Insight Focus

Globalisation may retreat further in 2023. If so, this is inflationary over the long term. Cheap energy & energy efficiency will remain important this year.

We can’t be the only ones approaching 2023 with trepidation. The 2020s have been a difficult decade so far:

- 2020 brought the COVID pandemic,

- 2021 brought disruption to supply chains around the world,

- 2022 brought industrial war back to Europe.

That’s plague, war and death so far. Which of the four outriders of the apocalypse will make an appearance in 2023..?

If like me you’re hoping for a less dramatic year, here are some things to look for (and what they mean for the sugar, ethanol and biomass markets).

Don’t Fight the Last War

Let’s start with what’s already happened, because it’s unlikely to play out in the same way in 2023.

COVID is Old News

The last zero-COVID holdout, China, has abruptly changed policy.

Sadly, people will continue to become seriously ill and die from COVID, as they do with many other human respiratory illnesses. But barring a new deadly variant it’s extremely unlikely that governments around the world will resume lockdowns and other restrictions.

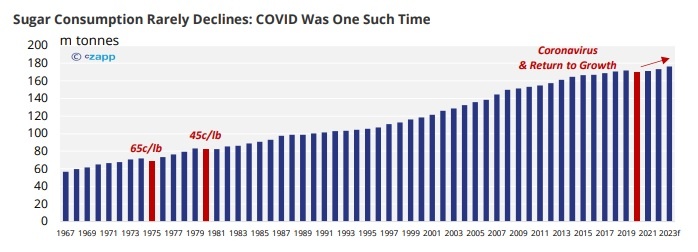

Lockdowns hit out of home consumption: sugar was affected around the world as people stopped drinking soft drinks at sports events, theatres, cinemas and restaurants. It’s socially acceptable to drink a litre of soda in a cinema but less common to do so at home while watching Netflix. This means sugar consumption in 2023 should continue to grow at least in line with global population growth, at above 1% a year.

Increased mobility should also mean global fuel consumption returns to normal growth.

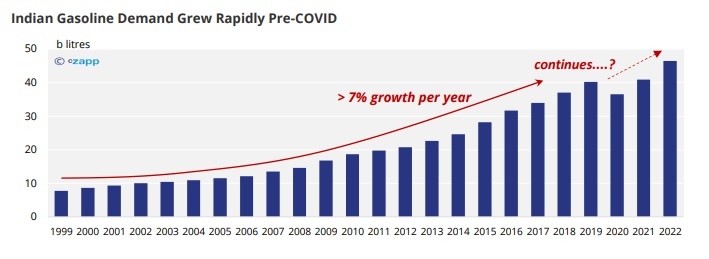

This is significant for the sugar and ethanol markets because India is aiming to reach a 20% blend of ethanol into gasoline by 2025/26. Pre-COVID, Indian gasoline demand was growing at more than 7% a year. If this continues, Indian gasoline demand (and therefore ethanol demand) will double every decade. Much of this ethanol will come from sugarcane to the detriment of global sugar supply.

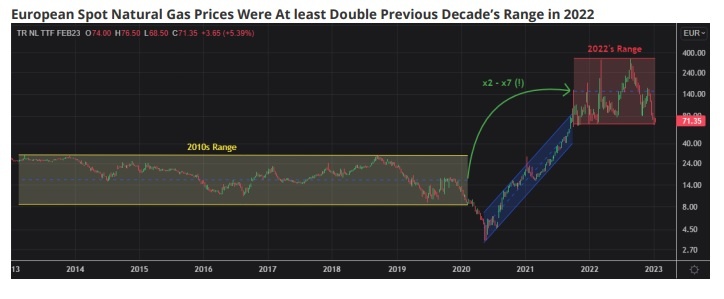

The World’s Supply Chain Problems are Over

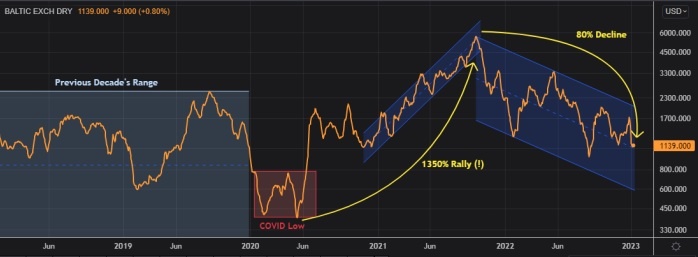

Global trade effectively stopped in H1’20 thanks to COVID restrictions. But this was followed by the huge global demand for goods after economies re-opened from H2’20 onwards, leading to a snarling of the world’s bulk freight and container flows. Freight prices rocketed higher and container availability was non-existent in many ports.

This presented huge challenges to companies around the world, challenges which supply chain experts like Cz battled to solve for our customers.

The Baltic Exchange Dry Index Shows the Chaos in the Freight Markets 2020-2022

Much of the world seems to be heading towards a recession thanks to a stronger US Dollar and higher interest rates. Demand for goods has fallen and retailers have been left with high inventories which need to be sold. As a result, container lines are re-introducing blank sailings just months after reporting record profits.

The whole world has been struggling with the bullwhip effect. But as the whip flails its intensity also diminishes. The next leg higher in freight prices (perhaps caused by a reduction in freight supply) is unlikely to be as severe as it was in 2021/22.

Inflation Should Cease (Temporarily)

The short-term food and energy security shock from Russia’s invasion of Ukraine is over. Markets find a way of resolving problems. Grains exports are proceeding slowly from the Black Sea. China and India are buying Russian crude at deep discounts and selling refined oil products to the West. In other words, new supply routes emerge from the wreckage of the old ones, even in war.

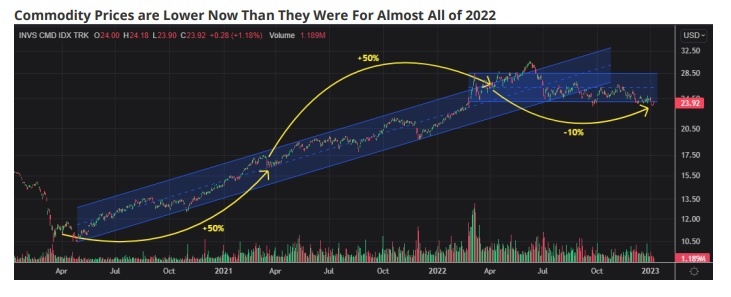

This also means that inflation is about to become last year’s problem. It was transitory-ish. Inflation is measured as a year-on-year increase or decrease in price. Most commodity prices peaked in March 2022 and have since declined: copper by 20%, crude oil by one-third, wheat by nearly half, lumber by 70%. In time these wholesale declines will be passed through to end-consumers and inflation will recede.

This could mean that the interest rate rises we’ve seen for the past year may slow or even reverse in many countries in 2023.

I mention these three items of old news because they will continue to dominate media discussions in 2023 even though they have decreasing relevance. What’s important isn’t what’s old, but what’s about to happen next.

2023 Outlook

Prepare for Structural Inflation

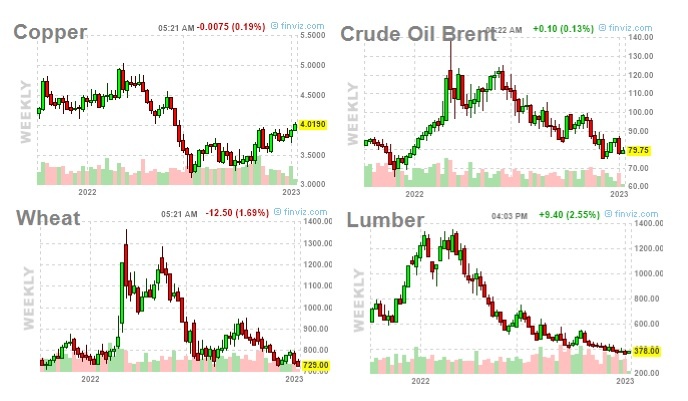

In the short-term inflation might be ending. But inflation will remain a major challenge for the rest of the 2020s. As I wrote last September, inflation can be both transitory and then structural.

A major reason for structural inflation is that globalization is reversing. Following the collapse of the Soviet Union in 1991, East Asia, Russia, Europe and North America have all become increasingly intertwined. Russia and the USA supplied cheap energy, East Asia supplied cheap goods, and European/North American consumers bought these goods.

Things look different today.

North America and Europe now have applied sanctions on Russia, Iran and Venezuela, who account for a large proportion of global energy supplies. Investments in American shale oil production have reduced. China and India have both emerged as buyers of discounted Russian energy.

On goods, the USA and China have been through a trade dispute (remember that?!), and China is aligning further with Brazil for agriculture (a first cargo of Brazilian corn recently sailed for China). European industrial costs have risen alongside energy prices.

If the era of reliable cheap energy supplies to G7 is ending, this is inflationary.

If the flow of cheap goods from East Asia to G7 might be reduced in the future, this is inflationary.

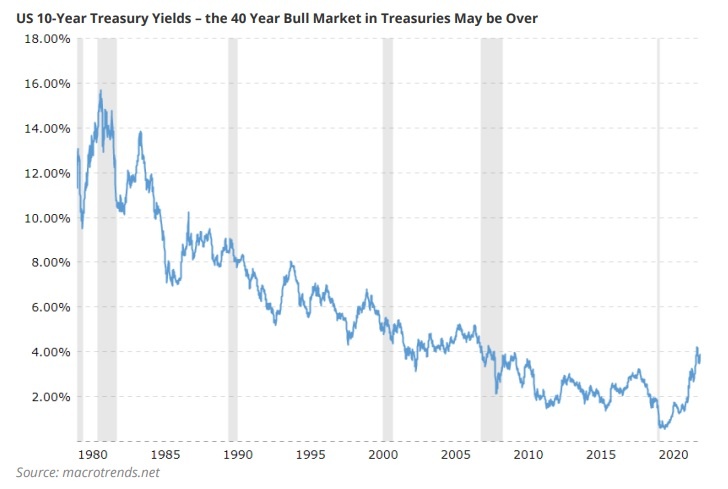

The major tool policymakers have to fight inflation are interest rates. Higher inflation in the long term probably means higher interest rates in the long term.

Let’s look at what energy, higher interest rates and regionalised trade mean for the sugar, ethanol and biomass markets.

The End of Cheap Energy

Energy security is national security.

Without cheap and reliable energy you can’t heat or cool homes and workplaces. You can’t light up the darkness. You can’t make cheap goods or move those goods. You can’t refrigerate food.

Even a services economy needs cheap energy. You can’t run data centres, transport networks or telecom networks without it.

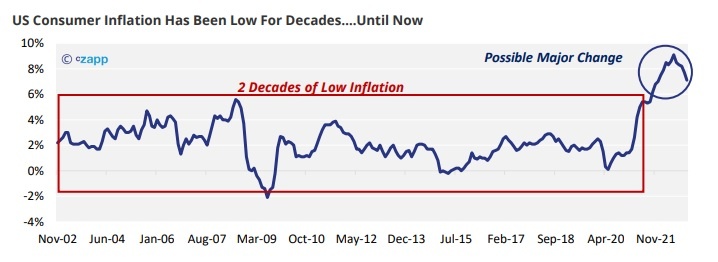

Europe needs to replace cheap Russian gas as its primary energy source and so has been buying world market liquified natural gas cargoes. It’s now competing directly with China, Japan, South Korea, Pakistan and others for these precious cargoes. European natural gas prices remain more than two-times higher than they did for most of the last decade.

Prices for LNG in countries competing with Europe for supply should converge to similar levels. For many, the era of cheap energy is over (while for Russia, the challenge is how to build infrastructure to sell its gas to new markets rather than flare it).

Being able to create and burn cheap biomass for energy could therefore be a competitive advantage in 2023. The sugarcane industry is blessed with an abundance of cheap biomass: more than 15% of the cane plant is fibre which is ultimately compressed into biomass as the cane is processed for its sucrose. Traditionally this bagasse has then been used to fire mill boilers.

The opportunity here is huge. Mills with low pressure boilers can spend comparatively little money to upgrade to higher pressure boilers and/or biomass dryers to increase the efficiency of their bagasse burn. Excess electricity can then be sold to the grid. For those mills who cannot do this, they could potentially sell their excess bagasse as is, either to nearby mills who can use it more effectively or for use at existing power stations, either domestically or overseas.

Our corporate finance team has extensive expertise in financing boiler upgrades, new cogeneration plants and in bagasse trading. Talk to them today to find out how you can benefit from the new energy boom.

Higher Interest Rates

If inflation remains persistent, then Central Banks around the world are likely to continue to keep interest rates high.

This means the last 40 years aren’t going to be a good guide to how financial markets will behave for the rest of the decade. Act accordingly.

In 2023, be prepared to refinance debt aggressively when rates are comparatively cheap. Be aware that finance may not be available when you need it at a price you like. Invest in productive assets (especially those related to cheap energy or energy efficiency), but be aware that investors will demand higher rates of return than they have in the recent past.

Somehow in this environment we also need to overcome a decade of underinvestment in commodities. We can see the effects in the sugar market, where global production has stagnated for more than 10 years. It’s almost certainly also true for a host of industrial and agricultural commodities too.

Our consulting and corporate finance teams are ready to help you navigate today’s markets. Ask Connor McGrath any question you like.

Increasingly Regionalised Trade

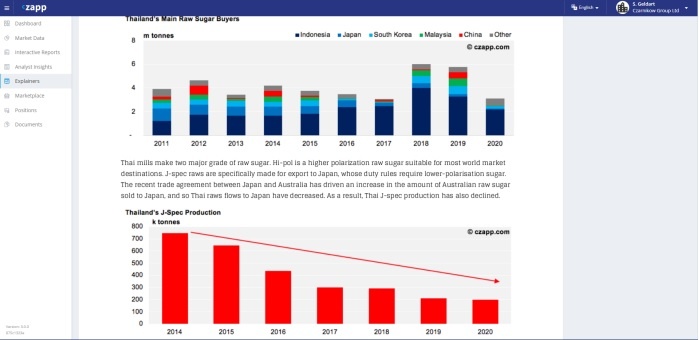

If trade becomes less globalized and more regionalized, physical values might gain in importance while benchmark futures markets become a little less important. This might be important because sugar futures can be hedged far more easily than physical values can. It’ll also be vital to navigate regional trade agreements, duties and sanctions effectively.

We have published a library of explainers on Czapp to help in the first instance. Beyond this, our consulting team can help you further. In the past we’ve helped customers learn about topics as diverse as the Indonesian sugar market, the Indian ethanol market and the Central American electricity generation market.

This increasingly regionalized trade may be less efficient than the globalized networks it replaces. Goods may not always be available at a moment’s notice at the required price. Europe has already found out to its cost that not all natural gas is the same.

Already, recent supply chain disruption has shown just-in-time logistics’ weaknesses. From 2023 onwards we’d recommend all supply chain participants carry slightly higher stocks of whatever products they need. Yes, this is expensive, especially with higher rates, but this is a cost worth paying to avoid stockouts.

Supply chain redundancy is also going to be essential. Humans have 2 eyes, 2 kidneys and 2 lungs, even though the energy requirement is higher than just having one of each organ. But if one fails, the other can still ensure near-normal function. Your supply chains should be similar. Ensure you are not dependent on any one source of supply. In 2022 Cz’s trade teams helped countless customers manage their logistics. Talk to us to find out how we can make your supply chains bulletproof this year.

Where are The Sugar Forecasts?

It may seem a bit strange to write a sugar market outlook for 2023 without including any specific crop or price forecasts. The reason for this is that we provide these forecasts throughout the year on Czapp.

Please look out for our Statshot report for an update on our latest crop forecasts. Premium subscribers can access sugar production and consumption data for all major sugar countries.

Premium subscribers also have access to our quarterly 5-Year Sugar Price Outlook and weekly Market View articles.

If you’re interested in subscribing to receive this information, please speak to Connor McGrath CMcGrath@czarnikow.com.

The fracturing of the post-1990s order is scary. The 2020s have been a hell of a ride so far. But amid the chaos, opportunities lurk everywhere. The rewards for taking calculated risks have never been greater.

Try to enjoy the ride and good luck for the year ahead.