Insight Focus

China liquid sugar and premix imports rise 42% YOY in Jan-Apr. High local sugar prices have driven the increased demand. Lower Thai and Indian sugar supply could slow premix and liquid sugar imports in H2’23.

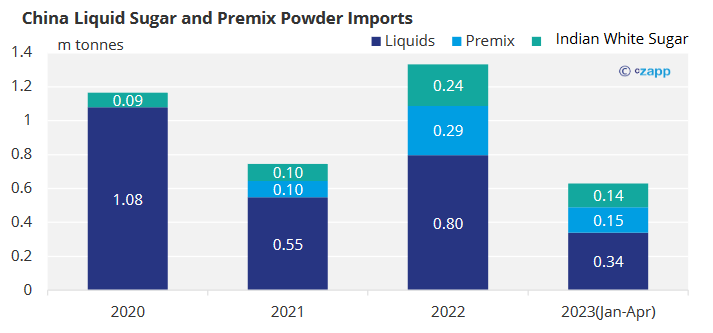

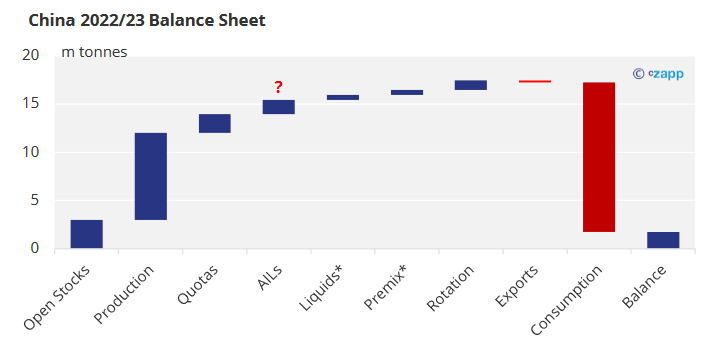

China imported 6m tonnes of sugar-related products (sugar equivalent) in 2022 via 5 legitimate channels with import duties ranging from zero to 50%. Up to now in 2023, almost no raw sugar has been sent to China due to the continuous negative import margins. In contrast, imports of liquid sugar and premix hit new highs thanks to lower tariffs.

Low-Duty Sugar Imports Hit New Highs

We have discussed in previous reports that the rapid rise in domestic sugar prices will prompt end users to turn to alternatives, and in order to ensure product flavour, syrups and premix powder seem to be good choices.

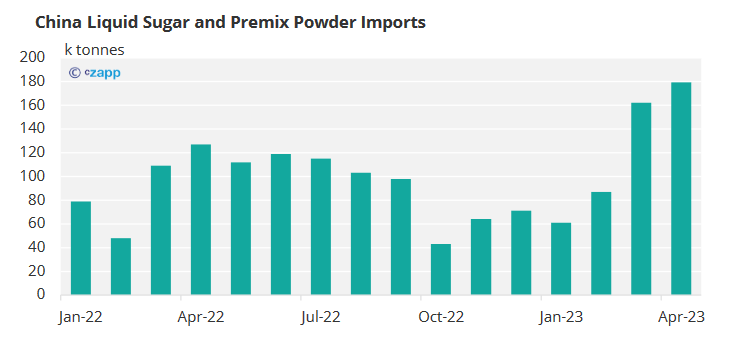

As a result, China imported 179.4k tonnes of liquid sugar and premix powder in April, another record high. Imports for the January-April totalled 0.5m tons, 42% higher than the same period last year.

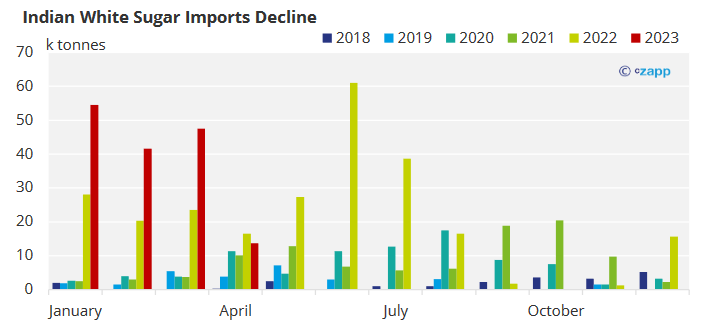

However, the light of Indian whites’ imports has dimmed. It fell to 13.7k tonnes in April, comparing to 47.52k tonnes last month. In the January-April period of this year, China imported 157k tonnes of Indian whites, compared with 251k tonnes for the whole of last year.

It is generally assumed that imports of Indian white sugar will be used for the premix powder production, in comprehensive bonded zone.

Hunan Province Comprehensive Bonded Zone – Yue Yang Area

Could Sourcing Be A Problem In H2 2023?

This brings up the concern in H2 2023.

Record imports of liquid sugar and premix depend on sugar supplies from Thailand and India. Thailand accounts for 97% of the liquid sugar imports and 77% of the premix. And Indian sugar dominates the production of premix powder in comprehensive bonded zone.

Due to regulatory risks and high sugar prices, we think producers may not have contracted much sugar ahead of time. As a result, the imports of liquids and premix could tone down in the second half of the year.

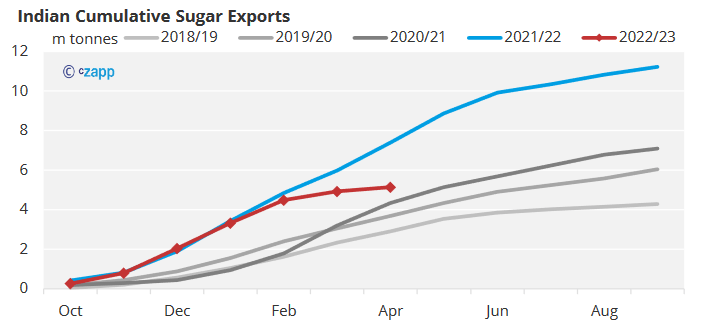

India’s sugar exports have reached 5.6 million tonnes, very close to this season’s limit of 6 million tonnes, and the remaining supply is very limited, if not zero.

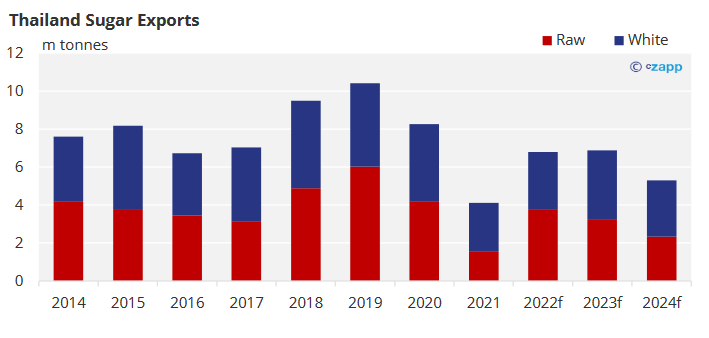

Thailand’s sugar production this season is lower than expected, and although white sugar supplies increases, the increase is limited. Some buyers are turning to Brazilian sugar.

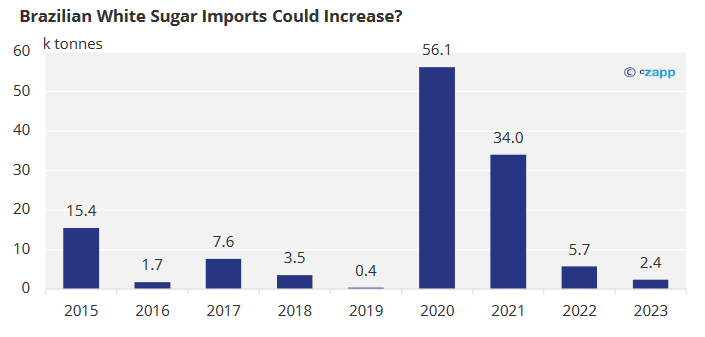

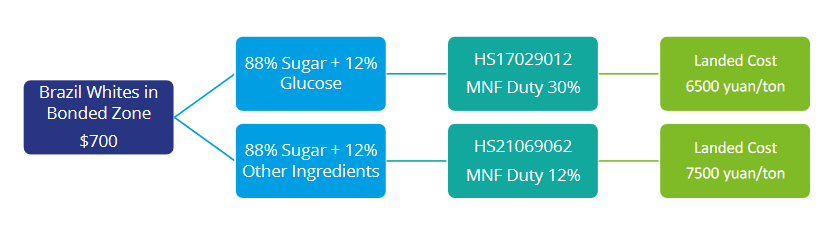

During Brazil’s last record 20/21 season, China imported 56.1k tons of Brazilian white sugar. Today, the CFR price of Brazilian low-quality whites is about 700 US dollars. It means the landed cost is about 6500-7500 yuan/ton, compared with the current Guangxi sugar price of 7200 yuan/ton. The margin seems not big enough to spur much growth.

Impact on Chinese Sugar Demand?

In conclusion, low-duty liquid sugar and premix imports are likely to be constrained by supply in the second half of 2023, despite bright performance in H1 2023.

We currently think that the imports are likely to remain the same as last year, totalling 1m tonnes in sugar equivalent. With this, and rotation of the central sugar reserve, the domestic sugar market looks set to come out of its corset for now.

However, if AILs imports further delay, the balance sheet could tight up and import margin would improve.

*liquid sugar and premix power are converted to sugar equivalent

For more articles, insight and price information on all things related related to food and beverages visit Czapp.