Insight Focus

- China’s sugar industry continues to seek better regulation of liquid sugar imports.

- Liquid sugar import margins have improved recently.

- We think liquid sugar imports will remain strong in 2024.

New Standards for Chinese Liquid Sugar

China is the world’s largest importer of sugar. As a result, Chinese sugar buying patterns can have a major impact on how world market sugar prices trade. World market sugar futures have fallen by around 25% in the past month. This means the market has renewed focus on major buyers.

For the raw sugar market, many analysts have been trying to establish at what price (and what time) Chinese refiners will buy Quota or Out Of Quota raws. Chinese bids might offer some price support.

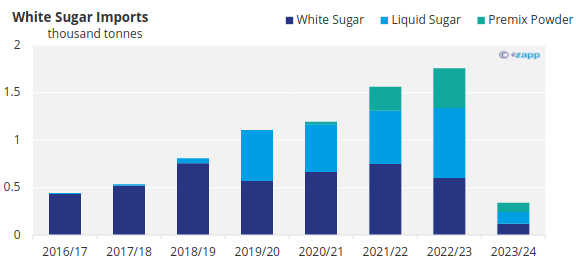

But China is now also a major white sugar importer, partly through conventional whites shipments but also through premix powder and liquid sugar imports.

The flow of liquid sugar into China is a relatively new phenomenon, starting in earnest in the 2019/20 season after the government shut down widespread white sugar smuggling into the country. Liquid sugar imports benefit from a lack of import duty and low processing costs at rock sugar factories, making it competitive versus crystalline sugar. The scale of the imports has attracted the attention of the local sugar industry, who for the past few years have tried to get the flow stopped with little success.

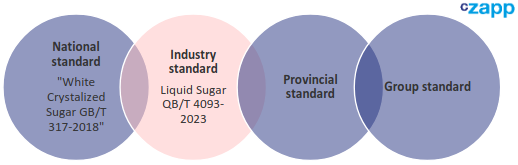

The Chinese sugar industry’s new goal, therefore, is to try to get liquid sugar imports incorporated into existing sugar market regulations. New Industry standards for liquid sugar have just been released and may be a step in this direction. These were drafted by the sugar industry, liquid sugar importers and governments.

The standard “Liquid Sugar (QB/T 4093-2023)” has now been approved and issued by the Ministry of Industry and Information Technology, and stipulates the sensory, physical and chemical requirements of liquid sugar, describes the corresponding test methods, stipulates the inspection rules and the content of marking, labeling, packaging, transportation and storage, and gives the product classification that is convenient for technical regulations.

This document applies to the production, inspection and sale of liquid sugar made from sugarcane, sugar beet or raw sugar as direct or indirect raw materials through processing or conversion processes.

This standard replaces QB/T 4093-2010 and will be implemented from July 1, 2024.

Liquid Sugar Import Margins Improve

The main consumers of liquid sugar imports are rock sugar factories. Last month the Chinese Sugar Association held a preparatory meeting for a rock sugar professional committee, which may be linked to the management of liquid sugar. As liquid sugar becomes more standardized it may also become more attractive to food and beverage manufacturers. This means there’s still room for liquid sugar consumption to grow, so long as it retains its price advantage.

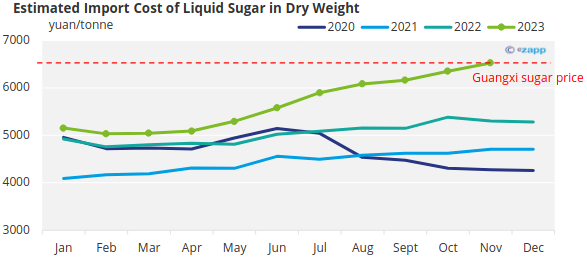

For the time being, all these moves haven’t had an impact on liquid sugar. When the world sugar futures were at their peak, liquid sugar import margins were temporarily negative, but imports are now profitable again. Due to December’s sharp drop in world market sugar prices, liquid sugar import costs are below RMB 5,500/tonne, compared to a domestic white sugar price of RMB 6,500/tonne.

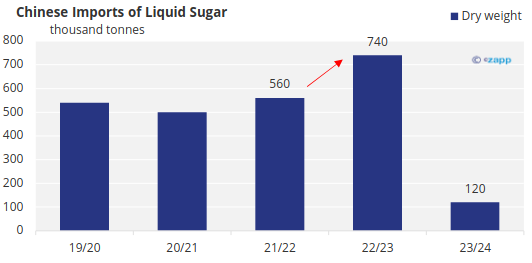

Not only that, but average import volumes from September to November remained stable above 90k tonnes per month (equivalent to 60k tonnes per month dry weight) despite the poor import margins during this time. 2023/24 liquid sugar imports to November therefore reached 120k tonnes (dry weight). In 2022/23 total imports were 740k tonnes, up 32% on the year before. If the current pace of imports is sustained, 2023/24 liquid sugar imports could match those of 2022/23.

* values of liquid sugar and premix powder are in dry weight, sugar equivalent.

As the lowest cost imported sugar product into China (thanks to the lack of import tariff), there’s no reason to expect a decline in liquid sugar imports in 2023/24. After all, China’s commercial sugar stocks have fallen to low levels and the local sugar deficit remains above 5m tonnes.

If we assume 700k tonnes liquid sugar imports in 2023/24, China’s overall white sugar demand (including premix powders and whites for consumption) could exceed 1.5m tonnes. This is more than 3x the level of legal white sugar imports that occurred 6 seasons ago. China remains the dominant buying force in the world’s raw sugar markets, and it’s becoming increasingly important in the white sugar market too.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.