Insight Focus

India won’t export sugar for the foreseeable future. The world is dangerously dependent on CS Brazil for sugar supply. Prices are elevated as a result.

To watch the full video instead, click here

Hi everyone, it’s Stephen from CZ with another update on the sugar market. Lots has happened since I last made a video so let’s get straight into it.

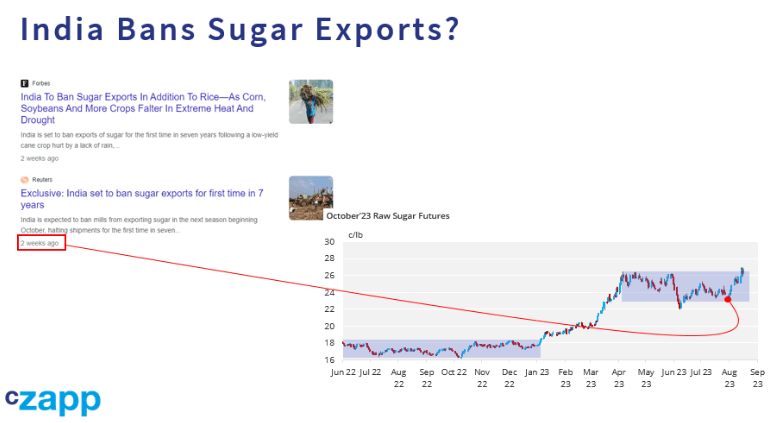

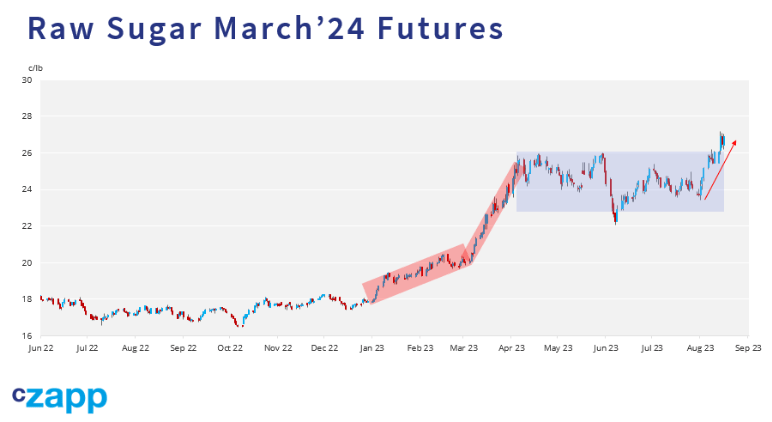

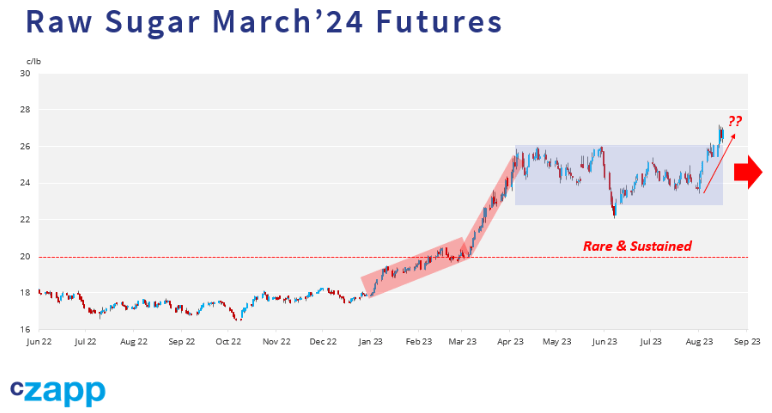

The big news in the last few weeks is the rumour that was all over the newswires that the Indian government was going to ban sugar exports. Before the news broke raw sugar was trading at 24c, now it’s above 26c.

Now, I think this is rubbish.

Sugar already can’t be exported because all of this year’s export quotas have been used up and the government doesn’t intend to issue more.

For next season, the government has already said it’ll only give out export quotas when it knows what next year’s sugar production looks like AND how the cane looks for the year after that.

The government has already in effect said it won’t allow sugar exports until April 2024 at the earliest. Why show its hand now and officially ban exports? It changes nothing other than box it into a corner. I think the government prefers ambiguity.

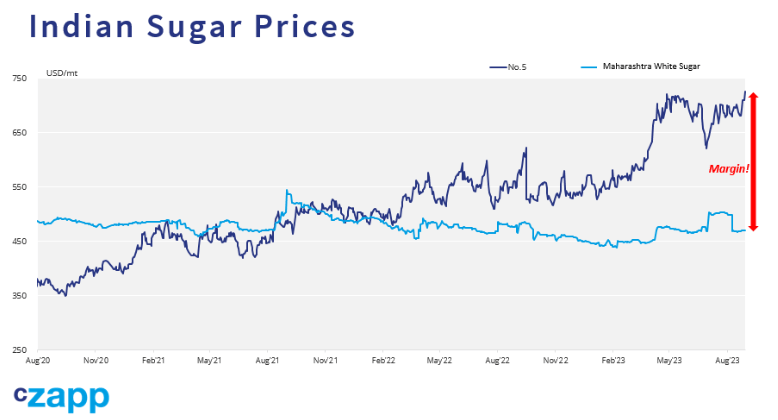

On the other hand, cane mills are still really keen on exporting sugar. Indian sugar prices are around $450/tonne. World market sugar prices are above $700/tonne. Of course they want to export.

On the other hand, cane mills are still really keen on exporting sugar. Indian sugar prices are around $450/tonne. World market sugar prices are above $700/tonne. Of course they want to export.

There’s a sugar and ethanol conference in Delhi in 2 weeks’ time which I’m speaking at where I expect the mills to put pressure on the government. Three government ministers are due to appear. Let’s see if the mood changes after that. I doubt it. Also, if you’re going to the conference, come and say hi.

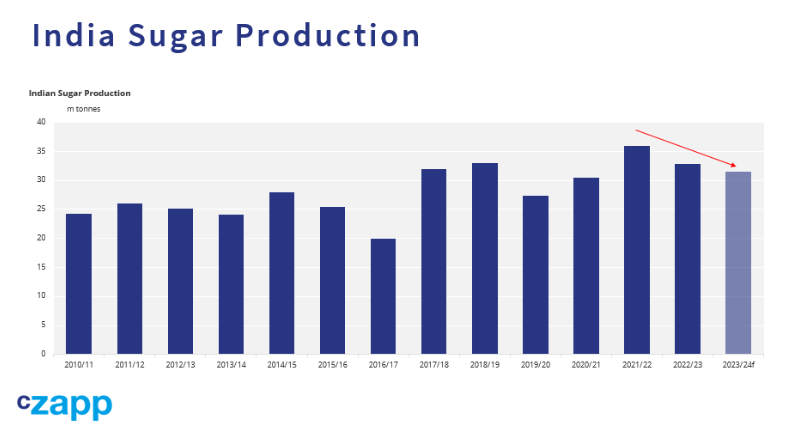

Meanwhile, Indian crop prospects keep getting worse. India is the world’s second-largest cane grower and largest sugar consumer. It really matters for the sugar market.

Meanwhile, Indian crop prospects keep getting worse. India is the world’s second-largest cane grower and largest sugar consumer. It really matters for the sugar market.

Rainfall was poor in June, good in July and awful in August. We desperately need more rainfall in September to help the sugar cane develop properly. If sugar production is less than 30m tonnes there’s no way the government will allow sugar exports next year. If it’s surprisingly high, say 34m tonnes, then there’s a good chance the government allows exports from April.

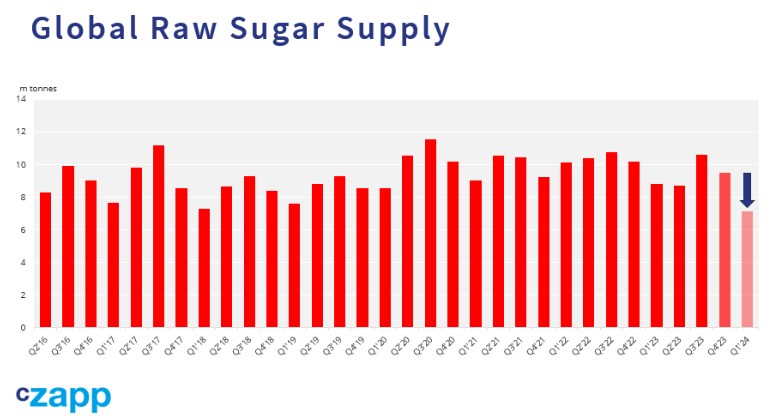

Whatever happens, the shortfall in the Thai and Indian crops means there’s a supply crunch coming for the sugar market.

Raw sugar availability in the first quarter of next year will be the lowest we’ve seen since at least 2016.

The March’24 futures contract, which covers this period, is close to 27c/lb. So the question for the market is whether that price is a fair reflection of the supply risks. Is it a high enough price to encourage someone somewhere to change their behaviour?

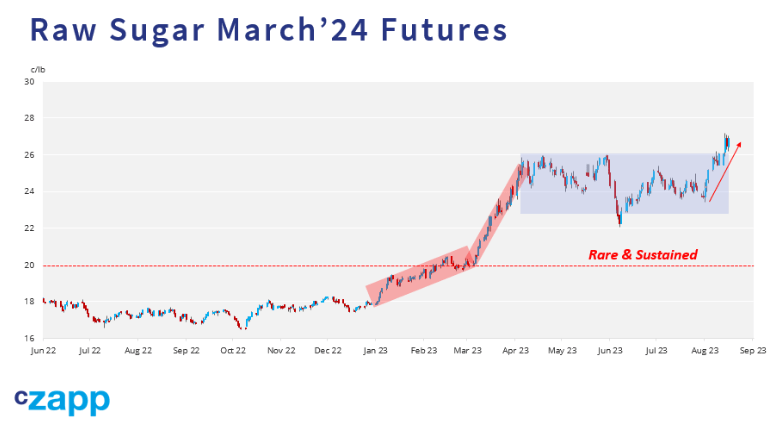

Well, as I mentioned in my last update, raw sugar demand in the first half of 2023 was 20% below normal. Prices above 20c/lb meant that raw sugar buyers deferred their demand and retreated from the market.

In fact, as I’ve said before, it’s very rare that sugar prices trade above 20c. It’s only happened on 5 occasions in the past 50 years. So while prices remain high, we can expect sugar demand to remain slow. Those who have stocks will eat through those rather than buy more.

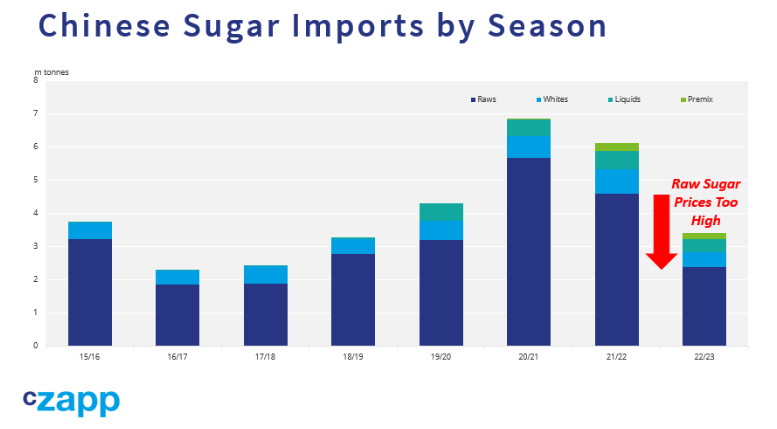

For example, China is usually one of the largest buyers of raw sugar in the world. But refiners here won’t break even on sugar imports unless prices trade below 22c.

They can process the government’s enormous sugar stocks and so aren’t under pressure to come to market. This is interesting, because India, one of the world’s largest sugar producers, won’t export sugar until the time is right.

They can process the government’s enormous sugar stocks and so aren’t under pressure to come to market. This is interesting, because India, one of the world’s largest sugar producers, won’t export sugar until the time is right.

But China, one of the world’s biggest sugar importers, won’t buy until the price is right. There’s a mismatch between their ambitions.

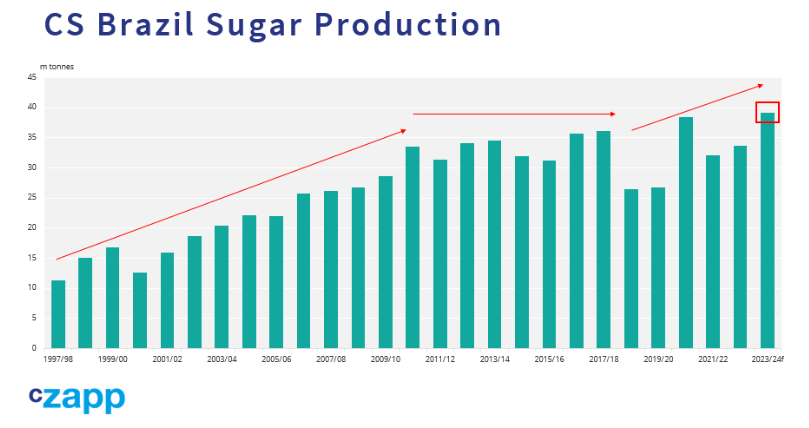

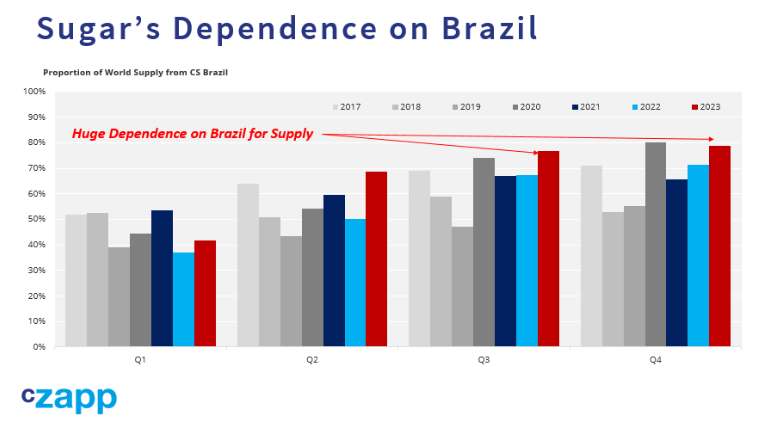

And then there’s Centre-South Brazil, the sugar market’s big beast. The world’s largest cane growing region, the world’s largest sugar producer and the world’s largest sugar exporter. It’s having an enormous season. It’s massive.

And then there’s Centre-South Brazil, the sugar market’s big beast. The world’s largest cane growing region, the world’s largest sugar producer and the world’s largest sugar exporter. It’s having an enormous season. It’s massive.

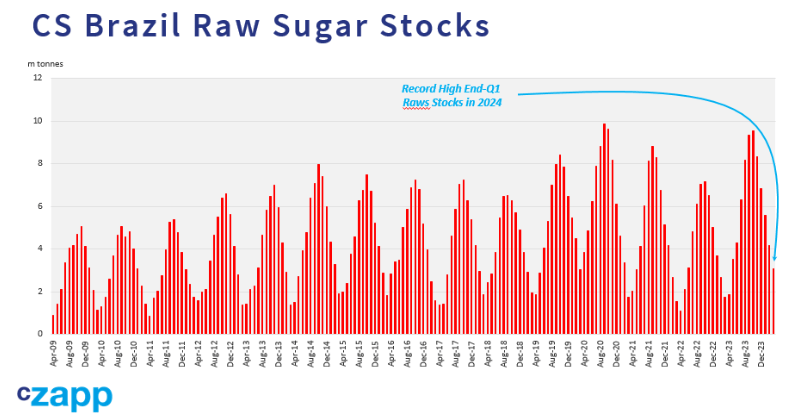

Sugar production will get close to 40m tonnes for the first time ever. Mills are making so much sugar they don’t know where to put it. The entire storage system up-country is full and ports can’t ship the sugar out fast enough.

This means that Brazil will end up carrying its huge sugar stocks into the first half of next year, precisely that time of stress that I talked about a moment ago. This should be bearish news for prices – Brazil can bridge the gap left by India and Thailand. But we just don’t know if Brazilian ports can get sugar out fast enough to meet market demand in Q1 2024, so for now prices remain elevated. Hopefully money will talk.

To me this indicates that the market doesn’t really need to break much higher. Not yet. Prices are doing their job in deferring demand and that will continue. Besides, interest rates and the US dollar remain elevated, which tends to be negative for commodity performance.

The main risk, of course, is that everything is hugely dependent on Brazilian performance. If something goes wrong in Brazil, the sugar market is in deep trouble. Imagine, for example, if a ship somehow blocked a sugar berth at Santos port, reducing export capacity.

This means in the short to medium term I think we remain in this broad range between 22 and 27c.

In the longer term, the sugar market still has profound problems which may lead to higher prices. I’ll outline what those problems are to premium sugar subscribers in my next 5-year price outlook.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.