Opinions Focus

China is including sugarcane in subsidized agricultural insurance cover to protect farmer incomes. China could produce 10.35m tonnes of sugar in the 2022-23 season. This means it would still need to import over 5m tonnes of sugar.

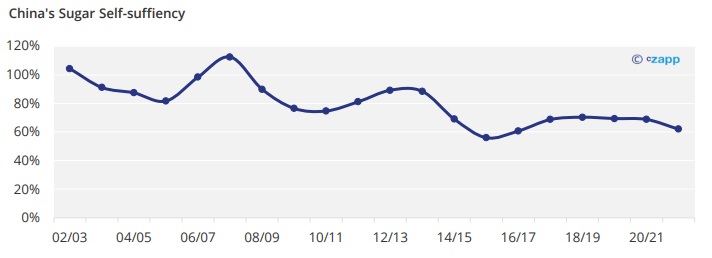

China Struggles on Sugar Self-sufficiency

- China produced around 9.7m tonnes of sugar in the 2021-22 season, 1m tonnes less than a year earlier.

- This equates to a self-sufficiency rate of 62%, in the bottom three of the past 20 seasons.

- China no longer seems to be aiming for sugar self-sufficient but to maintain sugar production at around 10m tonnes.

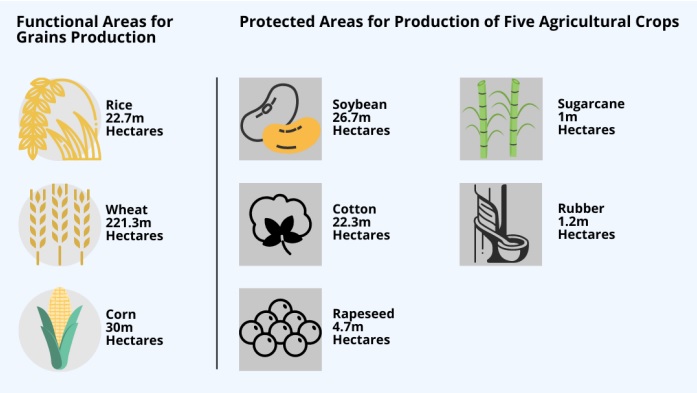

China set the goal of dedicating advantageous areas to grains and important agricultural crops in 2017.

China set the goal of dedicating advantageous areas to grains and important agricultural crops in 2017.- This includes 1 million hectares of sugarcane in the Guangxi Autonomous Region (767k ha) and Yunnan Province (233k ha).

- However, some protected cane areas were being used to grow fruit and eucalyptus because of higher returns.

- China expanded the scope of its High Sucrose & Yield Cane Base to cover all protected cane areas in 2019.

- Guangxi has built up 336k ha of High Sucrose & Yield Cane Base, with an average sucrose content of 15.6% and an average cane yield of 103.35 tonnes/ha.

- Under ideal conditions the protected area can produce up to 13m tonnes of sugar, yet it only produced 8.1m tonnes this season.

22/23 Crop to Recover with Record Beet Price

- Chinese 2022-23 sugar production could rebound 650k tonnes on the year to 10.35m tonnes.

- This is down to a recovery in the beet area due to a record high beet price and more favourable weather.

- Xinjiang, the second largest beet region, raised its beet price to RMB 560 (USD 83.69) from RMB 440/tonne for 2022-23.

- The cane area is expected to increase slightly in the 2022-23 season, which would already be a success.

- Guangxi government plans to boost sugar production by 5.0-5.5% in 2022-23, by removing areas of banana, eucalyptus, and fruit.

- However, this increase in the cane area was largely offset by losing land to rice and construction.

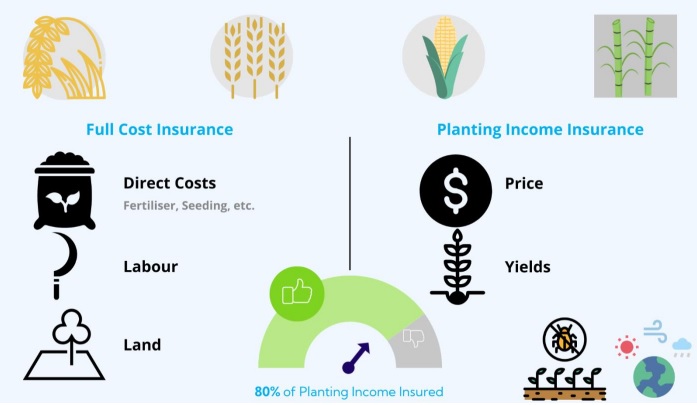

New Approach to Encourage Cane Planting

- China included sugarcane cost-in-full and income insurance coverage in 2022, along with three grain crops.

- It protects 80% of farmers’ income against natural disasters, pests, disease and price fluctuations.

- The central and provincial governments will pay 70% of the insurance cost.

- The rest will be shared between county governments and farmers.

- The new plan covers 3 times the value of previous direct cost and price insurance in 2020-21 and 2021-22.

Will It Work?

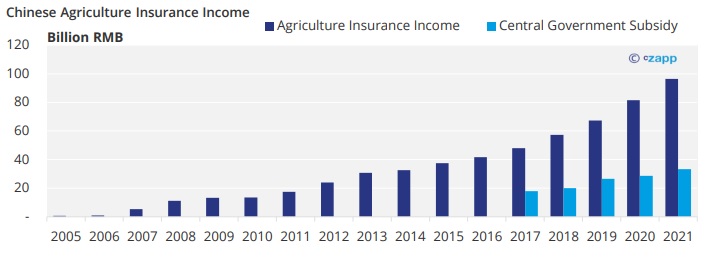

- The Chinese government is encouraging farmers to continue growing grains and cane by protecting their income through insurance and subsidies.

- The central government s spent RMB 231m on subsidising sugarcane insurance in Guangxi in 2021, 53% more than in 2020.

- It protected 591.2k farmers and increased farmer income by 7.7%.

- China also spent RMB 17.78b on the Guangxi sugar industry between 2016 and 2020.

- As a result, Guangxi’s cane acreage has remained around 760k ha between 2016-17 and 2021-22.

- Guangxi’s cane area shrank to 747k ha in 2016-17 from 865k in 2014-15.

Concluding Thoughts

- China is using insurance and subsidies to encourage the planting of sugarcane and grains.

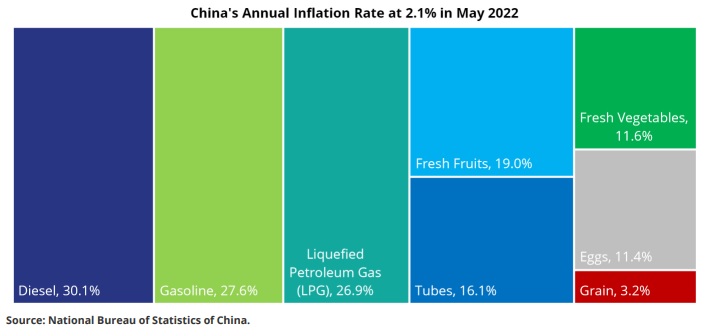

- The aim is to enhance food security and curb inflation with ample supply.

- We don’t expect a significant increase in sugarcane acreage despite all these government efforts.

- This means China’s sugar self-sufficiency rate could swing between 60% and 70%.

- China will need to import 4.7m-6.2m tonnes of sugar a year.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.