Triveni Engineering & Industries Ltd., one of the largest integrated sugar & ethanol manufacturers & engineered-to-order turbo gearbox manufacturers in the country and a leading player in water and wastewater management business, today announced its financial results for the fourth quarter & full year ended Mar 31, 2025 (Q4 & FY 25). The Company has prepared the financial results based on the Indian Accounting Standards (Ind AS) and as in the past, has been publishing and analyzing results on a consolidated basis.

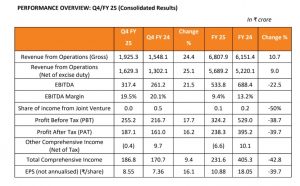

Net turnover for FY 25 is higher by 9%, driven by higher revenues across Sugar, Alcohol and Power Transmission businesses. Sugar business reported 2.8% increase in turnover over the previous year mainly due to higher realisation prices. The net turnover of Alcohol business increased 15.7% due to commissioning of a new multi-feed distillery at Rani Nangal and improved average realizations. Power Transmission business reported strong growth of 26.8% in its turnover. The turnover of water business declined marginally by 4.9%.

Profit Before Tax is 38.7% lower at ₹ 324.2 crore and Profit after Tax is at ₹ 238.3 crore.

Segment profits (PBIT) of Sugar business declined by 12.8% over the previous year due to higher cost of sugar sold during the year resulting from (a) higher cost of sugar produced in SS 2023-24 factoring in increased sugarcane price, and (b) higher cost of production of sugar produced in Sugar Season (SS) 2024-25 on account of lower recovery.

The profitability of the Alcohol business was adversely affected due to higher sales volume of ethanol produced from maize where margins were lower that substituted Surplus Food Grains (SFG), which was available till July 2023 at ₹ 20 per kg; lower sales volume of ethanol produced from molasses due to lower sugarcane crush and higher operations with C-heavy molasses and non-recovery of fixed expenses during the period the distilleries remained closed due to shortage of feedstocks and increase in internal transfer price of molasses. Further, the segment profits are net of segment loss of Sir Shadi Enterprises Limited (SSEL).

Power Transmission and Water business reported 18.4% and 4.4% growth in segment profits.

The gross debt as on March 31, 2025, on a standalone basis has increased to ₹ 1689.1 crore as compared to ₹ 1324.7 crore as on March 31, 2024. Standalone debt at the end of the period under review, comprises term loans of ₹ 328.44 crore, out of which loans of ₹ 201.8 crore are with interest subvention. On a consolidated basis, the gross debt is at ₹ 1969.2 crore as on March 31, 2025 as compared to ₹ 1411 crore as on March 31, 2024, including ₹ 202.6 crore pertaining to the subsidiary SSEL. Overall average cost of funds(standalone) is at 6.9% during FY 25 as against 6.5% in the previous year.

Commenting on the Company’s financial performance, Mr. Dhruv M. Sawhney, Chairman and Managing Director, Triveni Engineering & Industries Ltd, said: “The year gone by presented several profitability challenges to the Company especially in the Sugar and Alcohol businesses while our Power Transmission business delivered another year of stellar performance in revenues, profitability and order booking. The Company is hopeful of an improved performance in the coming year through proactive measures in our Sugar and Alcohol businesses.

Following the general trend of lower sugarcane crush and recoveries in the state of Uttar Pradesh, the sugarcane crush for the Company (on a standalone basis) in the just concluded Sugar Season (SS) 2024-25 was marginally lower at 8.19 million tonnes. The decline in crush took place in four sugar units: Rani Nangal, Milak Narayanpur and Chandanpur in the Central UP and Ramkola in the Eastern UP. The chief reasons are the climatic factors, such as, heavy rainfall and water logging in certain regions & spread of pests and red rot disease, which reduced the yields and recovery considerably. The sugarcane development teams have chalked out multi-pronged strategy to improve performance through intensive continued push for varietal substitution programme to reduce the proportion of vulnerable variety Co238, especially in low-lying/ water-logging prone areas and to substitute it by other high sucrose and high yield varieties. In addition, our focus would also be on crop protection through rigorous surveillance and large-scale preventives, extensive farmer engagement especially on nurtured demo plots to showcase higher yields, through superior agronomic practices.

Sugar prices have remained at healthy levels during FY 25, particularly in Q4 FY 25. We expect these trends to continue given the lower sugar stocks in the country on a year-on-year basis. We believe that a continually increasing portfolio of refined sugar and pharmaceutical-grade sugar production, which now stands at 73% of overall sugar production, augurs well for sugar realisations for the Company. We continue to make judicious investment in our facilities to enhance sugarcane crush rate, sugar quality and efficiencies.

In our Alcohol business, the Company commissioned a new multi-feed distillery during the year at Rani Nangal which boosted production over the previous year. However, the profitability was severely affected majorly due to low margin maize operations, lower sales volume of ethanol produced from molasses and non-recovery of fixed expenses during the period the distilleries remained closed due to shortage of feedstocks. In view of firm sugar prices, we switched operations in our sugar units (except one) to C-heavy molasses in the latter part of the season. While this strategy improves the overall profitability of the Company, it reduces the profitability of Alcohol business due to lower sales volume of ethanol. We are focusing on improving the sugarcane crush which will also help in increasing molasses availability and address supply chain issues relating to grain operations to improve the margin structure. With the option of three grain feedstocks – maize, SFG and Damaged Food Grains (DFG) – we are aiming to be nimble to seize all opportunities to lower procurement cost. We are also hopeful that the Government will address the feedstock and profitability challenges in various feedstocks as it remains committed to Ethanol Blended Petrol (EBP) programme with the formation of an inter-ministerial group to work on roadmap beyond EBP-20 i.e. 20% blending targets by 2025-26.

In our Engineering businesses, the Power Transmission business reported remarkable performance with new milestones achieved with respect to revenues, profitability and order booking in FY 25. During the year, the Company also secured multiple breakthrough qualification orders across targeted geographies and industries in Gears, enhancing its competitive positioning and supporting its strategic objective of expanding its global footprint. The business is also executing expansions to scale up operations to an annual capacity in the Gears segment alone to ₹ 700 crore (up from ₹ 400 crore presently) by September 2026. Our intensified marketing efforts globally coupled with the capacity enhancement programme are positioning us well for sustained growth. In the Water business, the year went by was muted in terms of market activity and finalization of orders. We expect this to improve in the coming years and the business is well-placed in terms of bids and credentials.

The proposed Scheme for amalgamation with SSEL and demerger of the Power Transmission business is awaiting approval of stock exchanges / SEBI. The Scheme is expected to enhance value discovery and operational efficiencies. This development reflects an ongoing commitment to delivering sustainable growth and long-term returns to our stakeholders.”