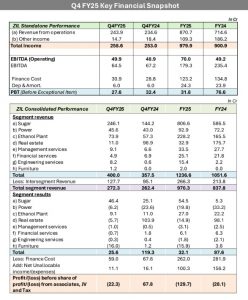

Zuari Industries Limited announced its audited financial results for the quarter and financial year ended March 31, 2025.On a standalone basis, the Company reported Revenue from Operations of ₹870.7 crore, a growth of 22% year-on-year. Standalone Operating EBITDA stood at ₹70.0 crore, up 42% over the previous financial year. Standalone Profit Before Tax (PBT), before exceptional items, was ₹31.8 crore. On a consolidated basis, the Company posted Revenue of ₹1,082.5 crore, a 1.4% increase year-on-year, and EBITDA of ₹161.3 crore for the financial year. The Consolidated Profit After Tax (PAT) stood at (₹94.4 crore), primarily on account of exceptional items.

The performance was driven by improvements across core businesses, particularly the Sugar, Power & Ethanol (SPE) division, along with contributions from subsidiaries and joint ventures.

SPE Division Highlights:

- Achieved highest-ever sugarcane crushing of 157 lakh quintals, up 11% y-o-y. • Produced 14.8 lakh quintals of sugar with an improved recovery rate of 10.61%.Milling operations commenced on 27 October 2024, the earliest startto date, supporting improved plant utilization. • Sugar sales grew 47% y-o-y to ₹602 crore, aided by improved realizations.

- Power exports rose 40% y-o-y to 9.1 crore units, generating ₹37.3 crore in revenue. • Ethanol sales stood at ₹226.2 crore, marking a 39% growth year-on-year.

These results reflect the impact of focused efforts on cane development, operational improvements, digital initiatives, and strategic planning.

Other Business Highlights:

- Real Estate (REI): Land monetization remained subdued due to regulatory uncertainty on circle rates in Goa.

- Zuari Infraworld India Ltd.: Achieved full sell-out of the St. Regis Residences project in Dubai. The company transitioned to an asset-light model, taking on Development Management mandates for projects in Hyderabad and Kolkata.

- Simon India Ltd. (SIL): Reported revenue of ₹15.4 crore. SIL is preparing to scale operations in the fertilizers and chemicals sector.

- Financial Services: Zuari Finserv Ltd. reported a 17% y-o-y increase in revenue. Zuari Insurance Broking Ltd. posted 22% growth in revenue.

- Zuari Management Services Ltd. (ZMSL): Expanded Business Advisory Services, successfully completing a market entry strategy for a UK-based client.

- Zuari Envien Bioenergy Pvt. Ltd. (JV): The 180 KLPD bioethanol project achieved 76% completion and remains on track for commissioning by September 2025.

- ZIAVPL (JV): Renewed its service agreement with oil marketing companies with a revised fee structure, enabling long-pending infrastructure upgrades.

Throughout FY 2024-25, the Company remained focused on integrating technology and digital solutions to enhance operational efficiency across business verticals.

Commenting on the Results, Athar Shahab, Managing Director, Zuari Industries Ltd, said: “Our financial performance for the year reflects the progress we have made in enhancing operational efficiencies, optimising resources, and executing our strategic priorities.

The Sugar, Power & Ethanol division delivered a strong performance, supported by timely operational improvements and cane excellence initiatives. Our subsidiaries and joint ventures also contributed meaningfully, with key milestones achieved across real estate, financial services, and industrial ventures.

While external factors continue to shape the business environment, we remain focused on long-term value creation through prudent capital allocation, technology integration, and operational resilience. Our focus will remain on strengthening core businesses while leveraging opportunities for future growth across segments.

We are confident that our integrated approach, supported by the dedication of our teams, will help us build a more agile, sustainable, and future-ready organization.”