Insight Focus

China’s sugar consumption is recovering after it lifted COVID controls. High sugar prices drive end consumers to seek cheaper alternatives. Higher liquid sugar and premix demand could replace some raw sugar demand.

Social mobility has gradually recovered, and the consumer market is recovering since China lifted COVID-19 controls in December 2022. The signal is clearer this month after China scrapped mandatory mask wearing for teachers and students.

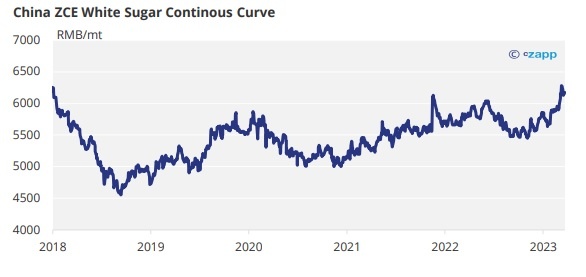

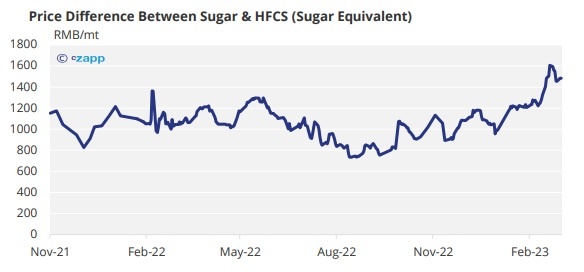

This month Chinese sugar prices reached their highest level since 2018. The price gap between white sugar and high fructose corn syrup (HFCS) has also widened.

How will consumers cope with this?

Sugar Purchasing Managers’ Dilemma

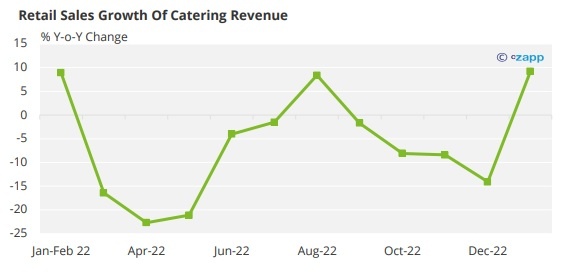

Sugar consumption should increase this year compared to 2022, in theory. In the first two months of 2023, the total retail sales of consumer goods rose 3.5% year on year, reversing the trend of three consecutive months of decline since October 2022.

Among that, the revenue of catering industry grew 9.2%, and online retail sales of food products grew 5.3%

Source: NBSC

Improved consumption is good news for food and beverage producers, which should also boost demand for sugar. But sugar purchasing managers could face awkward situations.

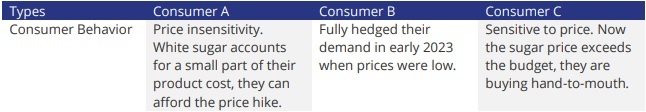

At the beginning of the 2022/23 season, sentiment in the Chinese sugar market was bearish. As a result, purchasing managers may have set low budgets. Faced with current high sugar prices, they are buying hand-to-mouth. They might be buying for a week at a time, whereas previously they might have been buying for 1-3 months.

It’s the slow season of the year, but by the time they get to the summer season they must buy at whatever price or look for alternatives.

Consumers Switch to HFCS

We had discussed the two major substitutions in history, which occurred around 2011 and 2017, when the price difference between sugar and HFCS was as high as RMB 4,000/tonne. In the 2021/22 season, the price difference was in the RMB 700 – 1,300/tonne range. We think it needs to be above RMB 1,500/tonne to incentivize new switches.

That’s where we are now. And corn prices are falling, which means the HFCS price has room to fall. If the gap widens, we should see consumers switch some demand from sugar to HFCS.

Higher Liquid Sugar & Premix Powder Demand

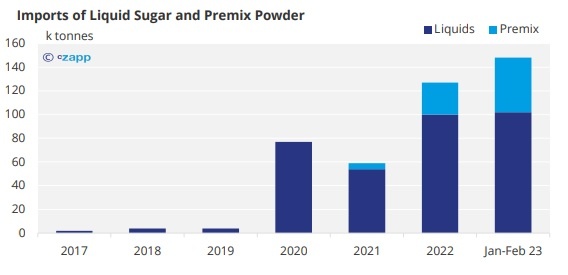

If you’re looking for the same flavor as sugar there are also cheaper options: liquid sugar and pre-mix powder. These products are imported, but unlike raw and white sugar imports they are tariff-free, which means they are much cheaper.

The problem is that liquid sugar has a short shelf life, usually between 30 and 60 days. The pre-mix powder may not meet user requirements because it contains different ingredients. But these issues are less important when consumers are facing cost pressures.

Therefore, we saw a record of 148k tonnes of liquids and premix imports in Jan-Feb 2023.

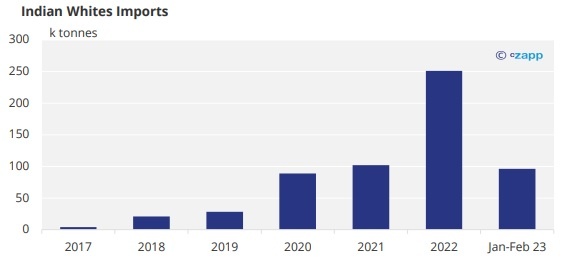

Besides, we also saw 96k tonnes of Indian white sugar imports. We think most of thi sugar is used for production of premix powder in the comprehensive bonded zones.

Raws Demand Could Reduce

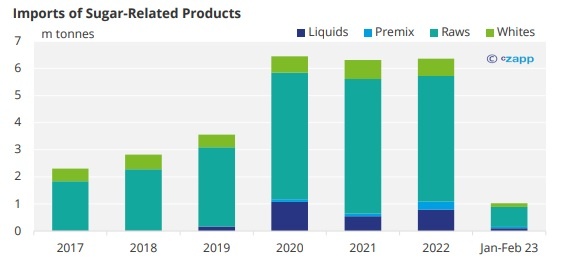

We should therefore expect import demand for liquids and premix to replace some of the demand for raw sugar in 2023.

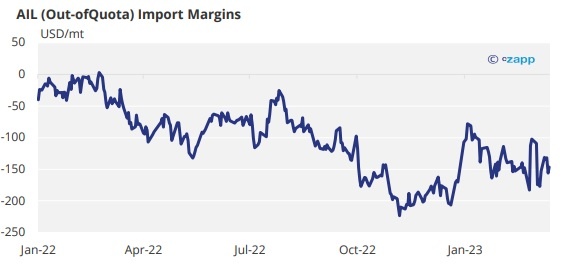

This is because 60% of raw sugar demand is Out Of Quota (AIL) and pays 50% import duty. Raw sugar import margins have been negative since early 2022.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.