Sugar prices in Kenya have witnessed a massive fall, leading to a challenging year for industry and sugarcane farmers. Let’s seek insights from experts in the business to understand what is prompting the decline in sweetener prices.

ChiniMandi spoke to Nick Kwolek, the founder of Kulea, commodity expert specializing in commodities in Africa, to understand why sugar prices have fallen so far in Kenya. In an interview with our portal, Kwolek shed light on the factors contributing to the rapid decrease in sugar prices in Kenya.

Q. What factors are contributing to the decrease in sugar prices in Kenya?

Ans: There are numerous factors that have affected the rapid decrease of the price of sugar in Kenya. The simple fact is that the in-country supply for the first time in 12 months has outstripped demand. The question is how did we get here?

1.) In December of 2022 the GOK (Government of Kenya) issued a series of import permits for duty free world market sugars to enter the country, by passing Kenya’s strict policy of 100% duty on non COMESA sugars (common market for east and southern africa). This led to the start of a large import campaign of ‘cheaper’ world market sugars. Over the 12 months to today the GOK has issued duty free import permits of 820,000 tons when in fact Kenya only needed 485,000 tons of imports to balance the supply and demand (SnD). Also bear in mind that 130,000 tons also came into Kenya from the COMESA region in 2023 and Kenya only needed 355,000 tons of world market sugars vs 820,000 tons of licences.

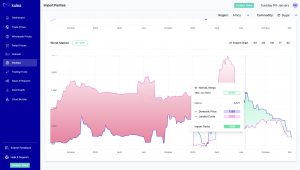

2.) Secondly add to this one of the biggest carrots in the sugar world was dangling tantalisingly in the face of traders, a 386 dollar per ton positive import parity as of the 18th of July 2023, below as can be seen from the excerpt from the Kulea app (app.kulea.com) below showing the parity and its subsequent collapse.

(Source: app.kulea.com)

This led domestic and international traders and producers alike on a mad dash to export sugars to Kenya. The early imports in the first 9 months of 2023 made excellent money, but it also encouraged irrational exuberance and an over import. Very few players actually understand the trading, import and domestic production environment in Kenya and the wider region as a whole and ploughed on with imports, come what may.

3.) The world market collapsed leaving traders both domestic and international holding high priced sugars against cheap replacement, in tandem the local market in Kenya collapsed around USD 500 dollars per ton. Far more than that 150 dollar collapse in the international prices.

4.) 9 of 15 Kenyan Kenyan sugar mills were forced to close in August which meant that fragile juvenile cane was finally allowed to grow (the source of the great shortage addressed by the import campaign). However the mills were allowed to restart in December of 2023 and much larger domestic production in the month of December (due to accumulated uncrushed cane for the last 5 months) crashed into a wall of imports bringing large stocks to a country that is used to running on a hand to mouth basis.

5.) The Kenyan shilling also collapsed over 23% over the course of 2023 meaning that when the domestic mills came back on stream in December the imports they ran into were relatively expensive. The mills were delighted to sell into this high priced market (in shilling terms) which only added huge pain to overburdened importers.

All of the above has culminated in a huge and if one looks at Kenyan history a pretty predictable price collapse. Kenya from a sugar perspective is a misunderstood country that many traders assume is simple and easy to trade. Kenya is in fact a complex beast with a good sized domestic sugar production, complex political and business landscape that always tends to trip even the best of traders up.

Q. Will a halt in sugar imports assist in stabilizing sugar prices?

Ans: Yes, this is needed to bring some balance back to the market. However sugar in Kenyan Shilling terms is still relatively expensive even with the huge drop we have seen, so the mills if they so choose could drive prices lower from here. We have seen a small bounce in prices this week, with flows of sugar moving up to Uganda from Kenya, which has helped to evacuate some additional stocks.

Q. What are the current sugar prices in Kenya?

Ans: 7300 Kenyan shillings per 20KG bag inclusive of VAT and all costs in the capital Nairobi this is equivalent to USD 900 PMT.

Q. How sugarcane farmers are impacted due to decline in sugar prices?

Ans: Cane farmers have had a tough year given that most of the mills were forced to close in mid 2023, and a collapse in yields and area under cane due to a heavy drought at the end of 2022. However from a pure cane remuneration perspective the farmers are happy as the cane price is at an all time high in Kenya Shilling terms and is up 32% YoY again in Kenyan Shilling terms.