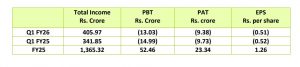

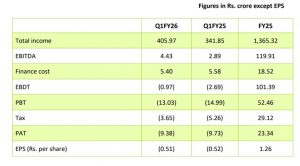

Dwarikesh Sugar Industries Ltd. announced its unaudited financial results for the quarter ended June 30, 2025. In Q1 FY26, the company reported Loss before tax (LBT) of Rs. 13.03 crore and Loss after tax (LAT) of Rs. 9.38 crore as compared to LBT of Rs. 14.99 crore and LAT of Rs. 9.73 crore reported during Q1 FY25.

Sugar prices, which were previously hovering around Rs. 4,000 per quintal in the earlier quarters, eased marginally during Q1 of FY 2025-26. However, there has been a rebound in sugar prices, with prices now nearing Rs. 4,100 per quintal. Looking ahead, sugar prices are expected to remain firm, according to the Dwarikesh Sugar.

Key numbers of P&L statement

Synopsis

Sugar sold during Q1 FY26 stood at 6.63 lakh quintals as compared to 6.75 lakh quintals of sugar sold during corresponding quarter last year. Average realization on domestic sugar sold during the quarter was Rs. 3,962 per quintal vis-à-vis realization of Rs. 3,833 per quintal during the corresponding quarter last year.

Sugar stock as on 30th June 2025 was 9.71 lakh quintals as compared to stock of 11.56 lakh quintals as on 30th June 2024.

During Q1 FY26, industrial alcohol sales stood at 21,649 KL as compared to 12,358 KL during the corresponding quarter of the previous year. Company has continued to make cane price payments ahead of schedule and has cleared the cane dues of SS 2024-25 in entirety.

On 30th June 2025, the company had outstanding long-term loans of Rs. 132.33 crore. Outstanding loan amount is in respect of loans availed for the distillery projects at DN and DD units. All the outstanding long-term loans are at concessional rate of interest.

The company enjoys long-term rating of (ICRA) AA- (pronounced as AA minus). ICRA has also retained the highest rating of A1+ for the company’s CP program of Rs. 300 crores.

The financial performance for Q1 FY26 was impacted by the early conclusion of crushing operations for the 2024-25 sugar season, with negligible sugarcane crushing and sugar production during the quarter. Additionally, distillery operations concluded in early June 2025. This truncated production period led to the under-absorption of overhead costs, which are typically distributed across active operational months when crushing and production are in full swing.

Looking ahead to the upcoming seasons, significant improvements are anticipated. There is growing optimism around higher crushing volumes and a more diversified varietal mix, driven by focused efforts in crop protection and varietal enhancement. These initiatives aim to address challenges such as adverse weather conditions and red rot infestations. Progress in these areas has been satisfactory, and the forthcoming season is expected to show notable improvements in both crushing and recovery rates, thereby contributing to enhanced operational performance.

Company says it remains steadfast in commitment to continually enhance operational efficiencies and maintain rigorous cost controls. Despite the inherent challenges posed by factors beyond our control, dedication remains resolute in optimizing operations and ensuring sustained performance.