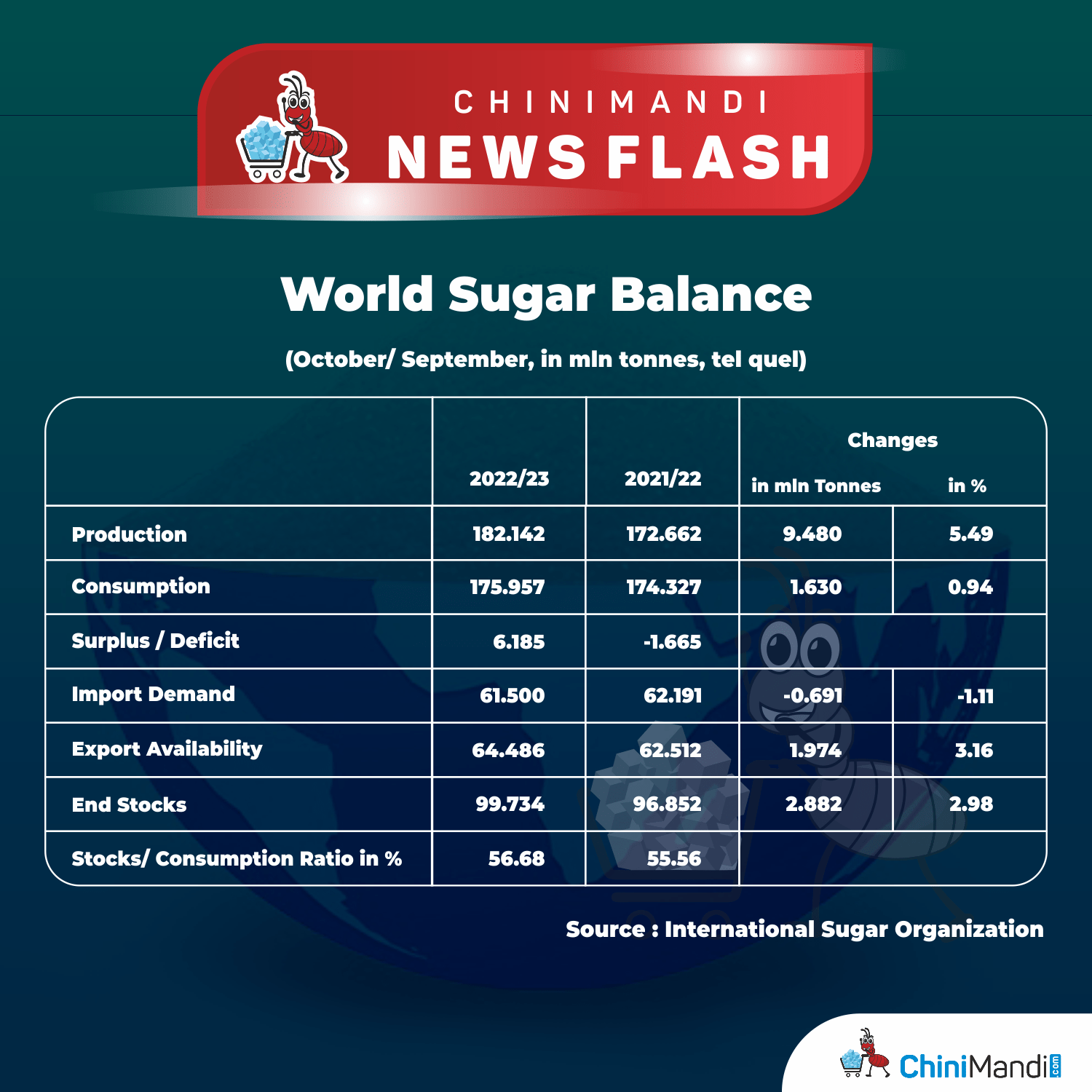

The International Sugar Organisation on Thursday announced its first revision of the global balance for 2022/23 (October/September) which shows a surplus of 6.185 mln tonnes, up from 5.571 mln tonnes in our August report.

Sugar production is expected to rise to a record 182.142 mln tonnes, up from 181.912 mln tonnes in August (and 172.662 mln tonnes last season). Meanwhile, consumption is projected to rise to 175.957 mln tonnes (up from 174.327 mln tonnes last season).

According to the inter-governmental body, submissions from its members for the 2022 sugar yearbook and the delays during the harvests in some southern hemisphere origins have prompted revisions to the 2021/22 balance sheet from 174.109 mln tonnes of production and 175.449 mln tonnes of consumption previously.

The projected trade balance has a surplus of 2.986 mln tonnes in 2022/23, from 2.347 mln tonnes in August, matching the increase in the global surplus.

ISO’s fundamental view remains neutral-to-bearish. In recent months, raw sugar prices have weakened marginally, although inflationary pressures have increased substantially, elevating production cost profiles for sugar crop producers and processors.

The ISA Daily Price and the ISO White Sugar Price Index for October averaged USD17.54 cents/lb, down USD0.31 cents/lb since our last report, and USD519.71/tonne, down USD11/tonne. During the last three months, the participation of speculators in the sugar market, and commodities more broadly, has become significantly less bullish, with non-commercial sugar positions near neutral on November 1st.

World ethanol production in 2022 is expected to reach 111.1 bln liters, representing a 2.0 bln liter increase over 2022, while consumption is projected to reach 106.6 bln liters, up 2.1 bln liters from last year. In India, the Ethanol Blended Petrol Programme expands at pace, with capacity rising and ethanol reference prices adjusted to secure increasing blending ambitions. In the EU, while inclusion is forecast to grow in the short to medium term, long-term views can only be perceived as negative, with a single vehicle technology (electric) seen as the tool of choice adopted by the bloc to limit transport emissions.

Meanwhile, in Brazil, the dynamics of fuel ethanol competitiveness may undergo a period of substantial change if the incoming President abandons the Petrobras pricing policy, severing an important link between sugar and energy. In the world’s top market for ethanol inclusion, the US, lower fuel demand and supply are expected in 2023.

The gap between sugar and cane molasses values has narrowed recently. Geopolitical tensions make the outlook for the molasses market uncertain and volatile. Russia normally exports between 250,000-300,000 tonnes of beet molasses each year, but these shipments have been disrupted by trade sanctions.