Czapp Insight Focus

The Philippines’ stagnating per capita consumption augurs badly for demand growth. The government’s health-focused measures seem to be driving the drop. An ageing population is also holding consumption back.

Filipino sugar consumption is barely growing. The government’s health-oriented sin taxes, plus languishing urbanization and population growths should be additional brakes on demand.

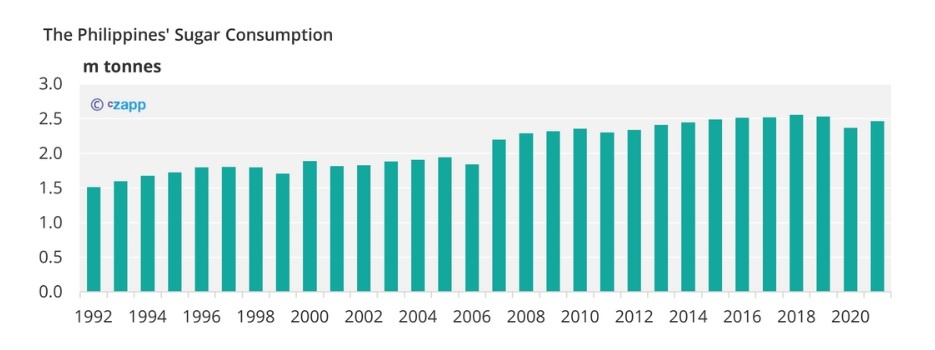

The Philippines’ Sugar Consumption Growth is Flattening

The Philippines consumes around 2.5m tonnes of sugar each year, making it one of the largest consumers in Asia, along with India, China, Indonesia and Thailand.

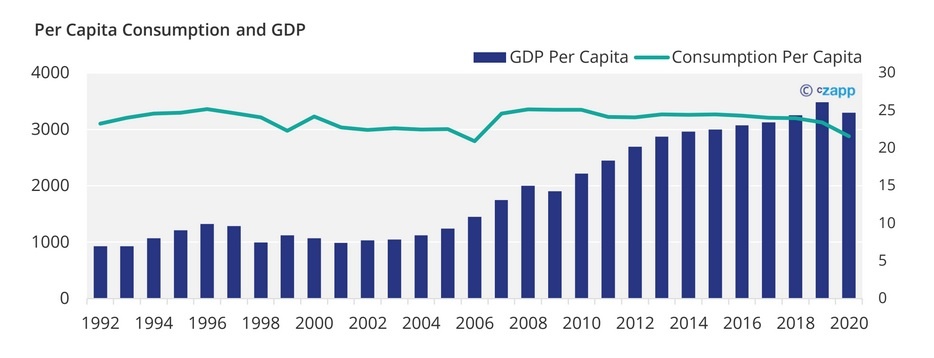

This equates to 23.5kg on a per capita basis, near its historic high.

Per-capita consumption is higher than might be expected given the Philippines’ low GDP per capita. However, such a discrepancy is not unusual in a sugar-producing country. For example, Brazil has the world’s highest per-capita sugar consumption. We now think national consumption has peaked, though, for the following main reasons:

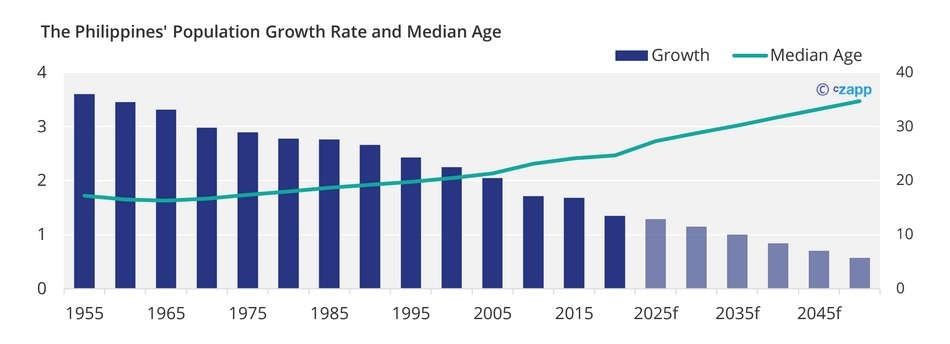

Population Growth Slowing

Firstly, its population growth rate has been falling since the 1950s, and we suspect this will remain the case.

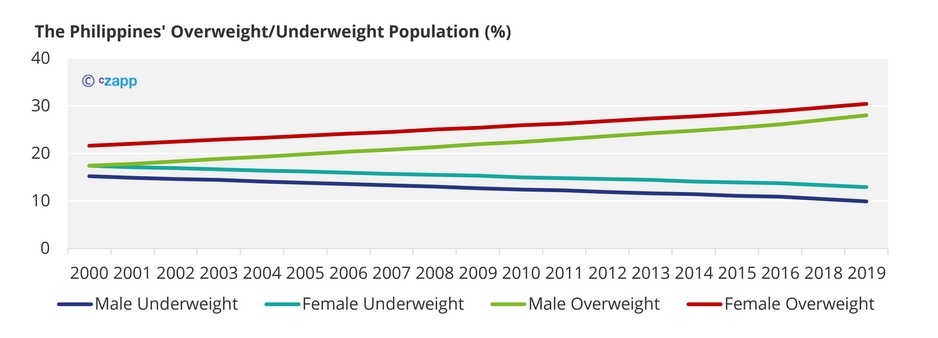

As the Philippines’ population growth rate continues to decrease, the size of its ageing population will increase, and various international studies have revealed that sugar consumption tends to be at its highest with teenagers and young adults.

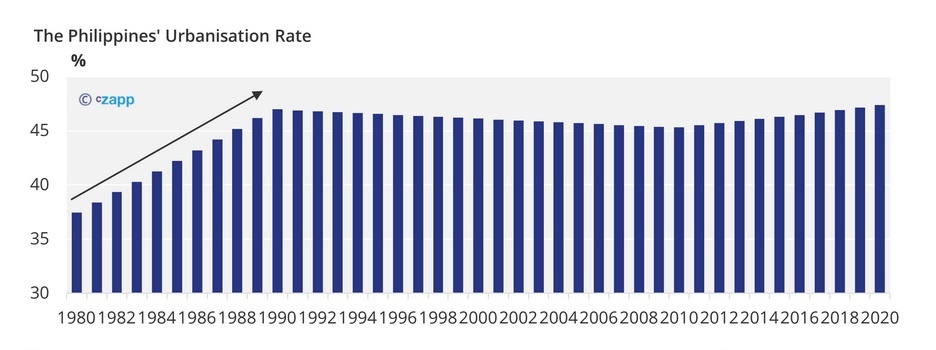

Urbanisation Has Slowed Dramatically

Another factor that should limit the Philippines’ consumption growth is urbanisation. We broadly assume that, as countries become more urban, they consume more sugar. This is because access to areas where sugar consumption is more common increases (such as restaurants, bars, and theatres). The same goes for the average disposable income and the prevalence convenience foods, which often contain more sugar. However, the Philippines urbanised rapidly between 1980 and 1990, but from 1990, its urbanisation rate has stagnated. This is likely because its urban and rural populations have grown at a similar rate.

This means that, for over thirty years, a key driver has had very little influence on per-capita consumption.

The Government Has Tried to Reduce Sugar Consumption

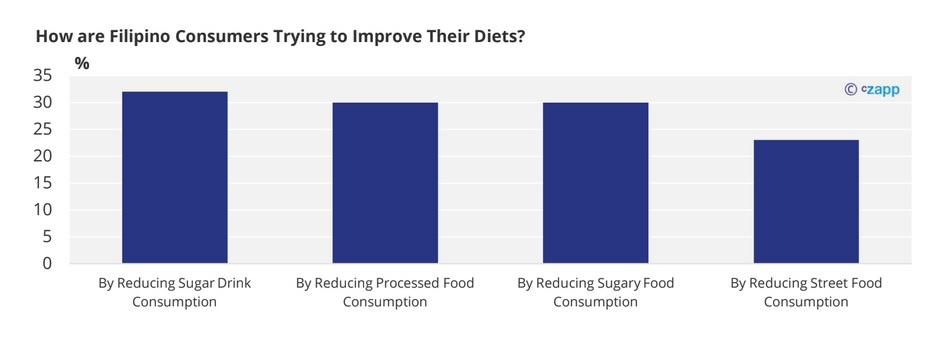

In 2018, the Filipino government introduced a tax on sugar-sweetened beverages (SSBs) to reduce sugar consumption and target rising levels of obesity.

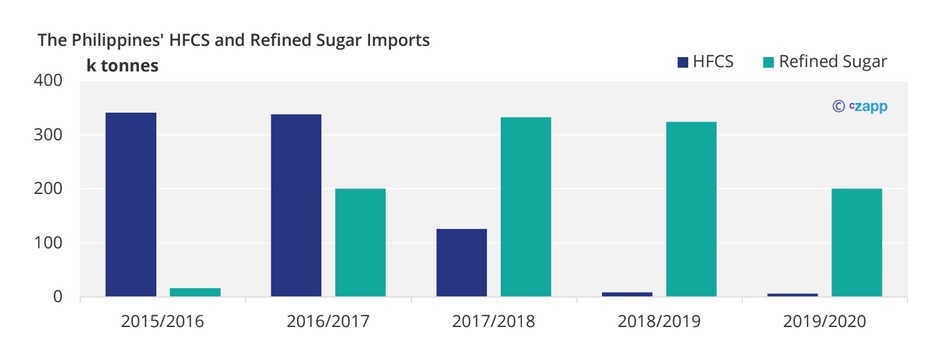

As it stands, the Filipino government has only targeted SSBs, but a state-run think tank is now pushing for an excise tax that applies to all ‘junk food’. If implemented, it would likely make a further dent in sugar consumption. With the existing tax, drinks containing sugar are subject to a 12 c/ltr duty, whilst those containing High Fructose Corn Syrup (HFCS) are subject to a 24 c/ltr duty. Formerly, the Philippines imported around 340k tonnes of HFCS per season, but when the tax was introduced, products were reformulated and these flows plummeted; refined sugar imports became the favoured way to ease the country’s deficit.

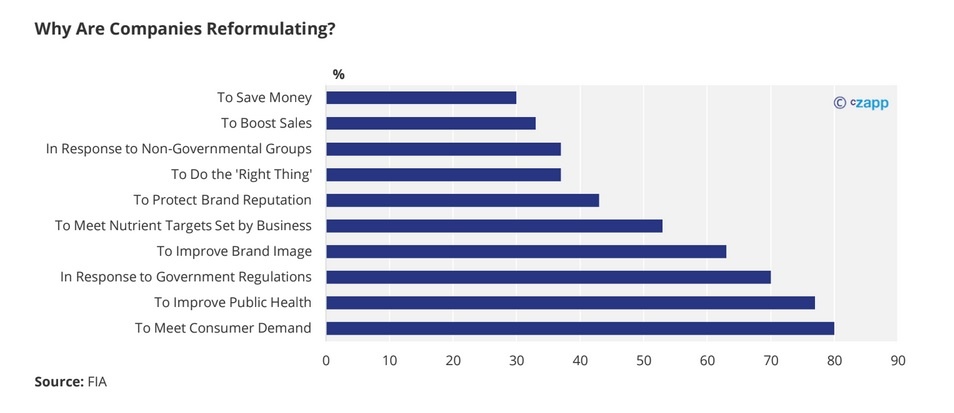

The effectiveness of such taxes is hotly debated, but the Filipino government says it helped lower SSB consumption by around 6.5% in the first year. Similar taxes have led to product reformulation in Chile, and whilst we’re seeing reformulation in the Philippines, the motives for it vary. Over 80% of producers are aiming to reduce sugar in their products.

Manufacturers are also voluntarily adding nutritional information onto their product labels. This may be because, according to FIA, 94% of Filipino consumers say they use nutritional labels to guide their purchasing decisions.

Further to this, several companies have pledged to reduce how often they advertise high sugar foods to children. This means products which directly target children under the age of 12 must meet specific nutritional criteria based on scientific evidence and dietary guidelines.

Concluding Thoughts

We suspect the Philippines’ sugar consumption will continue to rise. However, stagnant urbanisation and population growth should cap this. The high tax on HFCS should mean refined sugar remaining industrial consumers’ long-term choice, provided the sugar tax stays unchanged. And the government’s measures should show their true impact in the next couple of years, with consumer potentially becoming more health conscious.