Insight Focus

In this week’s Ask the Analyst we answer some of the questions posed during our recent global sugar market webinar. If you would like to watch the webinar recording, please follow this link. We plan to run our next webinar in Q3 and look forward to seeing you there.

Do you see India postponing its ethanol program to favour sugar production?

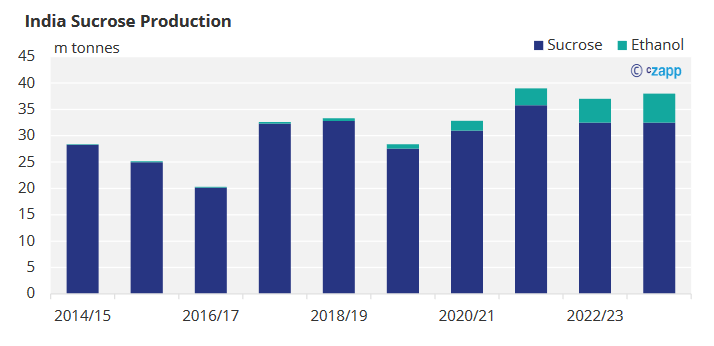

The Indian government has set a target of reaching an E20 gasoline ethanol blend by 2025. This has meant an increasing volume of sugar cane has been diverted toward ethanol distillation over the last few seasons.

For the upcoming 2023/24 season we think this will reach 5.5m tonnes of sugar lost to ethanol production. What would happen if a poor monsoon affected the sugar cane crop?

The ethanol programme was initially devised to deal with the large sugar surplus India produces. This was challenged at the WTO by several other sugar producing countries. However, the government now believes that the ethanol programme is a part of the nation’s energy security.

In the case of a poor crop, provided India continues to produce enough sugar to satisfy domestic consumption we think it is unlikely that they will postpone their ethanol programme. Instead, it is likely sugar exports would be reduced first.

If the sucrose market was in deficit the government would then have to choose whether to allow sugar imports, ethanol imports for fuel use or to temporarily cut the ethanol blend. India has a history of importing sugar when required, and the government has also encouraged huge investment in local distillation. It may therefore be unpalatable to require distilleries to slow/stop production. We therefore suspect that the government would seek sugar imports in the first instance.

What Does an El Niño mean for key sugar producers?

The El Niño weather phenomenon affects different parts of the world differently, as does the timing of its arrival.

For CS Brazil an El Niño tends to mean warmer temperatures but its effect on rains is less clear. The last time CS Brazil experienced an El Niño event, higher rainfall severely hampered logistics operations, slowing the crush down, but did have a positive effect on rainfall.

For a more in depth explanation of how it might affect production this season, please read another recent Ask the Analyst.

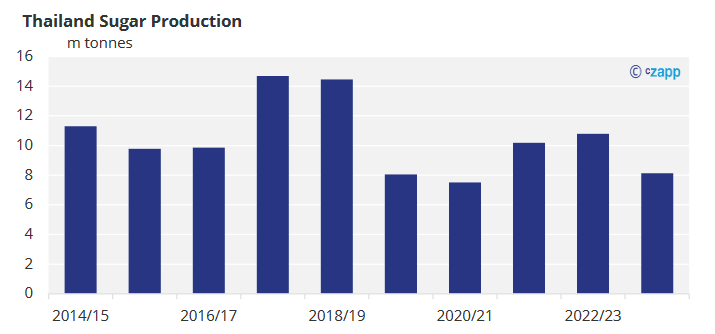

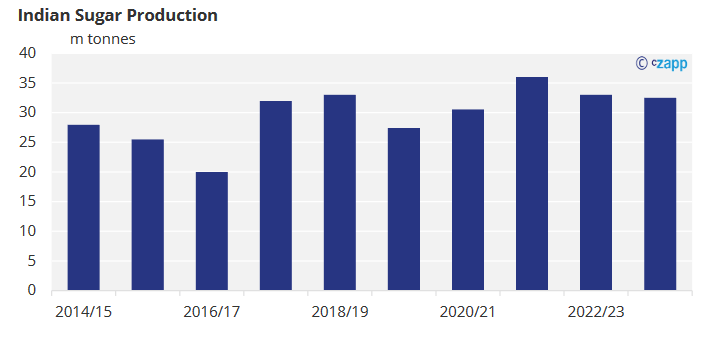

For Thailand, India and other countries across south Asia an El Niño generally means lower than normal rainfall. Lower rainfall in general is detrimental to crop development, especially where irrigation is not available.

Only around 20% of Thai cane is irrigated whilst India relies on many dams and reservoirs for irrigation so if rainfall is particularly low these reservoirs can run low too.

For the moment we have already accounted for El Niño having a detrimental effect on the 2023/24 Thai crop, we expect the cane crush to fall to an almost 14-year low.

For India we will wait and see how the monsoon looks once it starts at the end of the month/start of June before we consider adjusting our production forecast for 2023/24.

The last two seasons affected by a poor monsoon were 2016/17 and 2019/20, and each suffered roughly a 5m tonne year on year drop in production.

Will the new gasoline price model in Brazil affect sugar production?

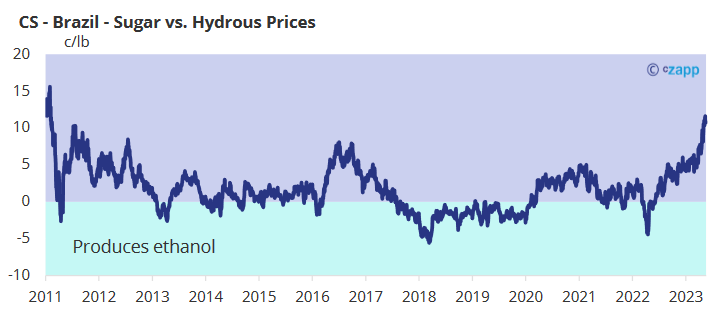

It was recently announced that Brazilian gasoline prices set by Petrobras will be decoupled from international oil prices. This weakens the link between sugar and oil prices since ethanol prices will no longer be so closely linked to oil prices.

Subsequently gasoline prices in Brazil fell. What does this mean for mills?

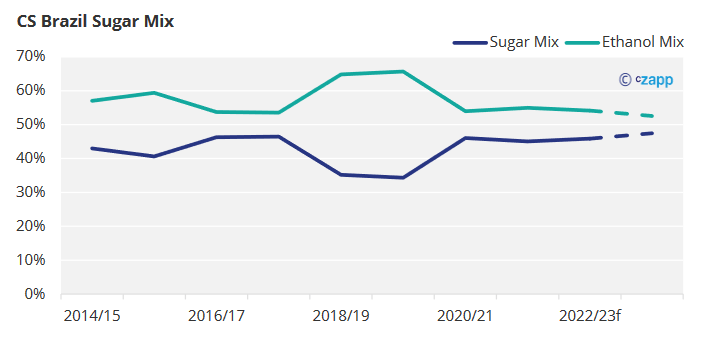

This price reduction notwithstanding, for most of the last year sugar has already paid much better than ethanol for Brazilian mills. Margins have only improved as sugar prices have rallied over the last few months.

This means that mills in Brazil have been maximising they amount of sugar they are producing at the expense of ethanol production. As a result, no matter how much higher sugar prices move, Brazilian mills cannot produce any more sugar than they are currently since they are already maximising their sugar output.

Regarding the recent gasoline price cut, since gasoline prices and ethanol prices are linked, ethanol prices will likely also need to weaken to keep ethanol competitive at the pump. This will make ethanol less competitive against sugar.

This shouldn’t have an effect on sugar output since as we covered above, mills are already maximising their sugar output at the expense of ethanol.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.