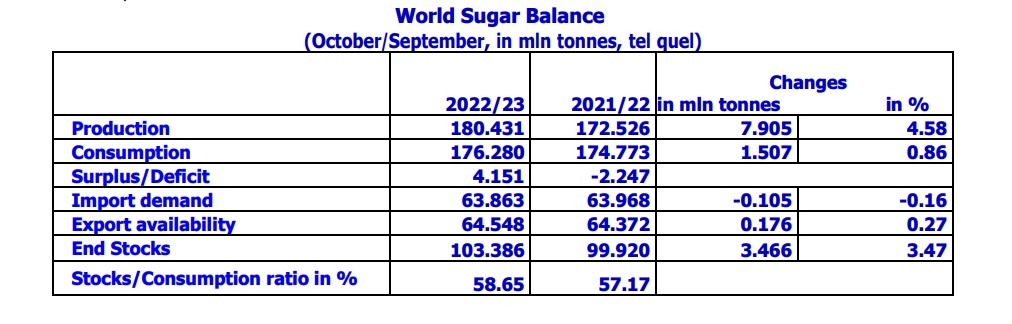

The ISO’s first revision of the global balance for 2022/23 (October/September) shows a surplus of 4.151 mln tonnes, down from 6.185 mln tonnes in our November report. Production is expected to rise to a record 180.431 mln tonnes, up from 172.526 mln tonnes in 2021/22 albeit below November’s estimate of 182.142 mln tonnes. Meanwhile, consumption is projected to rise to 176.280 mln tonnes, up from 174.773 mln tonnes last season and 169.708 mln tonnes in 2019/20.

The projected trade balance has a surplus of 0.404 mln tonnes in 2022/23 and 0.765 mln tonnes in 2021/22. Both are subject to a higher adjustment for unknown destination trade of 0.951 mln tonnes in 2021/22 and 0.600 mln tonnes in 2022/23. This adjustment is also incorporated into consumption estimates.

ISO’s fundamental view has changed from neutral-to-bearish to neutral for the next three months. In mid-January, raw sugar prices rose sharply supported by speculators re-establishing long positions. Meanwhile, the market continues to face a futures board in backwardation. This has been a market feature for over a year. It draws forward supply, where possible, underpins a bullish speculator strategy, and dominates market sentiment.

World ethanol production in 2022 is estimated to have reached 109.4 bln litres, up from 104.6 bln litres in 2021. For 2023, output is expected to recover further, reaching 111.8 bln litres. Meanwhile ethanol consumption is expected to have totalled 104.2 bln litres in 2022, revised lower from 104.5 bln litres as up-to-date data becomes available.

Consumption in 2023 is expected to rise to 106.9 bln litres, driven by increases in India, which alone is expected to contribute 864 mln litres to the global tally, but also by Brazil (+0.859 mln bln litres), US (+0.267 bln litres), China (+0.25 bln litres), the EU27+UK (+0.16 bln litres), Argentina (+0.135 bln litres) and Thailand (+0.125 bln litres).

In 2023 India’s ambitious Ethanol Blended Petrol Programme is set to achieve a 12% blend, up from 10% in 2022. Meanwhile, the end of the federal tax exemption on fuels in Brazil may help spur additional hydrous ethanol offtake from March onwards, despite the coming season likely to continue to focus on sugar. Tight molasses fundamentals are likely to prevail, supporting molasses prices in 2023, but geopolitical tensions continue to ensure a volatile outlook.

Global molasses production (excluding Brazil) is forecast to rise only slightly in 2022/23 but availability to the world market will be lower. Russia’s export activity will likely remain constrained, although there are no specific sanctions against Russian beet molasses exports.

Importantly, lower molasses production in India coupled with plans to raise the use of sugar for ethanol will reduce cane molasses exports. Both the US and the EU – the globes dominant importers – upped shipments in 2022. Tight fundamentals, however, could ease later in 2023 should a downturn in molasses demand emerge.