Insight Focus

El Nino typically causes warmer weather in Centre-South Brazil. It can also lead to higher rainfall, potentially disrupting cane crushing. We look at what happened during the last El Nino.

El Nino is expected to have different impacts depending on the region, but today, we will update on the impact it could have in the biggest raw sugar supplier in 2023: Centre-South (CS) Brazil.

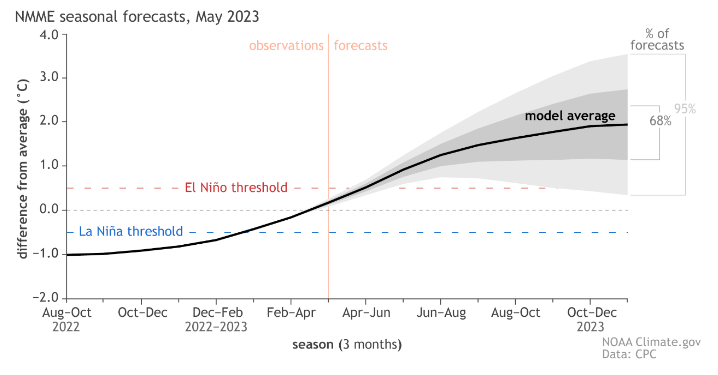

A recent update from NOAA (National Oceanic Atmospheric Administration) shows the sea surface temperature is climbing, but it has not yet reached an increase of 0.5ºC (one of the criteria required for an El Niño occurrence).

But even if this index exceeds the 0.5 °C, meteorologists will not confirm an actual of El Niño event unless the tropical atmosphere moves from its current neutral condition.

Source: NOAA

Source: NOAA

Nonetheless, the likelihood of an El Niño event from July-Sep has been increased to 90% and exceeds 90% until next February.

Effect on Centre South Brazil Cane Crushing

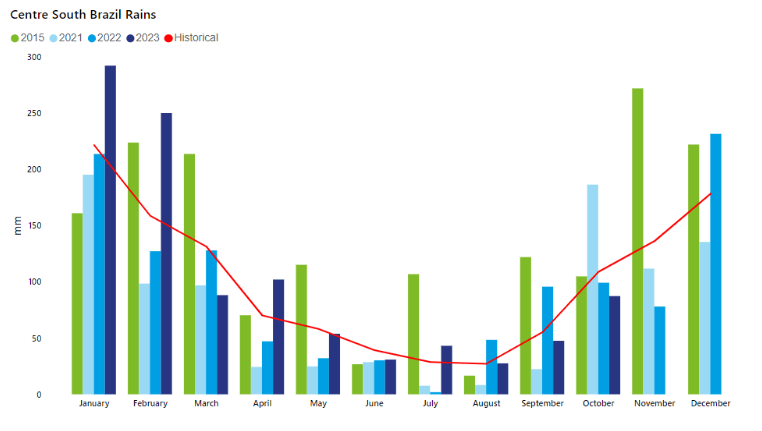

The region is located in an area where an El Niño event will cause increase of temperatures, but there is no clear pattern for rains.

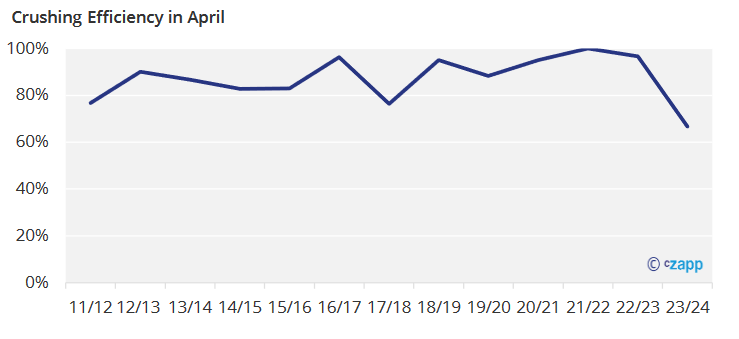

2023 cane harvesting started in April with the lowest efficiency in more than a decade, due to the high volume of rains. This has led to many people being wary of upcoming rains during the peak of the CS season. So far, weather in May has been drier than normal, allowing mills to make up some of the lost time.

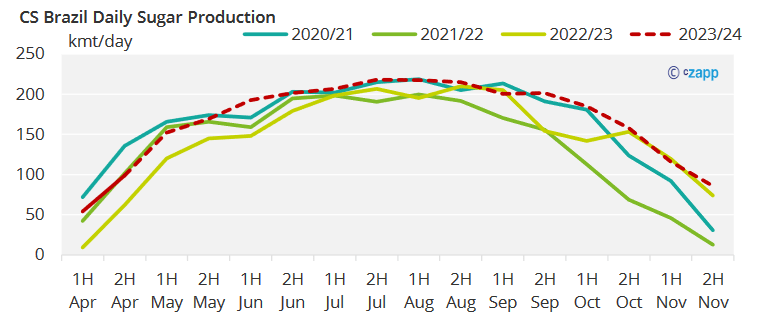

The bulk of the crush occurs between May and September, when around 80% of the season is done. In July for instance, each day of stoppage can mean more than 200k tonnes less sugar output.

The bulk of the crush occurs between May and September, when around 80% of the season is done. In July for instance, each day of stoppage can mean more than 200k tonnes less sugar output.

The last time there was an El Niño event, was during the 2015/16 season in Brazil. That year, between April and September, over 28 days of stoppages were reported on average in CS Brazil – 60% more than average.

The last time there was an El Niño event, was during the 2015/16 season in Brazil. That year, between April and September, over 28 days of stoppages were reported on average in CS Brazil – 60% more than average.

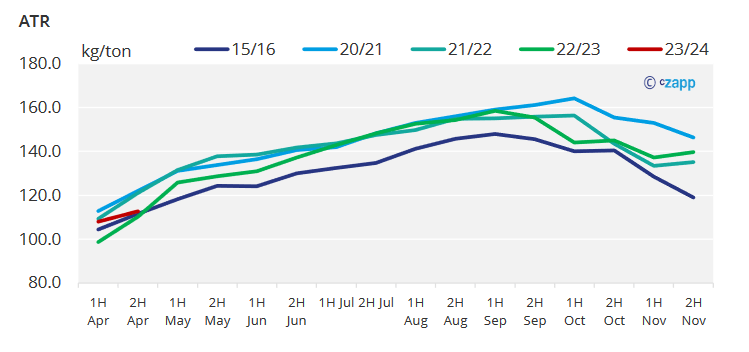

The higher volume of rain had a beneficial effect on cane development (i.e., ag. yields), resulting in record cane availability. Despite higher precipitation, mills pushed crush pace as much as possible, extending the season well into December. They ultimately managed to crush 618mmt of cane, one of the largest harvests on record. However, wetter weather also impacts sucrose, but negatively. Sucrose content (ATR) dropped to 130kg/ton.

The higher volume of rain had a beneficial effect on cane development (i.e., ag. yields), resulting in record cane availability. Despite higher precipitation, mills pushed crush pace as much as possible, extending the season well into December. They ultimately managed to crush 618mmt of cane, one of the largest harvests on record. However, wetter weather also impacts sucrose, but negatively. Sucrose content (ATR) dropped to 130kg/ton.

Low sucrose content and low sugar prices in 2015 did not encourage mills to maximise sugar output from their sucrose, resulting in total sugar output of 31.2m tonnes.

Low sucrose content and low sugar prices in 2015 did not encourage mills to maximise sugar output from their sucrose, resulting in total sugar output of 31.2m tonnes.

Today we are in a different environment. Prices are higher and mills are incentivized to maximise sugar output. We believe it’s highly unlikely that CS Brazil sugar production should drop as low as in 2015/16.

Drawing a parallel between the 2 seasons, while respecting the different context from each, we believe that in the event of a confirmed El Nino and higher precipitation during the season, sugar output could drop to around 36.2m tonnes this year – around 1.3m tonnes less than our current estimates.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.