Insight Focus

Sugar supply problem seen longer term as Indian exports dwindle. EU, Thailand unlikely to plug gap left by India. Global sugar prices should rise as a result.

We recently attended the International Sugar Colloquium in Tucson, Arizona. We shared our views on the world sugar market this year and beyond. Here are the key takeaways.

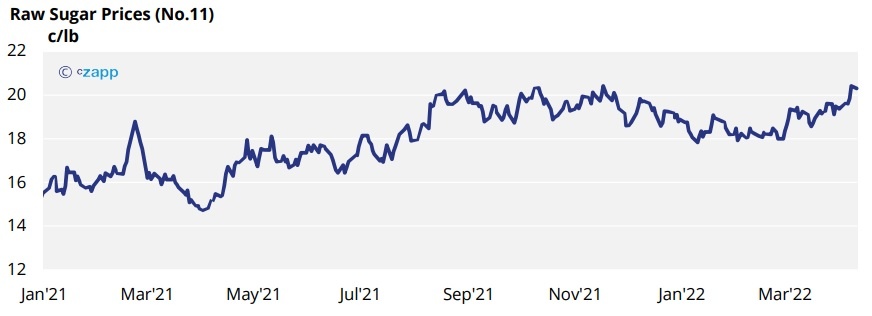

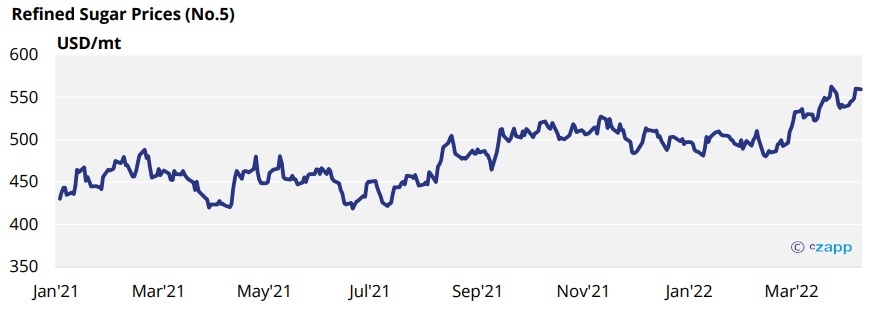

Sugar Prices Trade in the Range

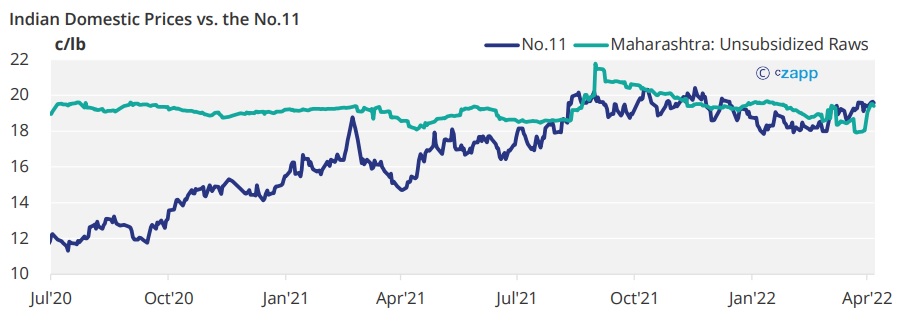

- The No.11 has been trading in a range for the last 18 months, between 18 and 20 c/lb

- The No.5 has been trending upwards, from 450 to 550 USD/tonne.

- We think the market will start to trade back into the upper end of this range, given the competition from ethanol in Brazil.

Brazil’s Outlook for 2022/23: Max Sugar on the Cards

- CS Brazilian mills should favour sugar production for 2022/23.

- We currently think the mills’ production mix will be 44.3% towards sugar, putting Brazilian sugar production at 32.7m tonnes for 2022/23.

- Russia’s invasion of Ukraine will continue to add volatility to the global oil market, though.

- This is important because sugar competes with fuel ethanol in Brazil.

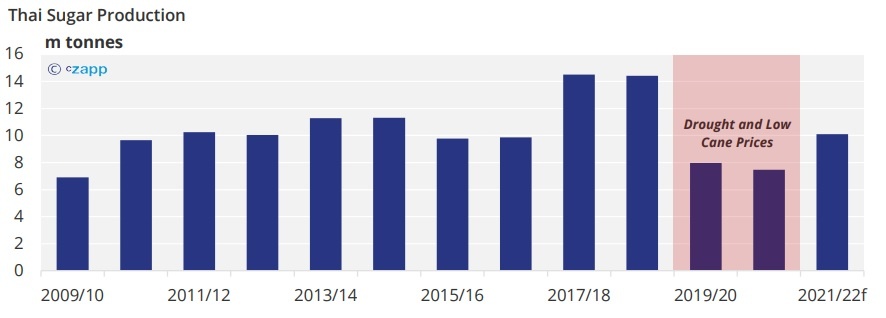

Thailand’s Outlook for 2022/23: Cane Rebounds Following Drought

- Thailand, like Brazil, is on for a rebound, with sugar production reaching 10m tonnes this season.

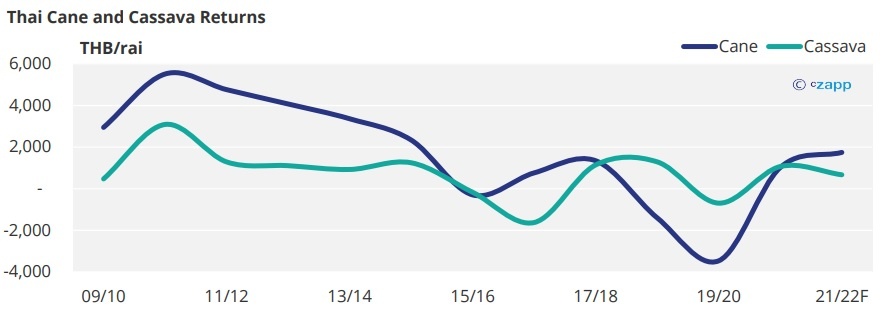

- Higher rainfall and returns have allowed this to happen, with strong cassava margins and drought hitting cane output the past two seasons.

- Cassava remains competitive, even with the high sugar prices, so a return to 2018/19 levels is unlikely.

- The market needs Thai sugar production to continue at current volumes, so sugar prices must keep pace with cassava, especially if Indian production drops.

India’s Outlook for 2022/23: Exports Flow Without a Subsidy

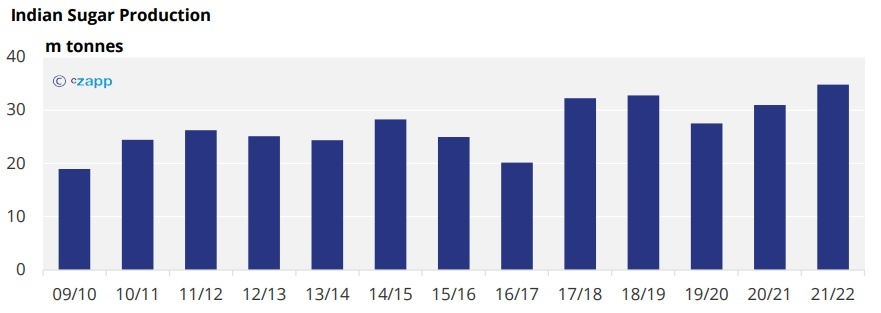

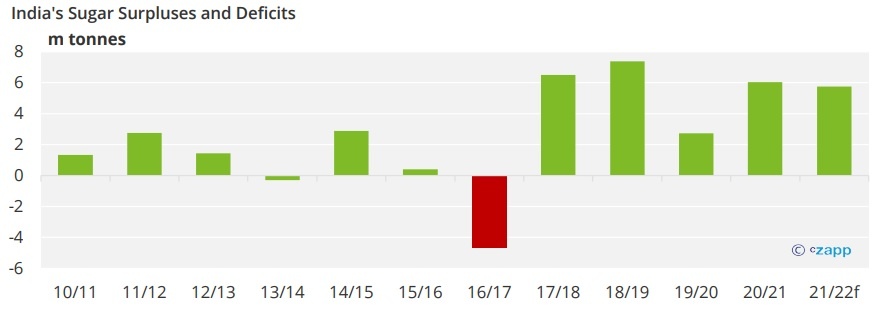

- India’s not struggled too much for sugar of late, with five consecutive surplus seasons.

- Over this period, it’s produced almost 28m tonnes more than it’s consumed.

- This surplus sugar must be exported, often with Government support, pushing the world market down.

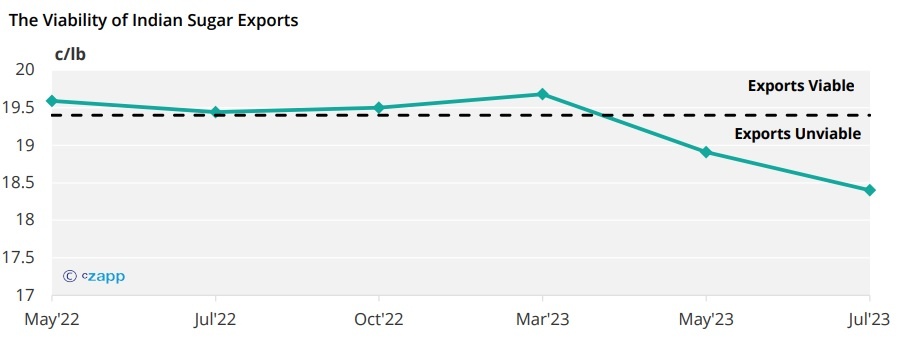

- This year, however, the market needs Indian sugar, and the world market has risen to make these exports workable without Government intervention.

- With Indian export parity currently around 19.4 c/lb, world market exports remain more profitable than domestic sales.

- India should export 8m tonnes of sugar this season.

Do We Have a Long-Term Supply Problem?

- Whilst the picture looks mostly positive for 2022/23, the world sugar market could have a longer-term supply problem looming.

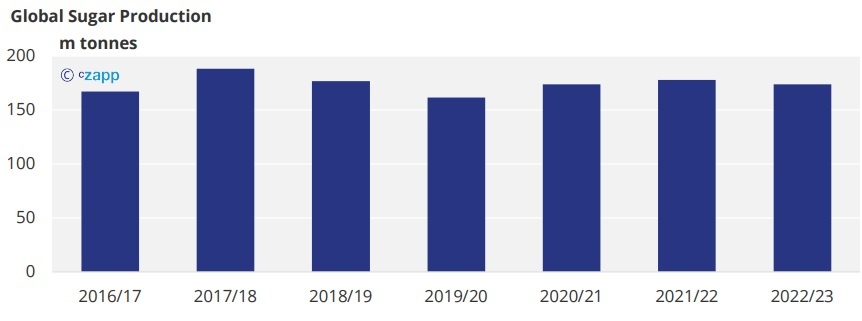

- Production has been stagnant since 2016, averaging around 172m tonnes annually.

- During this period, the market has been somewhat balanced.

- As we think consumption will keep climbing, we don’t see how this growth will be met by producers, especially regularly.

Is the World Market Overly Reliant on Certain Suppliers?

- The world market is highly dependent on Brazil and India, which together supply 70% of the world’s raw sugar.

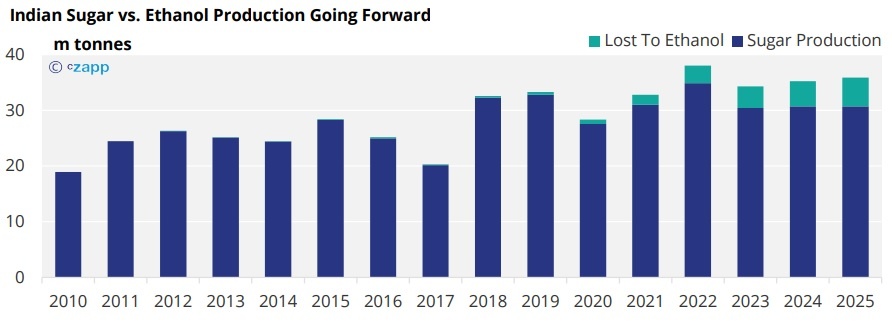

- We know Brazil is looking to maximise sugar production if it pays more than ethanol, but believe India will exit the sugar export market over time.

- This is because its ethanol demand should grow alongside rising oil prices and government efforts to reduce oil imports and sugar export subsidies.

- With this, India may be able to significantly reduce world market sugar exports by as early as 2025.

Who Could Make Up for India’s Removal?

- Knowing Indian supply will reduce, we’re looking at who could increase production to make up for the shortfall.

- We have already seen the Thai crop is in competition with cassava.

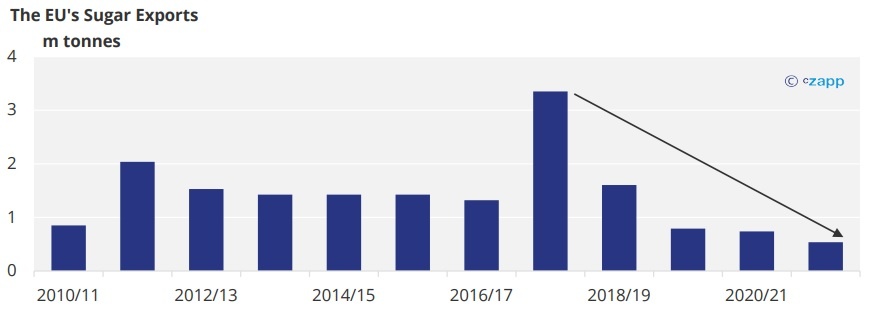

- The EU won’t likely increase production as low prices and highly competitive crop alternatives, namely wheat, give farmers there little incentive to plant beet.

- Since 2017/18, beet returns beet have continued to fall in the EU, leading to a collapse in exports.

- 2017/18 and the end of regulated quotas prompted a huge year for exports.

- Since then, there has been a steep decline.

- Prices haven’t been strong enough to support sustained surplus crops, and competition has taken land share.

- At current prices, there’s no clear replacement for India.

Could Consumption Fall to Match Production?

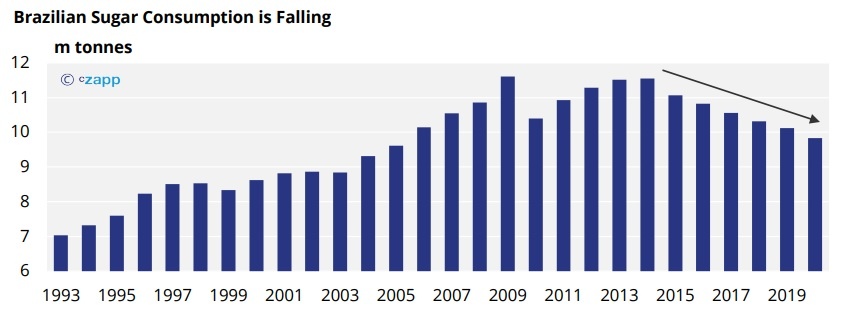

- We’ve written extensively about declining sugar consumption in key countries.

- Brazil has seen a large decline in consumption, falling from 11.5m to 10m tonnes since 2014.

- However, in the grand scheme of things, global sugar consumption is not falling.

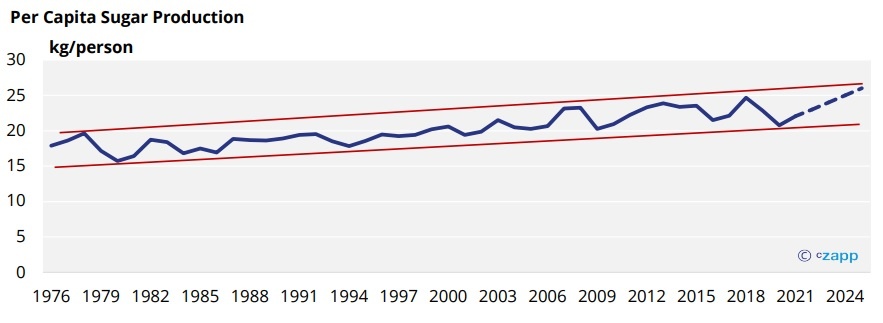

- The below chart shows per capita production and the trend since 1976.

- Current production is at the low end of the trend and needs to rise significantly to maintain a balanced market (as per the dotted line).

- Moving forward, we believe the market needs to match the dotted line, rising to >25 kg per head in 2025.

- We don’t currently see how this can happen, especially with India continuously removing sugar from the world market.

Concluding Thoughts

- Overall, we think the market will be sustained around 19.50-21c/lb in the next few months to help facilitate Indian exports.

- In the longer term, this trend should continue as production needs to increase substantially in the next three to five years to make up for India’s move to ethanol.

- On top of this, inflation is increasing production costs, with freight and fertiliser leading the charge.

- This will continue to push sugar prices up.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.