Sugar prices have come under marked pressure throughout 2025, driven by improved expectations regarding global availability

Raw sugar started the year at 19.5 c/lb, peaking in February amid deteriorating prospects for India’s 2024/25 crop and rising concerns about the performance of Brazil’s Center-South region in 2025/26. However, prices retreated as Brazilian production proved more resilient. According to Hedgepoint’s market intelligence coordinator, Lívea Coda, despite challenges such as lower than expected cane yields and quality, Brazil’s crushing is expected to exceed 600 Mt, a solid result compared to previous harvests, especially when combined with a record sugar mix.

“This result, together with the favorable conditions for the 2025/26 harvest in the Northern Hemisphere, led to a market adjustment. Prices have stabilized at around 16.5 c/lb, reflecting expectations of increased supply compared to previous harvests. However, persistent global demand for sugar prevented prices from remaining at the June low of 15.5 c/lb,” she explains.

The analyst recalls that during June, speculation intensified about a possible shift away from ethanol in Brazil’s Center-South region. However, sugar prices remained attractive, especially in the main producing states of São Paulo and Minas Gerais, which continued to boost the sugar mix to exceptionally high levels, mitigating any significant risk of reductions in the mix result.

At the 15.5 c/lb level, Chinese demand returned to the market, positioning China as the main buyer of Brazilian sugar during May, June and July. With arbitrage opportunities open, China strategically increased its stocks, taking advantage of the surplus in the period, despite having had a year of strong domestic production.

“We expect trade flows to remain bearish, with a projected surplus of more than 2.5 Mt between the third quarter of 2025 and the third quarter of 2026. While seasonal factors, such as the off-season in Brazil and low domestic ethanol stocks, may offer some support to prices, the projected surplus between the third and fourth quarter of 2025 is likely to dampen any significant recovery momentum in prices that may occur in early 2026,” she says.

Additional pressure comes from increased global availability, particularly from countries such as India, where export volumes could increase substantially depending on government decisions – note that 2 Mt has already been requested. This reinforces a bearish outlook for sugar.

However, according to the analyst, this does not mean that prices will fall abruptly or reach parity with ethanol. It simply suggests that a significant recovery, such as breaching the 20 c/lb threshold, seems unlikely in the short term. “A strong recovery in prices would probably require weather-related disruptions or relevant changes in fundamentals, either on the supply or demand side, to alter the current trajectory. For the time being, we don’t expect any significant changes,” she says.

Brazil CS

The 25/26 season is underperforming, largely due to the lingering effects of the 2024 fires and the drought at the start of 2025, despite the beneficial rains received at the end of last

year. These conditions have put pressure on the TCH and ATR results so far.

However, the Vegetation Health Index (VHI) has shown improvement as crushing has progressed, suggesting a possible resilience of productivity in the future. Past seasons, such as 12/13, 15/16 and 22/23, showed similar VHI trends and TCH recovery at later stages. These years also saw higher crushing volumes after the end of July compared to the long-term average, which allows us to expect some resilience in productivity and crushing in the region over the coming months.

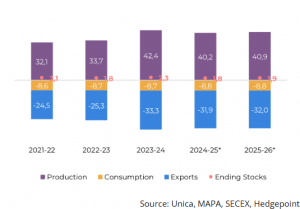

In terms of sugarcane numbers, we revised availability to 605 million tons. Although lower than initially expected, the result remains in the higher range of CS’s crushing volume over the years.

Despite discussions in June about ethanol detour, the mills are achieving a record sugar mix, which should reach 52%. This has offset some of the lower TCH and ATR results. We have therefore revised the ATR to 136.4 kg/t – a weak figure compared to the last 5 years.

As a result of the lower expectations for ATR, the slightly reduced TCH, closer to 76 t/ha, and a stronger sugar mix, sugar production is now forecast at 40.9 Mt, a drop of 650 kt, with exports estimated at 31.9 Mt, closely aligned with the 24/25 levels.

Brazil CS Ethanol

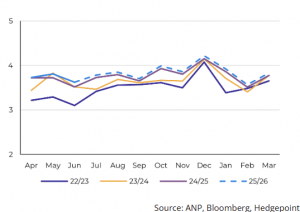

With regard to ethanol, the government announced a 3% increase in the blending target, raising it to 30% as of August 1st. Although this measure is widely seen as bullish for the market, expectations pointed to an earlier implementation in June. This delay, compared

to what was predicted not only by Hedgepoint but also by other analysts, provided partial relief for ethanol stocks.

The analyst explains that, however, given the deterioration of the harvest, especially the quality of the cane, ethanol stocks, which have already started the season under pressure, are likely to remain tight. This could lead to adjustments in the mix in states like Goiás and Mato Grosso, where ethanol usually has a competitive advantage over sugar.

The sugar mix in the Center-South region soared in July, breaking records and raising expectations for the index results, with São Paulo being one of the main drivers of this trend. “One contributing factor was the relief provided by corn ethanol, which led us to revise production to 9.4 billion liters,” she says.

“In addition, moderate gasoline prices have limited the competitiveness of ethanol in relation to sugar. The reduction in the spread between sugar and ethanol, which drove discussions in the market in June, was largely due to the weakness of sugar, rather than the strength of ethanol. In the end, sugar remained the most profitable option for the main producing states. As the harvest progresses, further changes in the mix will become increasingly difficult,” she explains.

Hedgepoint analysts point out that looking ahead, ethanol stocks are likely to remain tight – not critically low, but tight enough to suggest high prices during the period between harvests. This could weaken demand and provide additional support for sugar prices.

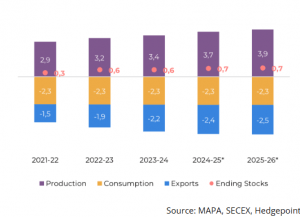

Brazil NNE

Sugar production for crop year 2024/25 (April-March) reached 3.75 Mt, driven by the crushing of approximately 58.4 Mt of cane. This was achieved with an ATR of 132 kg/ton and a sugar mix of 51%. “Looking ahead to 2025/26, a survey carried out by Hedgepoint with producers in the NNE region indicates a cane crushing projection of 60.6 Mt, almost 4% higher than the previous harvest. This figure is in line with Conab’s current estimate,” she explains.

Although some areas are experiencing above-average rainfall, which could slightly reduce ATR to around 131 kg/ton, this marginal drop is expected to be more than offset by increased cane availability and a higher sugar mix. The latter continues on an upward trend, supported by ongoing investments in the crystallization process.

As a result, sugar production in the region is currently estimated at 3.9 million tons, along with 2.2 billion liters of sugarcane ethanol. Taking into account the expansion of corn ethanol capacity, especially Inpasa’s investments, total ethanol production for 2025/26 could reach 2.75 billion liters.

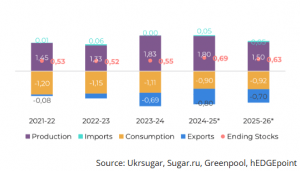

India

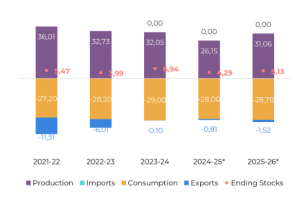

India’s sugar production in 2024/25 was below expectations, reaching a gross volume of approximately 30 Mt. After diverting 3.4 Mt to ethanol production, net sugar production stood at 26.1 Mt. As far as exports are concerned, the country exported 800 kt during the season, with the remaining quota of 200 kt able to be transferred to 2025/26.

Sugar Balance- India (Oct-Sept Mt)

(Source: ISMA, Hedgepoint)

For the analyst, looking ahead, the outlook for 2025/26 is more optimistic. “The abundant rains in May improved soil moisture and supported early crop development. Reflecting this, ISMA’s first estimate projects gross sugar production of close to 35 Mt. The deviation for ethanol should be between 4 and 4.5 Mt, resulting in net sugar production of between 30.5 and 31 Mt. Our current estimate is in line with the upper end of this range, at 31 Mt, with upside potential,” she calculates.

With regard to exports, Hedgepoint’s initial forecast was a conservative 500 kt. “However, taking into account the 200 kt unused in 2024/25 and ISMA’s request for the government to authorize around 2 Mt of exports, we have revised our projection to 1.5 Mt. At this level, India would continue to stockpile less than its three-month consumption target, a trend observed over the last five harvests,” she says.

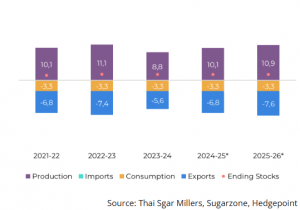

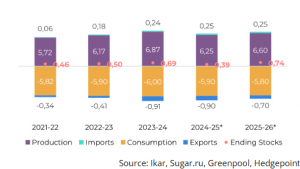

Thailand

Thailand’s sugar production reached 10 Mt in 2024/25, supported by an expansion in cultivated area and a partial recovery in productivity. Cane crushing increased by 10 Mt compared to the 2023/24 harvest, totaling 92 Mt, with more than 85% coming from fresh cane. Despite the increase in production, export volumes remained modest, in line with last season’s levels. In June, Thailand exported 3.57 Mt of sugar.

Of this total, raw sugar shipments increased by 18%, while white sugar exports fell by 14% year-on-year. However, we still expect total exports to reach around 6.7 Mt, as stock increases are not usually a typical behavior of the Thai market.

“Looking ahead to next season, we have revised our cane production forecast to 100 Mt. While this still represents a recovery, it is less pronounced than previously expected due to the risks of fungal diseases. On the other hand, weather conditions have been favorable, with above-average rainfall forecast for September and October in much of the country,” the analyst estimates.

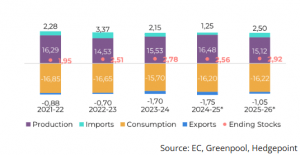

EU 27 and UK

Between 2022 and 2023, there was a significant increase in imports from Ukraine, which caused domestic prices to fall across Europe, even as exports from the continent increased during this period. This trend led to a decline in imports to 24/25, although not enough to secure the beet area. As a result, the European Commission estimates a 10.5% reduction in beet area. Including the relatively stable UK, our projection for the whole region reflects a 10% decline.

Despite some climatic concerns during the spring, beet development progressed well, with expectations of improved productivity. In the latest MARS report, the agency reduced its initial yield estimate by 2%, to around 74.8 t/ha. This level, although more pessimistic, remains 2% above the five-year average.

Germany suffered the most. The warm and dry spring, followed by an early start to summer, contributed to a greater number of diseases affecting root crops, with yields falling 5% below the five-year average and 11% compared to the 24/25 results. Poland and France, on the other hand, are expected to show an improvement on last season, of 3% and 2% respectively.

However, according to Hedgepoint’s projections, production in the region is still expected to fall compared to the previous year. The company’s outlook for the EU+UK points to a drop of 1.4 million tons in 25/26, which will probably increase the region’s import needs.

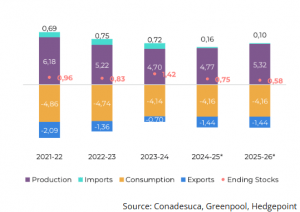

Mexico

The performance of Mexico’s sugar sector through July fell short of the market’s initial

expectations for the 2024/25 season and remains below current estimates. On July 19, cane crushing reached 45.6 Mt, slightly below Conadesuca’s fourth estimate of 46.3 Mt. This deficit directly affects sugar production, which currently stands at 4.7 Mt, probably close to the final figure. Even so, this volume represents a 1% increase compared to 2023/24, driven mainly by improved productivity both in the field and at the industrial level.

Although the agency has not yet released projections for 2025/26, the weather conditions offer grounds for optimism. In June, less than 2% of sugarcane producing micro-regions suffered some kind of drought, ranging from mild to severe. For Livea Coda, this suggests a potentially stronger result for sugar production in the next harvest, especially considering the favorable rains in May in most cane-growing regions and the positive forecast for August.

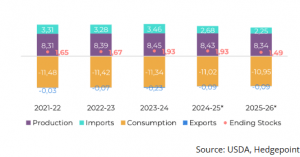

USA

The USDA reported that national sugar production in 2025/26 is expected to decrease slightly, from 8.43 Mtrv to 8.34 Mtrv. This drop is mainly attributed to the reduction in sugar beet production, as its productivity is expected to be slightly lower, offsetting the gains in sugar cane producing regions. As a result, sugar beet’s share of total production fell. In contrast, the area planted with sugar cane in Louisiana is expected to expand for the sixth consecutive year, marking the fourth year in a row that it will overtake Florida in planted area.

Despite the lower production outlook, total sugar availability in the US has been revised upwards. This adjustment stems from the reduction in consumption in 2024/25, which increased the estimated opening stocks for 2025/26. Weak demand for food-grade sugar is expected to persist into next season. Consequently, the USDA has reduced its import forecast, with sugar originating in Mexico facing the biggest reduction, of -208 ktrv.

Ukraine

According to local reports, the First Deputy Minister of Agrarian Policy announced a significant reduction in sugar beet plantings in Ukraine for the 2025 harvest. The area sown fell from 259,000 hectares in 2024 to 220,000 hectares, marking a reduction of 15.4%. This decline is largely a response to the reduction in import quotas from the EU, which was the most lucrative destination for Ukrainian sugar.

This trend could continue, as the EU has announced further quota cuts for Ukrainian products by July 2025 in response to concerns raised by European farmers. The quota for Ukrainian sugar has been set at 100 kt, a notable drop from quota-free imports of 400 kt in 2022/23 and over 500 kt in 2023/24, although still higher than the pre-war quota of 20 kt.

Due to the reduction in planted area, sugar production is now projected to reach just 1.5 Mt, which represents a 16.6% decline on the previous year. As far as exports are concerned, farmers have adjusted availability downwards, reflecting fewer destination opportunities.

Russia

As of August 11, 2025, operational data from Soyuzrossakhar indicates that 13 of Russia’s 66 sugar factories are currently processing sugar beet, 12 located in Krasnodar Krai and one in Stavropol Krai. Daily sugar production is 10.3 kt.

Since the start of the season (25/26), production has reached 74.2 kt of white beet sugar, 24 kt of dry granulated pulp and 18.0 kt of beet molasses. Another 15 factories are due to start operations this week.

Although adverse weather conditions have affected the southern region the most, the weight of beet in central Russia shows a healthy level compared to the 2024/25 harvest. According to Soyuzrossakhar, this trend supports a potential beet crop of 48 to 50 million tons in 2025.

According to the analyst, this volume suggests that sugar production could exceed the previous estimate of 6.4 million tons. “Our current projections are 6.6 million tons, with the possibility of an increase if there are no additional setbacks,” she calculates.

Preparations are also underway across the Eurasian Economic Union (EAEU): beet processing in Belarus is due to begin at the end of August, while Kazakhstan and Kyrgyzstan plan to start in the second half of September.

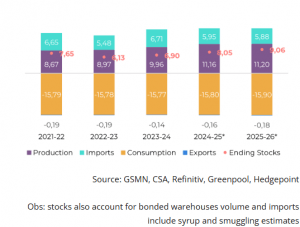

China

China’s sugar production in 2024/25 reached 11.16 Mt, supported by a planted area of 1.39 million hectares, an increase of more than 10% compared to 2023/24. Despite the

slightly lower productivity of 58.65 t/ha (combining cane and beet), total production increased by almost 12%.

Livea Coda explains that although expectations were high based on Brazil’s schedule and May deliveries, Chinese customs data for June showed less expressive import volumes, suggesting that part of the nominated cargo may have arrived in July – and indeed it did.

The country imported 740kt of sugar, a record for the period. With the favorable arbitrage for imports, China is expected to import more sugar than previously forecast, despite strong domestic production and a positive outlook for 2025/26. The Ministry of Agriculture has revised its import forecast for 2024/25 from 4.75 million tons to 5 million tons. Our current estimate includes 4.6 million tons of raw sugar and at least 1 million tons of syrup in sugar equivalent. Smuggling could still play a role, as seen in previous years.

So far, China’s sugar imports are 9% lower than in the previous season. However, we estimate that the volume expected to arrive between August and September will exceed last year’s by 13% over the same period. This increase should reduce the overall import deficit to just 4%. Taking syrup and smuggling into account, the deficit has the potential to be higher, estimated at 11%.

Looking ahead to 2025/26, the China Sugar Association projects production of 11.2 million tons, driven by a slight increase in planted area and improved productivity, estimated at 59.7 t/ha. The Association expects imports to remain stable and demand to increase marginally. Keeping imports stable between harvests implies an accumulation of stocks of around 1 million tons in our final figures.

Considering the generally favorable outlook for the 2025/26 season in the Northern Hemisphere and a solid result, albeit below initial expectations, from the Center-South region of Brazil, sugar prices may continue to favor stockpiling.

Lívea Coda is the Market Intelligence Coordinator at Hedgepoint Global Markets. She has been working in the agricultural commodities sector for over 5 years, especially with quantitative and fundamentalist research on the sugar and ethanol markets.