Insight Focus

The raw sugar market is staging a Santa rally. We’ve been positive on sugar prices for a while. This is because global sugar production isn’t growing.

Hello everyone, it’s Stephen from Czapp with an update on the sugar markets in December 2022.

Raw sugar futures have staged their own Santa rally and are trying to end 2022 with new highs. This is impressive because almost all other commodities are sideways to lower. It’s not clear therefore if this move will come to anything or not.

Long term viewers of my videos will know I’m quite bullish on prices in the coming months. I thought it would be helpful to look at one of the fundamental reasons why today: sugar production.

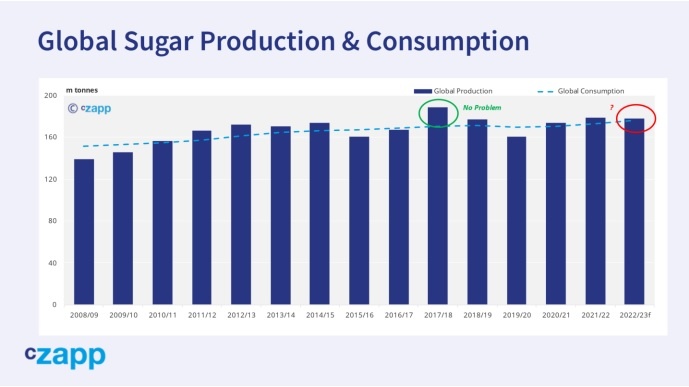

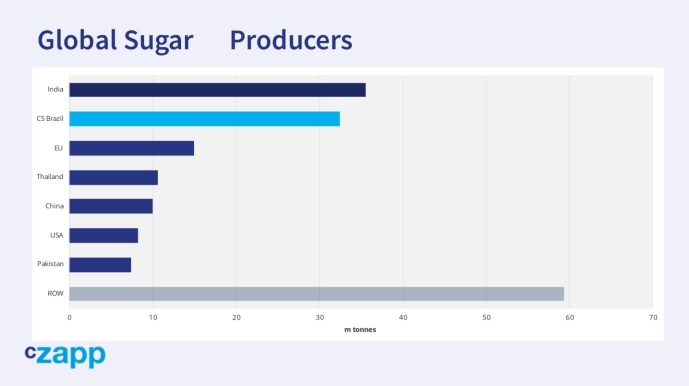

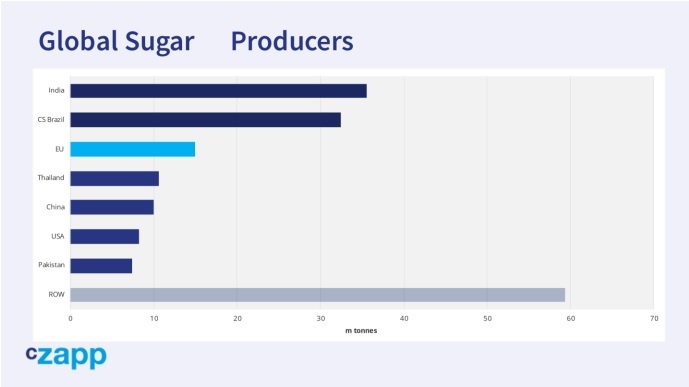

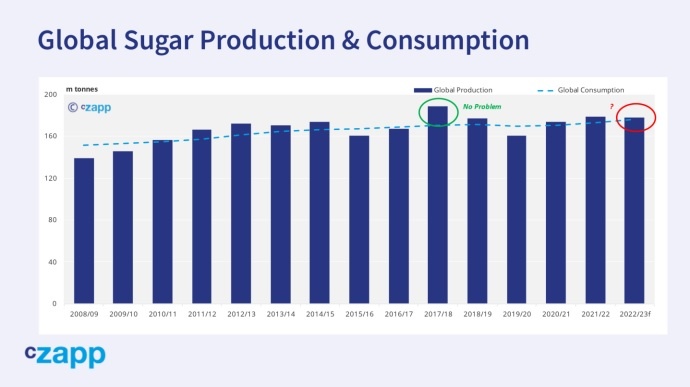

Why is this important? Global sugar production hasn’t changed in more than 10 years. We’ve been stuck at 175m tonnes a year, plus or minus 15m tonnes.

In 2023 for the first time ever global sugar consumption will exceed 175m tonnes. In a good year, when production is closer to 190m tonnes, that’s fine. There’s no stress in the sugar market. But in a bad year we will get a stock drawdown.

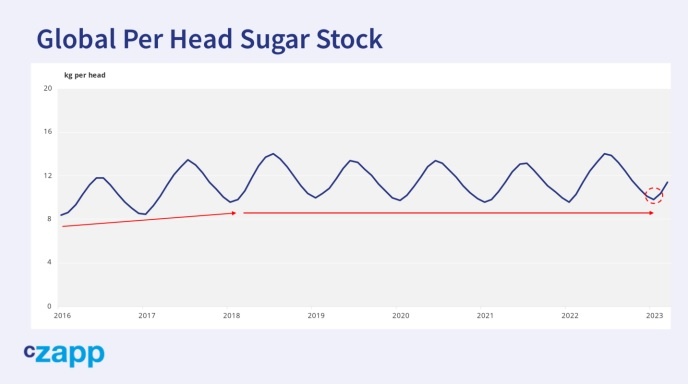

Sugar stocks have been largely unchanged in the past 4 years at 9.5g per person at the low point in the cycle, which is around about now. So will we get a normal crop in 2023? Or a bad one? If it’s bad, that probably means higher prices. Northern hemisphere cane harvests are now beginning around the world, so let’s see what could be in store.

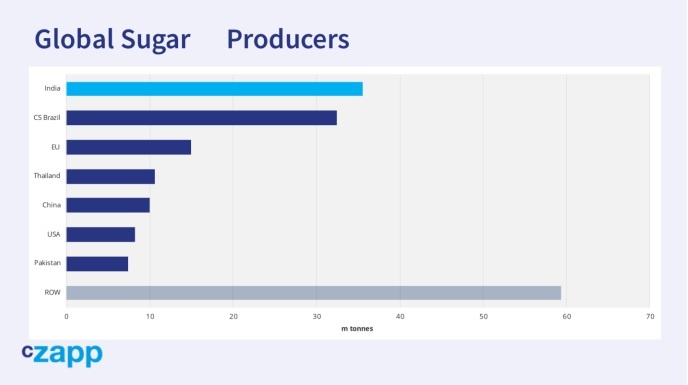

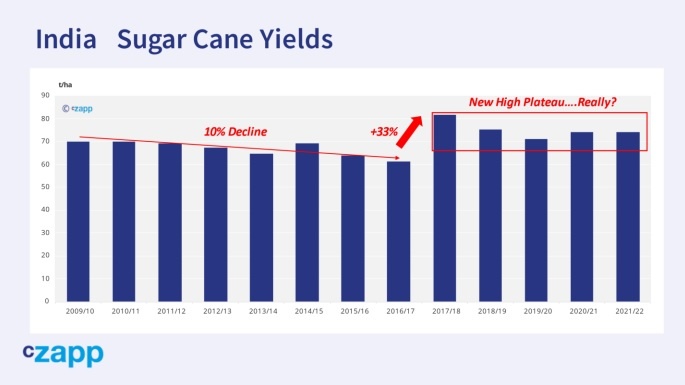

We start with India, which is the world’s largest sugar producer and so is really quite important. I’ll share a secret. Forecasting India is a mess. For a start, you can’t really treat it as one area. There’s cane in the north which is different to the southwest which is different to the south.

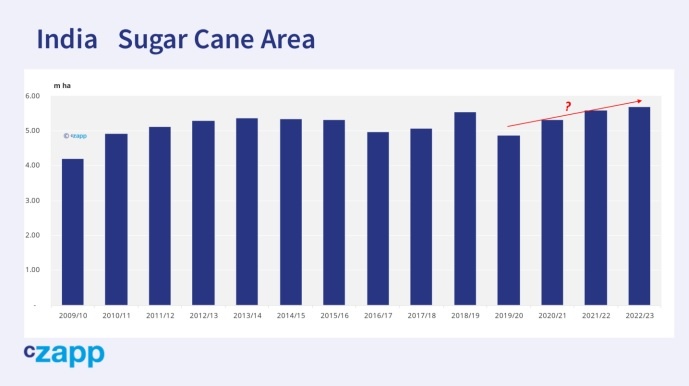

On top of this, no-one knows the cane area each year. The government gets farmers to register cane area with mills, but there’s often cane that’s unreported. Mill agronomists can’t always uncover it all.

Satellite mapping struggles because cane can often be intercropped, where other crops are grown between the rows of cane as it matures. So, while the government and the Indian sugar mills association and analysts may give you a precise forecast for Indian sugar production each year you need to mentally apply some pretty wide error margins, even with our forecasts I’m about to share.

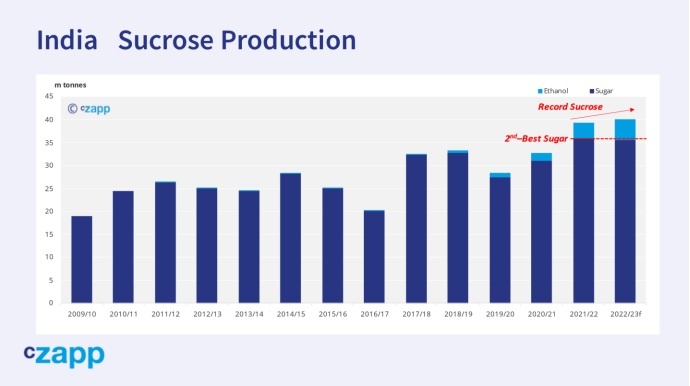

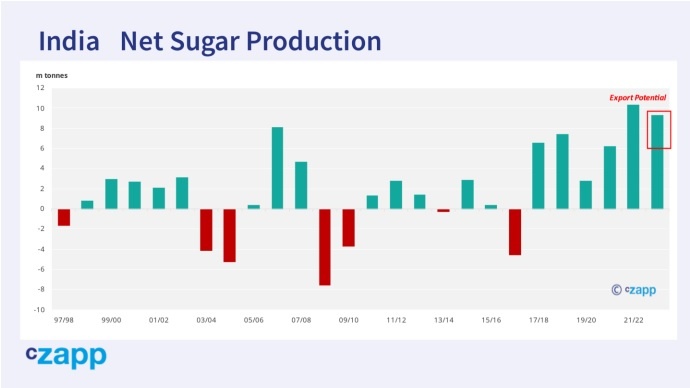

We think India will make 40m tonnes of sucrose this season. 4.5m tonnes will be diverted to make ethanol, leaving 35.5m tonnes of sugar. This would be the second highest amount of sugar they’ve ever made, beaten only by the cane harvest season just gone. The Indian sugar mills association are even more optimistic than we are. They think that sugar production will reach 36.5m tonnes, which if achieved would be a new record.

Either way, if these forecasts come true India will make around 9m tonnes more sugar than it consumes. The government has already allowed 6m tonnes of sugar exports this season. A further wave of exports is likely once the government is satisfied sugar production will be high enough. We should know the answer to this some time in February.

One final thing to note is that India is just about the only major sugar producer where cane acreage and sucrose output is increasing. As we’ll see shortly, most other major sugar producers are flat-lining. But in India’s case this growth actually adds to the sugar market’s risk, it doesn’t reduce risk. Cane is being grown in increasingly marginal areas, especially parts of northern Maharashtra which can be prone to low rainfall. This means Indian sugar output has greater dependence on good weather.

But we know that one year the weather in India won’t be so good, and what happens to the cane that year will be really important for sugar output, therefore sugar availability and therefore price.

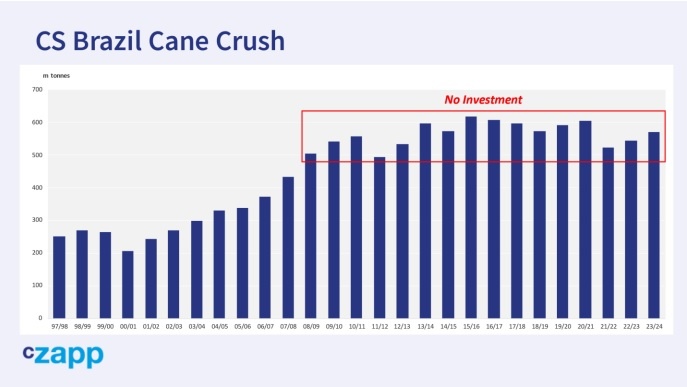

The other dominant sugar producer and exporter in the world is Centre-South Brazil.

This is the largest cane growing region in the world but has been starved of investment since the global financial crisis in 2008. In the season that’s just finished it looks like CS Brazil will have harvested 540m tonnes cane to make 33m tonnes of sugar.

This is the same amount of sugar that the region made in 2010/11. Since the middle of this year’s crush mills have maximized sugar output, not ethanol.

For next year we think cane crushing will improve a little, but mills will maximize sugar output from the start of the campaign as ethanol returns are low due to falling international gasoline prices. Motorists can choose whether to fill up cars with ethanol or gasoline and low gasoline prices undermine demand for ethanol, pushing mills to make sugar. So we think Brazil will make 34.7m tonnes sugar in 2023, which would mean that sugar production has gone nowhere in more than a decade.

In order for the Brazilian cane industry to expand again we need the back of the futures curve to rise to a premium over local cost of production to give big enough margins to potential investors. Until that happens the industry will continue to focus on deleveraging and also enhancing efficiency, rather than growing through greenfields.

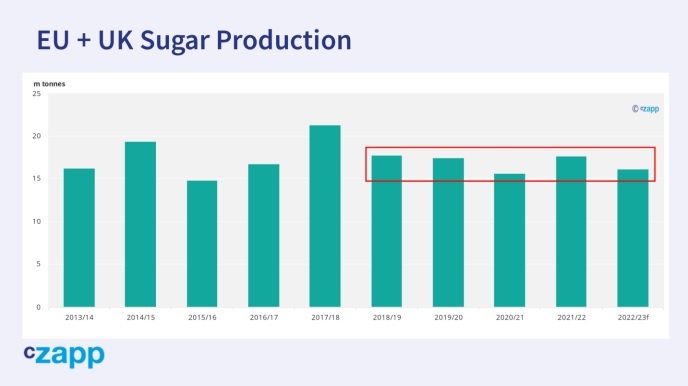

Turning to Europe, which is the third largest sugar producer in the world and makes sugar from beet, not cane.

Beet is an annual crop with a quick growth cycle. You plant in spring and harvest in the autumn. This should mean that farmers can respond quickly to changes in price. But it hasn’t really worked out that way, not in recent years. There’s been quite low volatility in production since 2018.

Anyway, beet prices for 2023 in Europe will definitely be higher than they have been for many years. This should be positive for beet acreage. But…. farm costs have also risen sharply, for fuel and fertilizer, for example. Returns for other competing crops are higher too. So we expect EU sugar production to grow next year, but not by as much as you’d think. Perhaps we’ll see 16.5m tonnes of sugar produced with the UK included. That’s up 4% on last year but 1m tonnes less than the year before.

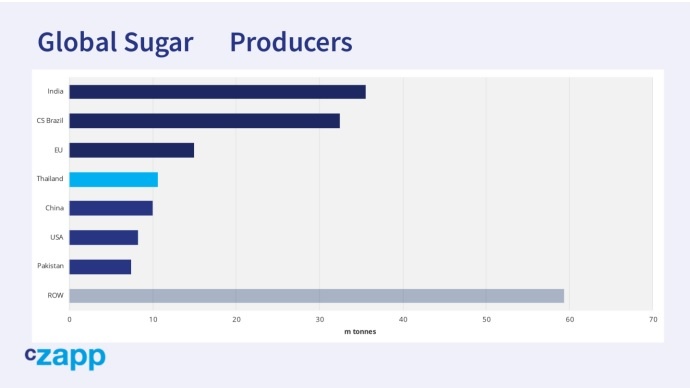

Moving on. Thailand is the world’s third largest sugar exporter.

It’s a prime supplier into East Asia, which is a deficit sugar region. What happens here is important for the sugar market. In 2023 we think Thailand will make 10.6m tonnes of sugar. This is an improvement on each of the last 3 years. But it’s also quite a long way below the record of 14.5 tonnes, and roughly in line with what it was producing 10 years ago. We expect a lot of this sugar to be whites, not raws, given Thai mills have relatively cheap costs of conversion as they use cane fibre to power their boilers.

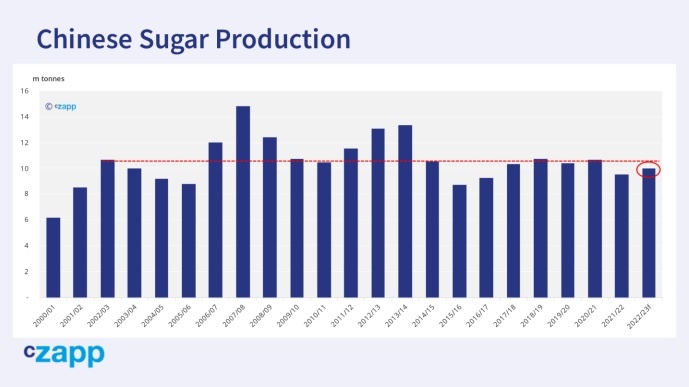

Finally, China is the only other region which makes 10m tonnes of sugar a year.

We think sugar production from cane and beet will be 10m tonnes in 2023. This is an increase on last year, but (I guess you’re sensing a theme here) is also the same level as China first achieved 20 years ago. The industry simply isn’t growing at all.

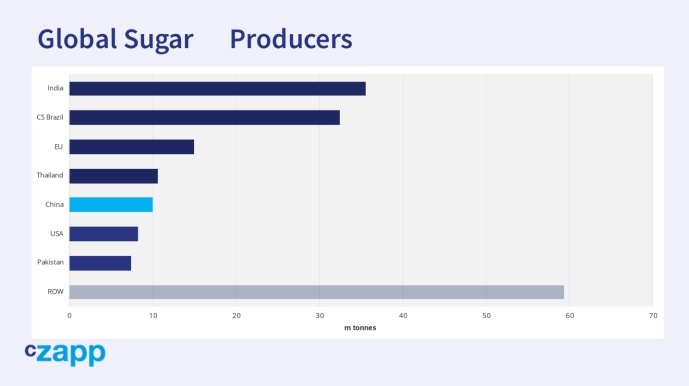

These are all the places that will make more than 10m tonnes of sugar in 2023. Together, they account for around 100m tonnes of sugar production, which is around 60% of the world’s output.

What happens in these countries, will dictate whether this year’s sugar production is sufficient to meet ever-rising consumption or not. Whether the farmers and cane/beet mills make money will then determine output in 2024 and beyond.

Global sugar production has been static for more than a decade at around 175m tonnes a year. Sugar consumption has now grown past 175m tonnes a year.

At some point in the near future we could have a season where sugar production isn’t sufficient to meet consumption, perhaps through bad weather or perhaps through poor sugar returns.

Please keep a close watch on the countries I’ve just covered in 2023 for an early sign of any problems.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.