Image Credits: Live Mint

The government will soon have to bail the sugar industry out of its predicament. On Tuesday, shares of sugar mills fell sharply on a sharp upward revision to sugar output estimates. While there were fears this could happen, the quantum was significant. The government may have little choice but to offer support in the form of export quotas and a rupee subsidy to make it worthwhile to export sugar.

The Indian Sugar Mills Association (ISMA) revised its estimate for sugar to 29.5 million tonnes, up from its earlier estimate of 26.1 mn tonnes. Thus, output will be in excess of consumption by about 4.5 mn tonnes. The previous season had closed with inventory of 4 mn tonnes, according to ISMA.

The main reason for the revision is a surge in Maharashtra’s output to 10 mn tonnes compared to 4.2 mn tonnes in the previous year. Karnataka’s output has also been revised up. Once again, the inability of the industry or government to accurately forecast sugarcane output and yields is a problem that comes back to bite investors.

ISMA has reiterated its demand to be allowed to export some of this excess, to lower the domestic surplus and support prices. Second, mills can raise cash through export sales, which can be used for business needs and to clear mounting arrears to cane farmers, which has risen to around Rs14,000 crore, according to a Mint report.

While the price paid for cane has increased, wholesale sugar prices are down by 19% over a year ago. In February, the government had imposed restrictions on sales and an import duty of 100% to support domestic prices.

Ratings agency Crisil had said then that these restrictions should restrict further declines in sugar prices and lead to an 8-10% improvement in realisations, which could help mills improve profitability and clear arrears. Counterpart ICRA Ltd said that sugar prices picked up after these initiatives but there is a risk if production exceeds 27 mn tonnes, which has played out now. Next year’s sugar season is also expected to see a good sugar output, according to early predictions.

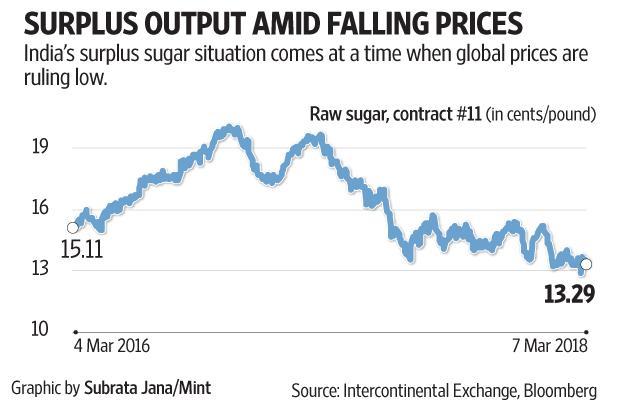

The industry, therefore, wants to export a part the excess of 4.5 mn tonnes by the first quarter of fiscal 2019 itself. Exports are usually done by mills in coastal states such as Maharashtra or Tamil Nadu, and not from those in landlocked Uttar Pradesh. The news on the international price front is not good. Raw sugar futures are trading lower by 12% from the start of 2018 and are down by 28.5% over a year ago.

In a conference call after its December quarter results, Balrampur Chini Mills Ltd’s management had said, in response to a question, that a subsidy of Rs10/kg could be needed based to make exports viable. While that’s a financial burden to the government, it may have no choice but to bear it.

The industry has accumulated substantial sugarcane arrears. One can expect the industry and government to agree upon a package of concessions, including export quotas, in return for clearing those arrears at the earliest. But these negotiations can take time.

The sharp fall in sugar mills’ shares reflects the uncertainty that will continue till then. Moreover, India’s revised sugar estimate upsets the global sugar supply balance too. International prices may decline further, which will widen the gap between domestic gaps and what export realisations offer.

Once there is clarity on exports and government support, investors will be able to take a view on the outlook for sugar mills. As of Tuesday, Balrampur Chini’s shares are down by a fifth over end-February, while that of Bajaj Hindusthan Sugar Mills Ltd is down by 12%, and Dhampur Sugar Mills Ltd is down by 15.9%.