gap is significant due to rapid demand growth and technology shifts.

Bridging the gap?

The report underscores the indispensability of International capital in bridging the financing gaps for India’s Net Zero pathway. While external flows account for only 17% of energy transition finance today, this share must rise to 42% by 2070.

Key reasons:

- Limited domestic capital availability

- Risk of crowding out private investments

- Need for concessional finance for unviable Net Zero technologies

- Importance of grants in early-stage innovation, including advanced biofuels, SAF, green hydrogen, and waste-to-energy systems

- Foreign Direct Investment (FDI), institutional equity, climate funds, and green bonds will play a growing role in enabling India’s clean-energy leap.

Transport: Financing needs

The report said that USD 1.54 trillion is needed by 2050, while only USD 1.32 trillion is available. Thereby, showing a gap of USD 0.22 trillion.

Financing needs rise to USD 4.3 trillion by 2070, while the available balance reaches USD 4.01 trillion, hence the financing gap is USD 0.29 trillion.

Although proportionally small, the absolute numbers are large, reflecting the massive expansion required in:

- Electric mobility

- Biofuel blending and distribution

- Hydrogen infrastructure

- EV battery manufacturing and recycling

- Urban and freight electrification

Biofuels remain critical in this mix, especially for heavy-duty transport, agriculture, railways, and aviation.

Foreign Direct Investment (FDI), climate funds, institutional equity, and green bonds are expected to play a significant role in leading India’s clean energy transformation.