Opinion Focus

As demand drops, there was a widespread expectation that supply chain issues would unwind. However, the global supply chain is still under extraordinary pressure. Combined with lower income from less demand, this creates a problem for 2023.

While supply chain disruption in an environment of high prices and high demand is a tricky situation to manage, negotiation of the same issues in a low-price environment is much more complex. Entering 2023, the supply chain will still have to navigate some complicated issues that have lingered from 2022.

Supply Chain Issues Not Resolved Yet

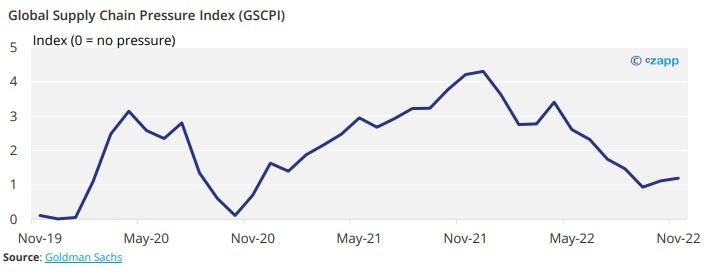

After about two years of global supply chain issues, the current detangling of the supply chain is only the tip of the iceberg. While the situation has improved drastically from peak disruption last November, there are some lingering issues to deal with into 2023.

According to Oxford Economics, the bulk of the pressure in November could be attributed to transportation and prices, with inventory, labour and activity all taking a back seat.

There is a real learning curve to be followed in the New Year about reorganised supply chains and ways in which reliability can be guaranteed to ensure the chaos of 2021 does not repeat itself.

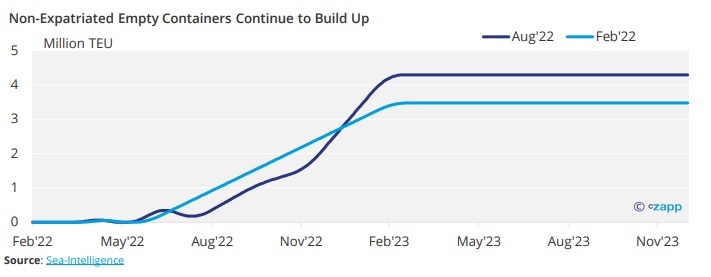

Freight Coming Down but Ports Still Backlogged

While port congestion has eased due to less demand, ports are still severely backlogged from the aftermath of the container shortages. After companies moved at a breakneck pace to construct new containers in 2020 and 2021, the demand glut means that they have now been stacking up in port warehouses. This of course put upward pressure on inflation.

Some cargoes will no longer call at Rotterdam’s Delta II or Maasvlakte II terminals, instead discharging at Antwerp. This will mean that customers that were scheduled to discharge at Rotterdam will have to instead have cargo unloaded at Antwerp and relocate it at their own cost. Still, reliability at ports is heavily compromised.

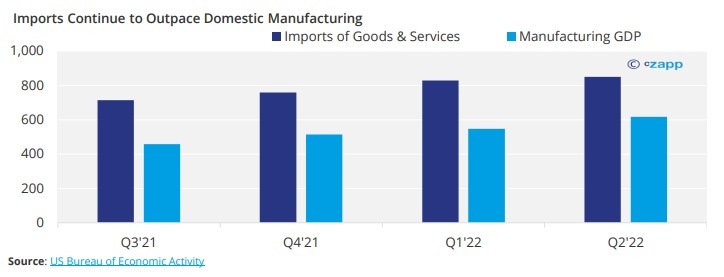

Onshoring and Friendshoring Not Having Desired Effect

While onshoring and more regional trade was largely seen as one of the solutions to supply chain upheaval caused by Covid, moves to relocate production are not having the desired effect.

According to a Goldman Sachs report, reshoring poses the risk of exacerbating inflation. However, the analysts say that in the US, goods imports continue to outpace domestic manufacturing output.

Supply Chain Weakness Contends with Low Demand

Generally, the end of the year is seen as a high-sales period in advance of a much more muted January. But Christmas sales have been lacklustre this year, driven by soaring energy and living costs.

Supply chain snarls were one thing amid plenty of demand. Now as demand slows down, they are quite another. Now, the danger is that there will be too much supply for waning demand, after two years of supply restrictions.

This could force retailers to heavily discount goods in order to reduce warehouse inventories and overheads. With less demand, this will impact the maritime freight and air cargo industries – although freight rates have already been sinking this year.

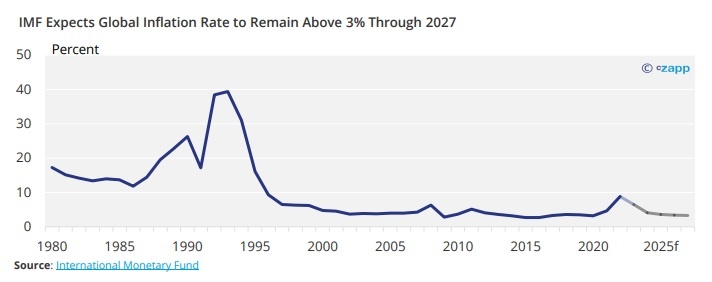

Costs Continue Rising

According to IMF projections, global inflation should hit its peak in 2022. Nevertheless, it will remain elevated above the 3.5% seen in 2019 until at least 2025.

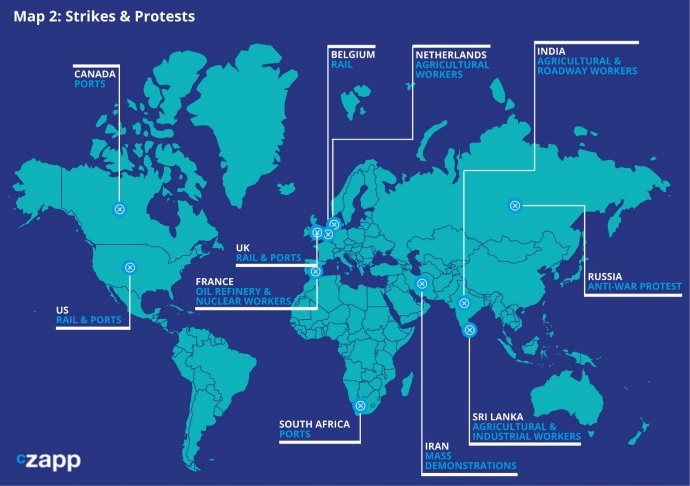

Worker salaries are also a major issue entering 2023. Low unemployment coupled with the rising cost of living has forced workers around the world to campaign for higher salaries, with labour action including strikes, protests and walk outs.

The expectation is for wage inflation to become one of the main drivers of supply chain costs in 2023, alongside the price of energy. This of course will impact the entire supply chain.

Regulatory Bodies Lose Ground

Last month, the WTO released its ruling on the steel tariffs imposed under the Trump administration. According to the organisation, the tariffs violate global trade rules.

The power of organisations such as the WTO relies upon member countries’ adherence to rulings. Now that the US has rejected the body’s decision, this undermines the organisation and could set a precedent for distortion in world markets – including across agricultural goods.

Lack of Fertiliser in 2022 Comes Home to Roost

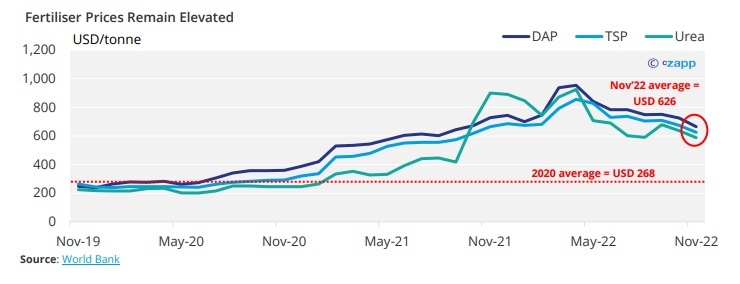

Fertiliser prices have been a huge issue for farmers since beginning of 2021. Although prices have come down substantially since the highs caused by the Russian invasion of Ukraine, levels are still more than double those seen in 2020.

This means that not only will there be implications for the 2023 harvest, but also potentially the 2024 crop too.

Concluding Thoughts

- There is general consensus that the first half of 2023 will be much softer in terms of demand than the same period of 2022.

- The question remains whether the supply chain can recover in time for the second half, when activity is expected to pick up.

- According to HSBC, global trade growth next year will slow to 1.1%, from 6.1% in 2022.

- Supply chain disruptions should unwind more during 2023 amid weak demand.

- But there will still be headaches for months to come, as labour issues and China’s COVID outbreaks are hard to price in.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.