NOIDA, February 02, 2022: Triveni Engineering & Industries Ltd. (‘Triveni’), the second largest integrated sugar producer in the country; a market leader of engineered-to-order high speed gears & gearboxes and a leading player in water and wastewater management business, today announced its financial results for the third quarter and nine months ended Dec 31, 2021 (Q3/9M FY 22). The Company has prepared the financial results based on the Indian Accounting Standards (Ind AS) and as in the past, has been publishing and analyzing results on a consolidated basis.

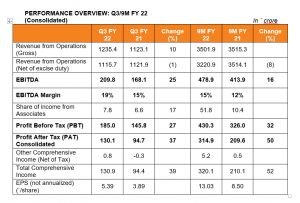

- Net turnover has declined by 1% in the current quarter and 8% in the nine-month period due to lower sugar sales volume by 18% and 22% in the aforesaid periods. No exports have taken place in respect of the Season 2021-22. All other segments registered increase in turnover except for 6% lower turnover in Water Business for nine-month

- Aggregate of Sugar & Distillery segments achieved 22% and 12% increase in profitability during the quarter and nine-month Substantial increase in sugar prices in the current quarter has helped sugar operations to maintain the profitability. In respect of distillery operations, both sales volumes and high realization prices have contributed to increase in profitability.

- Engineering business at an aggregate level reported strong revenue increase of 38% and 12% and increase in profitability by 114% and 76% during the quarter and nine-month period. Power Transmission and Water Business have achieved higher profitability of 91% and 54% during nine- month

- The total debt on a standalone basis as on Dec 31, 2021 is ₹ 525 crore as against ₹ 550 crore as on Dec 31, It comprises term loans of ₹ 385 crore, almost all such loans are with interest subvention or at subsidized interest rate. On a consolidated basis, the total debt is at ₹ 592 crore with term loan at ₹ 451 crore.

Commenting on the Company’s financial performance, Mr. Dhruv M. Sawhney, Chairman and Managing Director, Triveni Engineering & Industries Ltd, said:

“Overall performance of the Company during the nine months ended December 31, 2021 has been satisfactory. The increase in cane prices by ₹ 250 per tonne for the Sugar Season 2021-22 (SS 2021-22) will be largely offset by recent increase in sugar prices. While the estimated stocks of 6.65 million tonnes at the end of the current sugar season are likely to support the domestic sugar prices, continuance of exports and / or substantial diversion of sugar for ethanol next year will be key to maintain the sugar prices. We hope that the Government addresses the long pending increase in Minimum Selling Price (MSP) of sugar to maintain viability of sugar mills and to preserve their cane price paying capacity.

On the pricing side, even though sugar prices have come off their recent peaks both in domestic and global markets, they are higher than last year. With a global deficit anticipated yet again in SS 2021- 22, we expect international sugar prices to stay firm. It appears that without an export assistance programme/reintroduction of Maximum Admissible Export Quantity (MAEQ), northern millers may not participate in exports unless the international prices improve meaningfully from current levels. Nevertheless, exports may continue to be viable from Maharashtra and other coastal regions.

We witnessed delayed start to the sugar season (SS) 2021-22 owing to extremely high rainfall especially in the crucial month of October. Certain regions of Uttar Pradesh have witnessed uncharacteristically high rainfall even in the last one month. All these climatic issues may have an impact on the yields and recovery. However, the improved weather conditions hereon will facilitate uninterrupted crush and improved recoveries. The Company continues to pursue change in varietal mix to reduce dependence on Co-0238 variety

The distillery segment continued its strong performance driven by higher sales volumes and realization prices due to improved product mix. Owing to some approval delays, inclement weather and COVID related constraints, we are now expecting the first tranche of 220 KLPD distillery expansion of the our 340 KLPD expansion plans to commence by March 2022. The balance 120 KLPD is expected to be operational around Q1 FY 23. The Company’s overall capacity after both expansions will more than double from current levels of 320 KLPD to 660 KLPD.

We remain excited about our engineering businesses, which has largely overcome the impact of COVID on its operations and those of its customers and has put up much better performance in terms of turnover and profitability. A broad-based economic recovery which is already underway is likely to keep

the demand strong for these businesses. Power transmission business is poised for strong growth in the coming years across the gamut of services such as Defence, Gears and Built to print. The Company has a strong order pipeline in its Water business and we continue to bid for many new projects to improve it further.”