Mysuru, August 03, 2022: Triveni Engineering & Industries Ltd. (‘Triveni’), one of the largest integrated sugar producersin the country, a dominant player in engineered-to-order high speed gears & gearboxes and a leading player in water and wastewater management business, today announced its financial results for the first quarter ended Jun 30, 2022 (Q1 FY 23). The Company has prepared the financial results based on the Indian Accounting Standards (Ind AS) and as in the past, has been publishing and analyzing results on a consolidated basis.

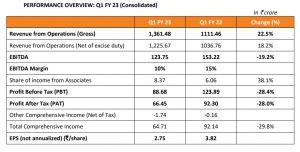

Net turnover has increased by 18.2% in Q1 FY 23 primarily driven by higher sugar and alcohol dispatches along with higher realizations

• Profit before tax (PBT) declined by 28.4% on a year-on-year basis to ₹ 88.68 crore. This is mainly because the previous corresponding quarter included a net income of ₹ 45.31 crore on account of export subsidy pertaining to FY 21.

• In respect of distillery operations, higher realisations along with commissioning of additional capacity in Q1 FY 23 resulting in higher sales volumes, have contributed to the increase in profitability by 44.3% on a year-on-year basis.

• Engineering business at an aggregate level reported strong revenue increase of 32.9% during the current quarter over the corresponding period last year.

• Power Transmission Business order booking in Q1 FY 23 reported an impressive growth of 41.5% over the corresponding period last year. We expect this strong growth trend to sustain in the coming quarters, which would boost revenue growth for FY 23 and FY 24.

• The total debt on a standalone basis as on June 30, 2022 is ₹ 1541.53 crore as against ₹ 1503.74 crore as on March 31, 2022. It comprises term loans of ₹ 386.09 crore, almost all such loans are with interest subvention or at subsidized interest rate. Higher debt level as on June 30, 2022 is owing to faster sugarcane price payment. There are no outstanding cane dues as on June 30, 2022 as against ₹ 213.48 crore as on March 31, 2022 and ₹ 272.65 crore as on June 30, 2021. On a consolidated basis, the total debt is at ₹ 1617.68 crore as on June 30, 2022 as against ₹ 1567.96 crore as on March 31, 2022. It

comprises term loans of ₹ 462.24 crore.

• Overall average cost of funds is at 5.07% during Q1 FY 23 as against 5.27% in the corresponding period of previous year.

Commenting on the Company’s financial performance, Mr. Dhruv M. Sawhney, Chairman and Managing Director, Triveni Engineering & Industries Ltd, said:

“We are pleased to note that in the recently concluded Sugar Season (SS) 2021-22, the Company registered good performance despite general trends of low yields and recovery in the state of Uttar Pradesh. Both the engineering businesses have also performed well with robust order booking, this trend is expected to continue and result in revenue growth in FY 23 and FY 24.

We are enthused with the performance of the distillery segment. As against capacity of 320 KLPD operated in FY 2021-22, our capacity currently stands at 660 KLPD which will result in significant growth in the turnover and profitability of the distillery segment. We have decided to further expand the capacity by 450 KLPD so that it becomes a sizeable business and provides significant revenue streams. We have full confidence in the commitment of the Government of India (GoI) to the Ethanol Blended Petrol (EBP) programme and are augmenting capacities on dual feedstock basis to provide us flexibility to select the feedstock based on commercial economics.

With expected production of 36.2 million tonnes of sugar and exports of 11 million tonnes in the Sugar Season (SS) 2021-22, closing inventories are expected at 6.09 million tonnes. Based on the current sowing, pattern of rainfall and crop condition, production of 35.5 million tonnes of sugar is estimated in the ensuing sugar season i.e. SS 2022-23. To maintain the balance, exports of around 8 million tonnes will be required and hence, it is imperative that clarity is provided on exports for the next season at the earliest to capitalize on the international price opportunities and INR depreciation.

With respect to the Company’s sugar business, the previously announced debottlenecking and modernization plans at three of our sugar units are progressing well and we expect this activity to be completed by October 2022 as communicated earlier. For the upcoming sugar season, with increase in cane area by 3% this year, better crop health, more focused crop surveillance plan and a good forecast of monsoon, we expect increase in yield and production and hence cane availability and consequently higher crush for the Company.

On the engineering side, we believe both our Power Transmission and Water businesses are well placed for the long-term. In Power Transmission business, we believe the growth in domestic economy along with Atmanirbhar Bharat Abhiyan (Self-reliant India campaign) will drive capex across end user industries. This coupled with the Company’s strategy and plan to increase its global footprint will lead to growth at an accelerated pace in the coming years. In the Water business, the growing water scarcity is catalysing new opportunities in the areas of recycle, reuse and Zero Liquid discharge. We believe that the disruption caused by the pandemic has largely been over and normalcy in business environment is returning which will lead to floating of tenders for new projects as well as finalization

of earlier tenders. With its leadership position and robust financials, Triveni is equipped to capitalize on these increased opportunities.”