Insight Focus

Seafarer shortages have been crippling the freight industry for the past year. A variety of factors are now exacerbating the issue. Shipping companies now have to offer competitive benefits to attract talent or risk further freight bottlenecks.

A chronic shortage of seafarers is threatening to upend global freight flows. The exodus from the profession started after the COVID-19 pandemic made a job notorious for its long hours, months away from home and dangerous operation even tougher. The pandemic meant seafarers face increased restrictions on shore leave and isolation. A career as a merchant seaman has now been made even less attractive by the war in Ukraine and issues with visas.

Working Conditions Exacerbated by COVID

Working conditions for seafarers are often volatile and difficult to cope with. Factors such as long working hours, shift work and long stretches of isolation are just some of the reasons why the risk of burnout is heightened in the profession.

In non-profit The Mission to Seafarers’ Happiness Index, overall seafarer satisfaction levels at sea dropped in 2019 by more than 5% on the year to 6.32 out of 10.

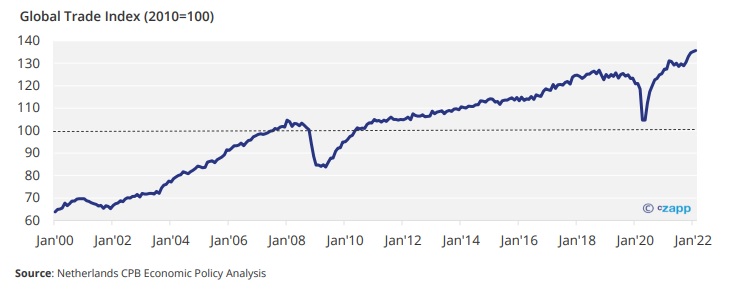

Shippers and seafarers are estimated to transport about 80% of global trade by volume, and demand for freight has been rising throughout the pandemic as e-commerce has soared.

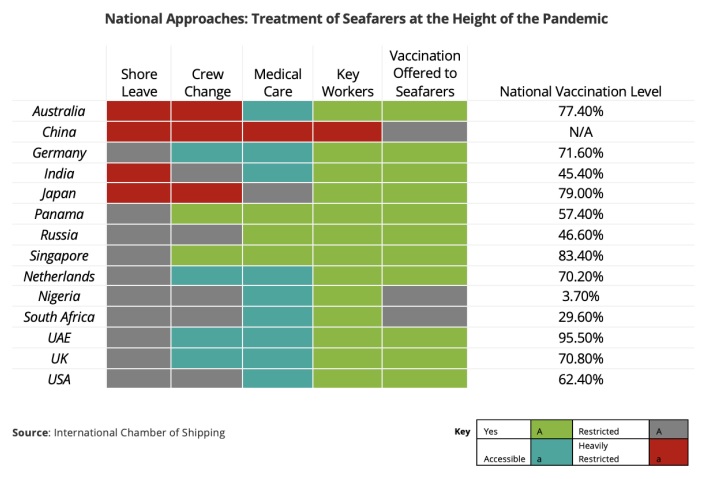

Simultaneously, when COVID swept the world, seafarers’ lives were upended. Not only was there a huge increase in demand for freight services, but in certain countries, shore leave, and crew changes were heavily restricted, worsening conditions.

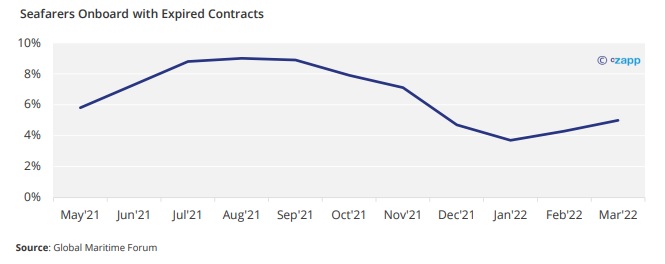

COVID restrictions in 2020 meant some seafarers found themselves stranded on board for as long as a year, far past their contractual obligations and beyond the 11-month Maritime Labour Convention cap. In December 2020, the International Labour Standards on Seafarers (ILO) even concluded that governments breached seafarers’ rights during the pandemic. It’s therefore no surprise that it’s become increasingly difficult to recruit seafarers to meet rising demand.

Although there’s still a surplus of ratings – general skilled seafarers who carry out support work – supply is still far tighter than it was in 2015, while demand continues to grow. Meanwhile, the chronic shortage of officers that has persisted for the past 15 years is worsening.

Nationalities Another Thorn in the Side

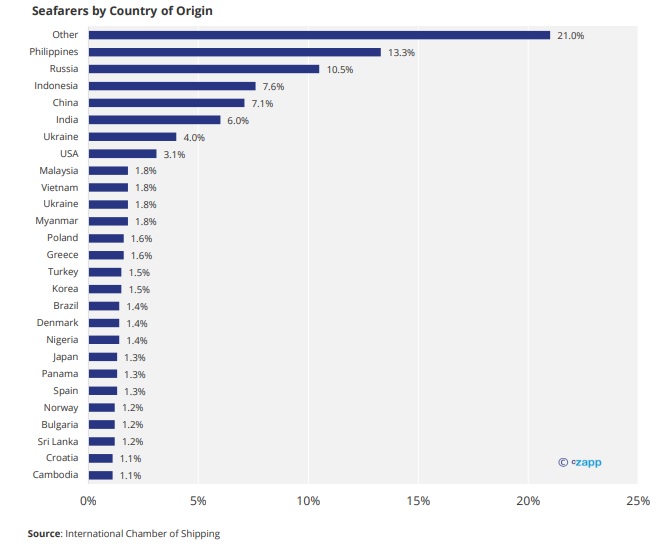

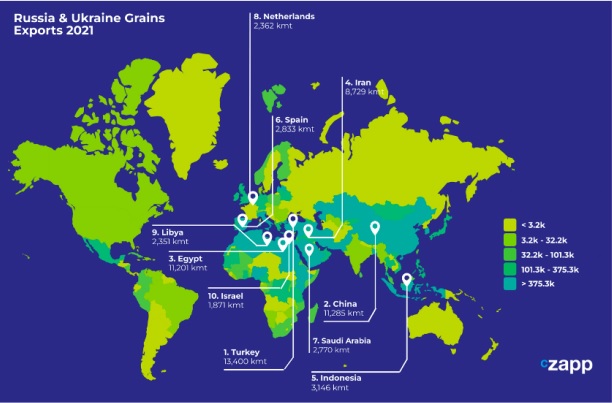

The five largest seafarer suppliers globally are the Philippines, Russia, Indonesia, China and India. South Asia was hit particularly hard by COVID outbreaks, while China still maintains a strict zero-COVID policy. This has created huge bottlenecks in international trade in the first few months of 2022.

Other than this, the Russia’s invasion of Ukraine has prompted several countries to ban Russian vessels from their ports. Although the sanctions do not extend to ordinary crew members, a lack of transparency around the rules has worsened the problems.

In addition, Russian seafarers are struggling to receive payment after Russian banks were removed from the SWIFT payment system. If the 200,000 Russian seafarers working on international vessels are unable to receive payment over the long term, there’s a real risk of an exodus of workers from the industry. This would mean a loss of about 10% of global seafarers.

Some formalities have also been allowed to fall by the wayside. Contracts have been allowed to expire due to COVID restrictions. These reached their peak of 9% in the Q3’221 butafter a fall at the end of the year, prevalence began to rise again in 2022.

Now, due to crew shortages from Russia and Ukraine, some shipping companies are asking crews to delay rotations, extending their time at sea.

Russia-Ukraine Traps Seafarers in Black Sea

Russian and Ukrainian seafarers make up around 15% of the global seafarer workforce, but it’s not just those crew members that are caught up in Russia’s war in Ukraine.

There is increasing danger for vessels entering the Black Sea due to reports that mines have been discovered “both inside and outside of the designated Warlike Operations Areas (WOAs),” according to the International Maritime Employers’ Council.

It’s vital that commercial vessels are able to continue transiting the Black Sea given the ports are a vital source of grains and fertilisers for the global market.

According to the IMO, around 84 vessels and 500 seafarers are stranded off the Ukrainian coast and at least 10 have been damaged by projectiles as of the end of April. Shipping companies have called on NATO to provide naval escorts to commercial vessels.

And as well as the blockage of sea routes, the difficulties in flying over Ukrainian and Russian airspace are creating problems for companies that need to fly seafarers in and out.

COVID-Driven Job Trends Show Lagging Labour Force

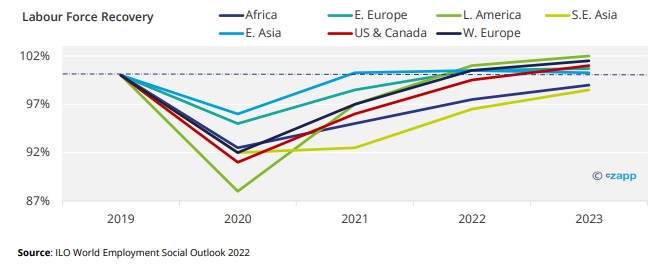

The Great Resignation has been a theme of the past few years, particularly in the US job market, but some of the principles of the movement have now begun to spill over into other jurisdictions. After the pandemic brought about mass layoffs, a fast rebound at the end of 2020 soon slowed and now employers all around the world are struggling to recruit.

Now, major seafarer providing regions, such as Southeast Asia, are lagging in the labour force recovery rate.

High staff turnover also leads to training bottlenecks. Although shipping companies may be able to recruit new seafarers, the time taken to train them severely impacts profitability. More trainees mean a higher man-berth ratio, increasing costs for vessel operators.

Legal Issues Add New Layer to Crisis

Although seafarers are not required to hold a visa for shore leave under ILO rules, they may be denied entry to a given country beyond the International Ship and Port Facility Security (ISPS) zones. This can be due to visa issues or nationality complications, according to the International Chamber of Shipping (ICS). The ICS encourages vessels to report those instances where shore leave is being prohibited due to strict COVID border measures.

Shippers Need to Offer More

The ICS has warned that there will be a shortage of merchant sailors to crew commercial ships if action is not taken to address these issues. This would jeopardise any progress made to release global trade bottlenecks.

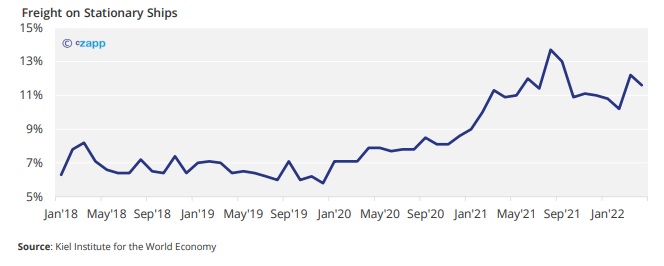

Already, the amount of freight on stationary ships is going up, which poses a risk for profitability and sustainable growth.

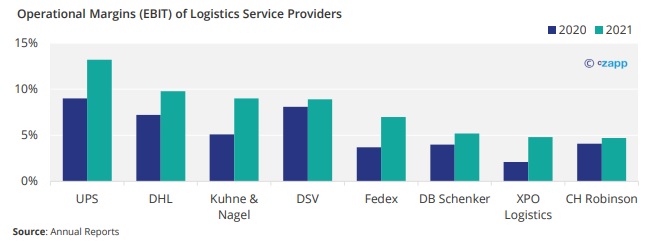

This earnings season, many shipping companies posted record profits due to heightened demand and rising shipping costs, but shipping companies are conscious of the challenges that face them.

Maersk has recognised the difficulty facing staff over the past two years and has awarded a USD 1,000 year-end bonus to its workers in 2020 and 2021. South Korean firm, HMM, gave workers a 7.9% raise and a bonus worth nearly six months’ pay. And after a bumper year for China’s Cosco Shipping Holdings, it awarded workers up to 30 times their monthly salaries. In Taiwan, shippers Evergreen Marine Corp. and Wan Hai awarded workers bonuses equivalent to 40 times and 12 times their monthly salary, respectively.

And Cyprus is making efforts to alleviate pressure for Russian and Ukrainian seafarers stuck in payment limbo. It announced it would fast-track the process of opening Cypriot bank accounts for those affected by the war in Ukraine.

Concluding Thoughts

While seafarers have become some of the most important key workers in maintaining the global economy in the past few years, they also played a crucial role in the rollout of food, medical supplies, fuel and other essential goods during the pandemic and Russia’s invasion of Ukraine. But the workers’ efforts often go overlooked.

During the vaccine rollout, governments were urged to categorise seafarers as essential workers to prioritise them for the vaccine. The ICS proposes that all seafarers should be recognised as key workers.

Although in many cases conditions have improved for seafarers after many countries chose to relax COVID restrictions, an extra layer of complexity was added by Russia’s invasion of Ukraine. Even before the pandemic, the Global Preparedness Monitoring Board (GPMB) of the Johns Hopkins Center for Health Security, raised concerns about the international community’s preparedness for pandemic-like events.

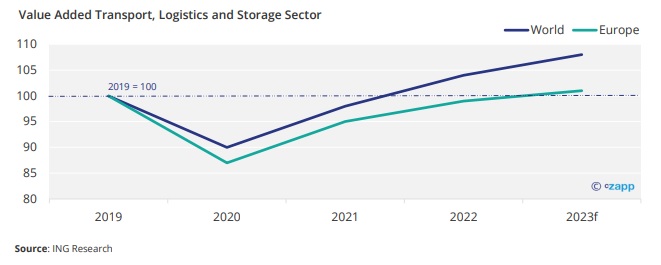

Global transport and logistics demand continues to grow and is expected to exceed pre-pandemic levels this year.

But a mass exodus of seafarers would lead to a crisis for the global supply chain. Industry leaders at the London International Shipping Week at the end of 2021 warned of looming problems ahead for the shipping industry if crew issues are not addressed.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.