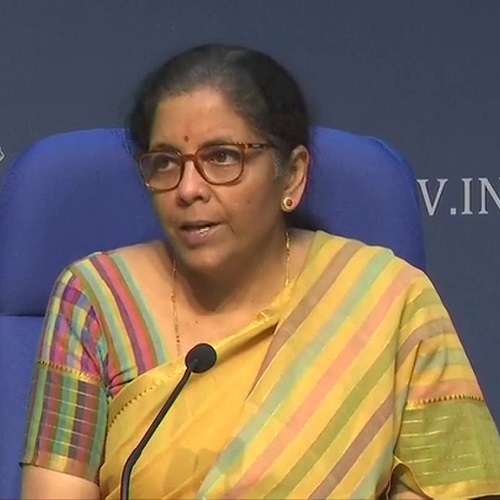

New Delhi [India], July 19 (ANI): The value of the Indian rupee has depreciated by around 25 per cent against the US dollar since December 2014 and the recent fall is due to global factors like soaring crude oil prices and the Russia-Ukraine conflict, Union Finance Minister Nirmala Sitharaman said on Monday.

One US dollar was worth 63.33 Indian rupees on December 31, 2014. The Indian rupee depreciated to 79.41 against the US dollar on July 11, 2022, as per data mentioned by the Finance Minister in a written reply to a question in the Lok Sabha.

The Indian rupee hit a fresh low of 79.98 against the US dollar on Monday. The value of the Indian rupee has depreciated for the seventh consecutive day.

In reply to a starred question in the Lok Sabha, Sitharaman said, “global factors such as the Russia-Ukraine conflict, soaring crude oil prices and tightening of global financial conditions are the major reasons for the weakening of the Indian Rupee against the US dollar.”

However, she informed the lower house of the parliament that the Indian currency has strengthened against other major global currencies.

“Currencies such as the British pound, the Japanese yen and the Euro have weakened more than the Indian rupee against the US dollar and therefore, the Indian rupee has strengthened against these currencies in 2022,” the Finance Minister said.

On the impact of the depreciation in the value of the rupee on the economy, the government said, the currency fluctuation is only one of the factors that impact an economy.

The government said the depreciation of the currency is likely to enhance the export competitiveness which in turn impacts the economy positively.

The depreciation of the currency also impacts imports by making them more costly, the government said.

The Reserve Bank of India (RBI) regularly monitors the foreign exchange market and intervenes in situations of excess volatility. The Reserve Bank of India has raised interest rates in recent months that increase the attractiveness of holding the Indian rupee for residents and non-residents, she said.

The Finance Minister further added that the outflow of foreign portfolio capital is a major reason for the depreciation of the Indian rupee.

Foreign portfolio investors have withdrawn nearly $14 billion from the Indian equity markets in the financial year 2022-23 so far, she said. (ANI)