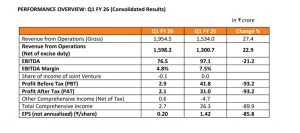

Triveni Engineering & Industries Ltd., one of the largest integrated sugar & ethanol manufacturers & engineered-to-order turbo gearbox manufacturers in the country and a leading player in water and wastewater management business announced its financial results for the first quarter ended June 30, 2025 (Q1 FY 26).

- The increase in turnover (net) during Q1 FY 26 is driven by 17% increase in sugar turnover and 48% increase in distillery revenues whereas the topline for engineering businesses was largely flat. While the growth in sugar turnover was on the back of 14% increase in volumes [including that of the subsidiary SSEL (Sir Shadi Lal Enterprises Limited) acquired on June 20, 2024] and 4% improvement in realization, the growth in distillery revenues was largely on back of strong volume growth, including due to full impact of new grain capacities commissioned in Q1 FY 25.

- Profit Before Tax (PBT) stood at ₹ 2.9 crore, significantly lower than ₹ 41.8 crore reported in Q1FY25. The drop in profitability (margins) was largely on account of lower profitability in the Sugar, Distillery and Power Transmission Business (PTB).

-The profitability of Sugar business, despite higher volumes and realization, was lower than last year due to higher cost of production (COP) of sugar sold in Q1FY26 resulting from lower recovery achieved in SS 2024-25.

-The profitability of the distillery operation was impacted by loss of Rs 2 crore (PBIT) in Distillery segment of the subsidiary SSEL and higher proportion of grain ethanol in overall mix, wherein contribution is lower, especially for FCI-rice which formed 27% of total alcohol sales.

-The profitability of the PTB was adversely affected by lower turnover, expenses incurred towards maintaining higher staffing levels to meet increased activities and higher depreciation on capitalization in respect of ongoing capex programme.

- The gross debt on a standalone basis as on June 30, 2025 increased to ₹ 1,385 crore as compared to ₹ 1,150 crore as on June 30, 2024. Standalone debt at the end of the period under review, comprises term loans of ₹ 320 crore, out of which loans of ₹ 180 crore are with interest subvention. On a consolidated basis, the gross debt is at ₹ 1,688 crore as on June 30, 2025 as compared to ₹ 1,279 crore as on June 30, 2024. Overall average cost of funds (standalone) is at 7.3% during Q1 FY 26 as against 7.1% in the previous corresponding period.

Commenting on the Company’s financial performance, Dhruv M. Sawhney, Chairman and Managing Director, Triveni Engineering & Industries Ltd, said: “As expected, the performance during the quarter was muted. During this period, the profitability of sugar gets affected as the off-season costs are expensed out and further, in Distillery, the margins of FCI-rice, which formed 27% of total alcohol sales, were relatively lower.

Looking ahead, I remain cautiously optimistic. Early monsoon trends have been encouraging and bode well for the agricultural sector, particularly for the sugarcane crop in UP. Our continuous field surveys indicate a healthy crop with minimal pest or disease incidence. These positive developments, combined with the efforts of our teams on varietal substitution, agronomic practice improvements, preventive measures for crop protection, improving plant efficiencies and better sales realizations, position us for an improved operating performance in FY 26. That said, these expectations are contingent on external factors such as moderate progress of the monsoon, minimal waterlogging, and low incidence of disease and pest outbreaks over next three months.

Encouragingly, we are now seeing a meaningful correction in input costs, particularly maize, and expect profitability to recover in the coming quarters. Earlier in the year, we had contracted FCI-rice as an alternate to high maize prices prevailing then but in view of correction in the prices of maize, maize operations presently are more profitable.

In our Engineering segment, PTB had a muted quarter due to the customary lower delivery urgency from customers in the first quarter and deferment of key orders. Despite this, I am pleased to share that PTB continues to gain traction across core markets. As of June 30, 2025, the order book crossed the ₹ 400 crore mark, standing at ₹ 423 crore—underscoring strong market momentum and providing healthy visibility for near-term performance. The Water business remains subdued due to limited market activity and delayed order finalizations. However, we anticipate an uptick in the coming quarters, with the business well-positioned in terms of bids and credentials.

Lastly, the proposed scheme of amalgamation with SSEL and the demerger of the Power Transmission business is expected to unlock value and drive operational efficiencies. This strategic move reflects our continued commitment to sustainable growth and long-term value creation for our stakeholders. We are currently awaiting regulatory approvals to move forward with the transaction.”