Insight Focus

The world’s food supply chain is coming under the microscope. Governments are increasingly regulating foods. This can have a huge impact on food and beverage firms.

New food policies can blindside companies in the food and beverage supply chain. While it’s hard to keep track on all the moving parts, we put together a rundown of some of the major recent developments to look out for.

Australia

In a nutshell: Australia’s PRP, which launched in 2020, aims to reduce the prevalence of overweight and obesity, as well as tacking chronic, diet-related diseases. In 2020, the program started with sodium reduction targets for 27 food categories and saturated fat reduction targets for five food categories. In 2021, sugar reduction targets were set for nine categories, while sodium reduction targets extended to a further three categories.

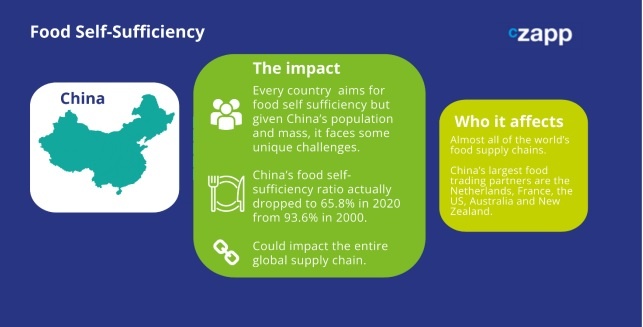

China

In a nutshell: Given that it is one of the most populous countries in the world, it is perhaps no surprise that China is the world’s largest food importer. Despite efforts to ramp up domestic production, recent issues including prolonged Covid-19 lockdowns, animal flus, extreme weather and declining availability of land have all negatively impacted the goal in the past few years.

Egypt

In a nutshell: In response to inflation, the Egyptian government is curtailing the price of bread. Citizens will be able to buy 90g loaves for less than EGP 1 ($0.03).

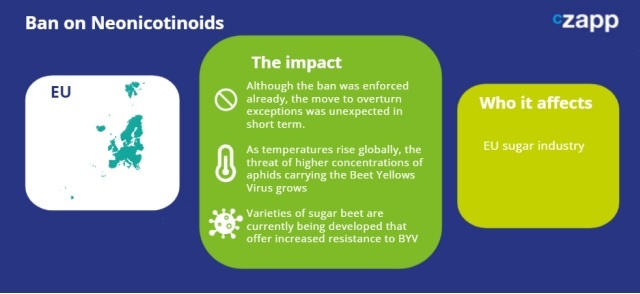

European Union

In a nutshell: This ban was introduced in 2018 due to concerns that insecticides that are harmful to pollinators. However, producers of sugar beet were granted exceptions allowing the continued use of the insecticides. That is, until last week when the European Court of Justice overturned the exemptions and forcing beet producers to set aside the neonics.

Read more about the European beet industry and neonicotinoids here.

India

The policy: 20% ethanol blending target.

In a nutshell: India has a prolific agriculture sector. It is the world’s second largest producer of wheat and rice and has huge capabilities in fruit, vegetables, pulses and sugarcane. Due to these capabilities, the country aims to offset its energy spending through biomass. In 2018, the government set the target of blending 10% ethanol in petrol by 2022 and 20% by 2030. It later moved up its 20% target to 2025 and met the 10% goal early.

Kazakhstan

In a nutshell: The production of certain foods, such as eggs, have been subsidized by the government to protect domestic industry. In 2020, the government removed these subsidies, but recently reportedly replaced them after production dropped dramatically. Kazakhstan’s Association of Food, Sugar and Processing Industries has also called for an increase in irrigation and transport subsidies for sugar production. This year, the government will increase the planting of grains, legumes and sugar beet, while reducing land dedicated to rice, cotton and oil crops.

Mexico

In a nutshell: Mexico is the homeland of corn and is also a major consumer. It imports about 16 billion tonnes of corn from the US every year, mainly to be used as livestock feed or for industrial purposes. But much of that corn is genetically modified, and Mexico is looking to phase it out. The Latin American country argues that the seeds will contaminate its ancient, native varieties – compromising genetic biodiversity.

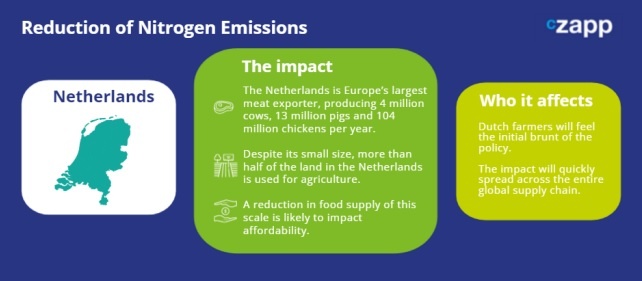

The Netherlands

In a nutshell: In an effort to meet emissions reduction targets, the Dutch government is disincentivizing livestock farming. The government aims to halve its nitrous oxide and ammonia emissions by 2030, a target many say is unrealistic. Farmers have staged widespread protests and the government is now planning a program of forced buyouts.

Philippines

In a nutshell: The PDP is the Philippine government’s ambitious policy to strengthen its economy and foster job creation. A key part of the plan is modernising agriculture and agribusiness. This includes providing access to markets, strengthening supply chains and diversifying farming income. The Asian Development Bank (ADB) has already approved a USD 500 million loan for the plan.

Singapore

In a nutshell: Singapore is rolling out a new labelling scheme for sugar sweetened beverages (SSBs), following in the footsteps of a handful of countries including Chile, Mexico and Barbados. Companies working in the region, including Suntory and Yeo, have already taken steps to reformulate beverages so they don’t fall into the lowest ‘C’ and ‘D’ categories.

Read more in our sugar consumption case studies here.

South Africa

In a nutshell: Loadshedding has been taking place in South Africa since 2007, meaning that power is rationed between electrical grid areas in order to even out limited supply amid high demand. This often results in power outages that can last between two and four hours. There are eight stages of loadshedding, with the least disruption felt in stage 1. At stage eight, power is cut to about half the country.

Thailand

In a nutshell: The Thai government is in discussions over whether to implement a tax on high-sodium foods. The rules, if adopted, would apply to packaged foods such as noodles and snacks.

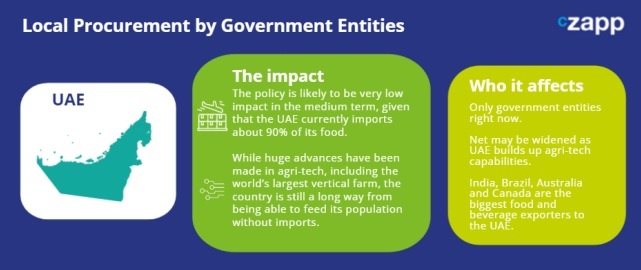

UAE

The policy: Local procurement by government entities

In a nutshell: In another policy linked to domestic food security, the UAE wants all government entities, including the armed forced and hospitals, to buy locally sourced products.

Find out more about the world’s largest vertical farm here.

Global

The policy: Reduction of trans-fats

In a nutshell: The WHO has called on world leaders to legislate against the inclusion of industrially produced trans fats (TFAs) in food products. The WHO wants countries to impose a mandatory limit of 2g of TFAs per 100g of total fats on all food products. It also wants a ban on the use of partially hydrogenated oils as a food ingredient.

Who does it affect?

- Producers of partially hydrogenated oils

- Food and beverage manufacturers, particularly those selling cakes, cookies, crackers, animal products, margarine, fried potatoes, potato chips, popcorn and household shortening.

How impactful will it be?

- While not an actual policy (yet), this report has very far-reaching implications for the food and beverage industry.

- Already, mandatory policies related to TFA have been adopted in 60 countries covering almost half of the world population.

- In 2023, best practices are being considered in Mexico, Nigeria and Sri Lanka.

- Other middle-income countries, such as Argentina, Bangladesh, India, Paraguay, Philippines and Ukraine are considering adoption.

Read the full WHO report here.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.