The International Sugar Organization (ISO) presented its first revision of the global 2025-26 sugar balance. The ISO estimated that it expects a global sugar surplus of 1.625 million metric tonnes (mln tonnes) for the 2025/26 season, attributing the projected excess to an increase in production.

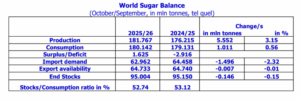

ISO’s fundamental view of the global supply/demand situation sees a global surplus (the difference between forecast world consumption and production) of just 1.625 mln tonnes, marking a swing of 1.856 mln tonnes from a modest global deficit reported in August. For 2024/25, the deficit has narrowed to 2.916 mln tonnes, driven by better harvest progress in major southern hemisphere producing countries. World production in 2025/26 is now estimated at 181.767 mln tonnes, up 5.552 mln tonnes from last season. Drivers include anticipated increased production in India, Thailand and Pakistan. World consumption is projected to reach 180.142 mln tonnes in 2025/26, up 1.011 mln tonnes on the previous season, while 2023/24 consumption is finalised at 181.207 mln tonnes, based on submissions from ISO members. These revisions show consumption in 2023/24 set an all-time high.

According to the ISO, shifts in trade dynamics remain a key market consideration. For 2025/26, global trade volumes are expected to remain steady with exports projected at 64.733 mln tonnes, up from 63.890 mln tonnes in August, and only marginally higher than last season. The trade flow outlook for 2025/26 is in surplus, as import demand is estimated at 62.962 mln tonnes, down from 63.768 mln tonnes in August. By comparison, 2024/25 trade statistics show a negligible surplus of 0.227 mln tonnes, with exports reaching 64.740 mln tonnes.

The ending stocks/consumption ratio for 2025/26 is estimated to fall to 52.74%. As has been the norm over the last year, the ISO has also been reporting an adjusted stock total figure to reflect losses in the refining process as well as stock updates from members. This pushes the global stock to consumption ratio to less than 43%, a 15-year low.

A summary of our world balance projected for 2025/26 and estimated for 2024/25 is provided below.

“Speculators maintained significant net short positions throughout 2025, peaking at a 6-year record net-short in September, although no CFTC report has been issued since September 23rd following the US government shutdown on October 1st. Based on the FAO monthly statistics, sugar is now the worst performing commodity in the index, with a current value below the base of the index, which covered the period between 2014 and 2016,” ISO said on market price update.

The internsational sugar body said, “The outlook for prices over the next three months is neutral as the 2024/25 trade deficit was resolved in part through stock releases in India, while the projected surplus in the 2025/26 cycle is still too modest to be significant, as harvest results only slowly become available and crop failures often only become apparent partway or at the end of harvests. Meanwhile, export programmes, for 2025/26, might not be fully operational subject to prevailing price levels and domestic market parities.”

Global ethanol production is projected to reach 122.0 bln litres in 2025 (up 2.3% from 119.2 bln litres in 2024), whilst consumption is expected to reach 121.7 bln litres (up 3.3% from 117.8 bln litres), with upward revisions driven by stronger offtake in India, Canada, and Colombia. US production is forecast at a record 61.45 bln litres supported by new trade agreements with the UK, EU, and others, whilst Brazil’s output is expected to decline to 33.34 bln litres as mills allocate a record-low percentage of cane towards ethanol. India represents the year’s most dramatic development, with production surging to 10.5 bln litres from 7.34 bln litres as the country pivots towards grain-based feedstocks (now over 60% of production) to meet its 20% blending target. European consumption continues expanding to 6.84 bln litres through higher blending targets and increased E10 availability, whilst Vietnam and Indonesia prepare for E10 and E5 mandates in 2026.