Main focus

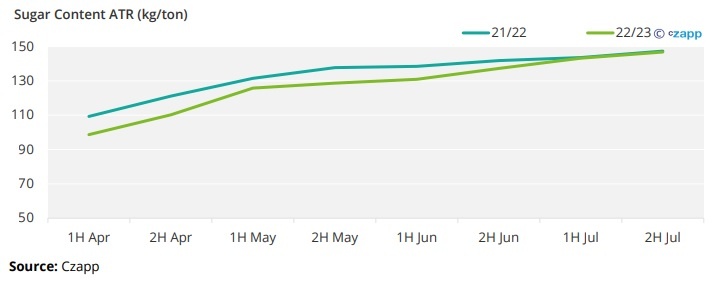

At the beginning of this crop, the sucrose levels (ATR) were much lower than 2021/22. However, on the 2H July, ATR has picked up and reached 148 kg/ton. Is the recent recovery in ATR enough to bring it to last year’s levels?

If you would like us to answer one of your questions in an upcoming issue, please email will@czapp.com.

Are Brazilian Sucrose Levels Lower than last year?

At the beginning of this crop, the sucrose levels (ATR) were much lower than 2021/22.

Unica (Sugarcane Industry Union), in one of its fortnightly reports, even cautioned that the ATR of this crop could be 3 kg/ton less yoy.

However, recent data shows ATR has picked up and reached last year’s levels. 2H of July recorded an ATR of 148 kg/ton.

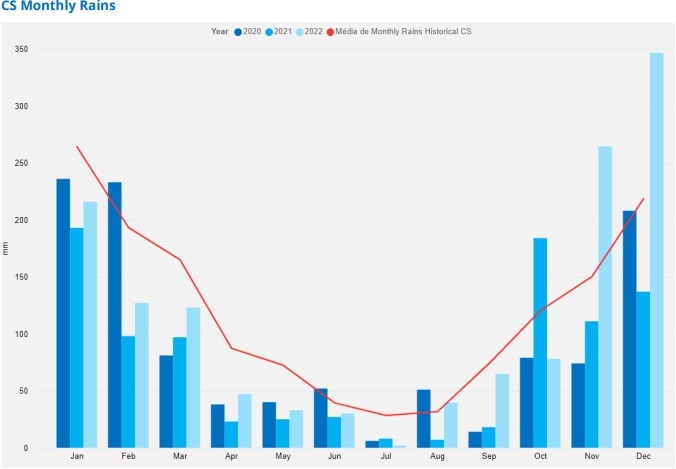

The recovery of ATR last month was driven by persistently dry weather. Lack of rains causes a stress in cane, causing it to concentrate sucrose.

Since the start of the season, rains have been below average. And July has been even worst than the past couple of years, registering precipitation 93% lower than historical average.

Source: Access our rains historical data and forecast on our interactive data session on Czapp

However, is the recent recovery in ATR enough to bring it to last year’s levels?

Finally, Center-South Brazil has seen some rains this week – hindering harvest operations and causing up to 2 days of stoppages. The increase of the sucrose curve will likely be affected by wet weather across CS.

Therefore, August could be a lost month in possible ATR concentration.

Considering that rains are on average from September onwards, it makes it even less likely for ATR to reach 2021/22 level.

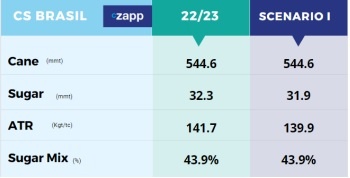

We are forecasting an ATR of 141.7kg/ton for this season, with a sugar output of 32.3mmt.

If UNICA assumption is correct, then ATR could be as low as 140kg/ton. This would result in a sugar production 400kmt lower than our present estimates.

In short, yes ATR will be lower than last season despite recent recovery. However, it is not expected to be responsible for a significant downgrade in sugar output from CS Brazil.

Cane crush on the other hand, well that might be a topic for another Ask the Analyst …

For more articles, insight and price information on all things related related to food and beverages visit Czapp.