Insight Focus

China Reserve Exchange’s announcement sparked speculation about sugar destocking. China’s raw sugar import demand is likely to increase due to re-stocking needs. The outlook for Chinese AIL import margin is gloomy.

An Unusual Signal

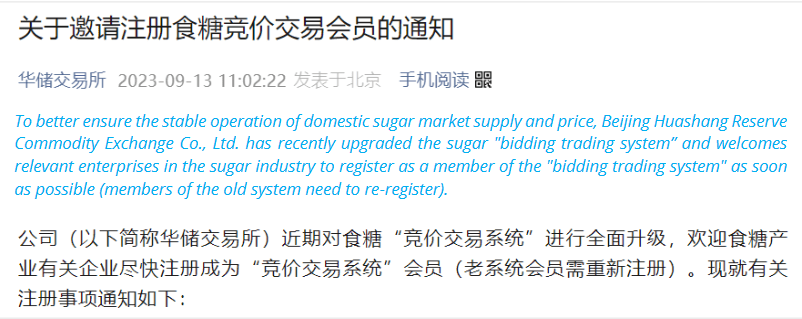

On Wednesday, the China Reserve Exchange invited registrations to become a member of sugar auction trading. This seemed to confirm this week’s destocking rumour, which further fuelled bearish sentiment in local sugar prices.

If the rumours are true, this will be the first public auction of sugar reserves since the 2016/17 season.

Source: China Reserve Exchange

‘Destocking’ in 2023

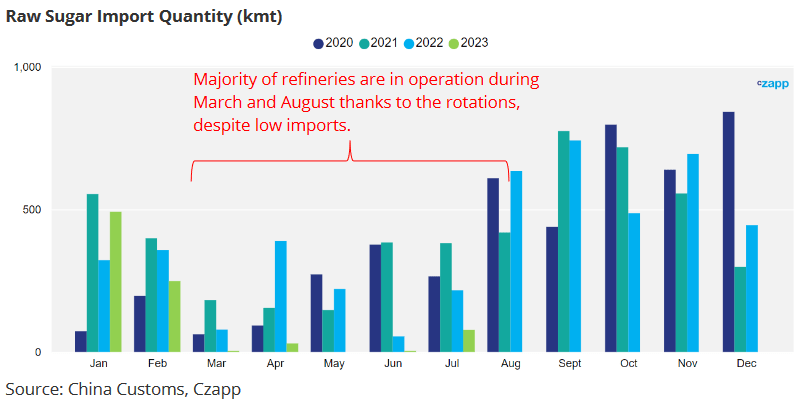

We’ve heard two rounds of stock rotation rumours in March and late May respectively.

Sugar stock rotation is not public. COFCO buys raw sugar on the world market and releases old raws stock to the domestic market, after it has been processed by the refineries. This ensures that the sugar reserve quality remains high. This has also eased tightness in the domestic market.

Refineries also benefit from this. With rotation, they manage to maintain their throughput despite low raw sugar imports.

This latest rumour (if it’s true) may be different. Destocking is a public bidding operation, which is why the announcement by China Reserve Exchange caused market attention.

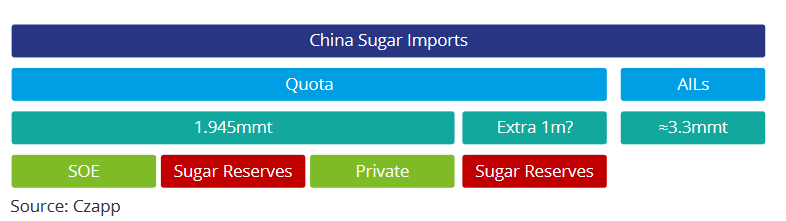

This year, China may release as much as 1.4 million tonnes of supply to the domestic market, does this mean that China will also import the same amount of raw sugar at low tariffs to replenish its sugar reserves? What’s its impact on domestic and world market?

Impact on Domestic and World Market?

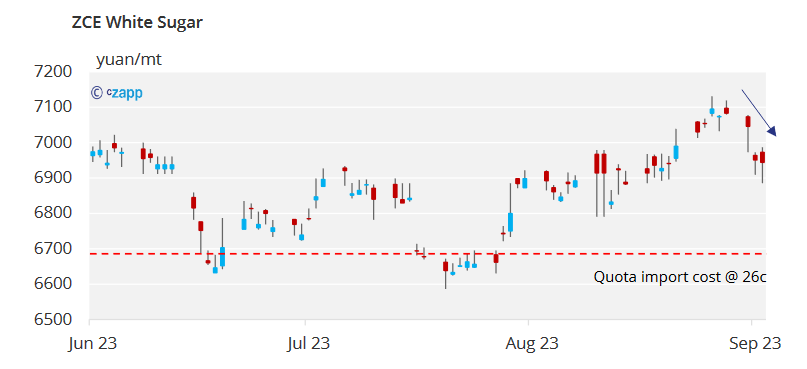

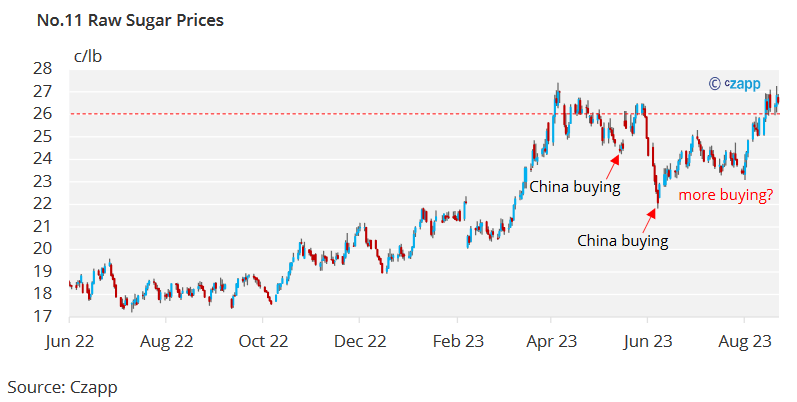

The market has spoken. ZCE white sugar prices have fallen nearly 3 percent since the rumour. The import cost of quota is only 6700 yuan/tonne when sugar is high at 26c/lb, which is far lower than the current sugar price.

This could mean support for the world market as China’s buying target can be higher, and demand too. However, we believe that a fair portion of the extra quota (if there’s one) may have already been purchased during previous raw sugar corrections.

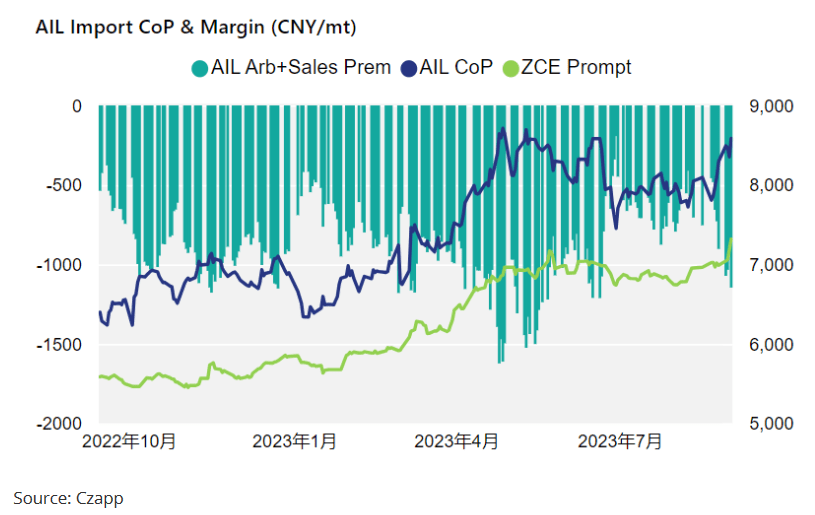

With the bulk arrival of raws from September, the start of beet crushing in September, and this possible destocking, China’s sugar market does not seem to lack sugar at present. This is not good news for sugar refiners as they are unlikely to fully use this year’s AILs under such poor margins.

They will have to lobby the government to keep their allocation of next year’s AILs intact.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.