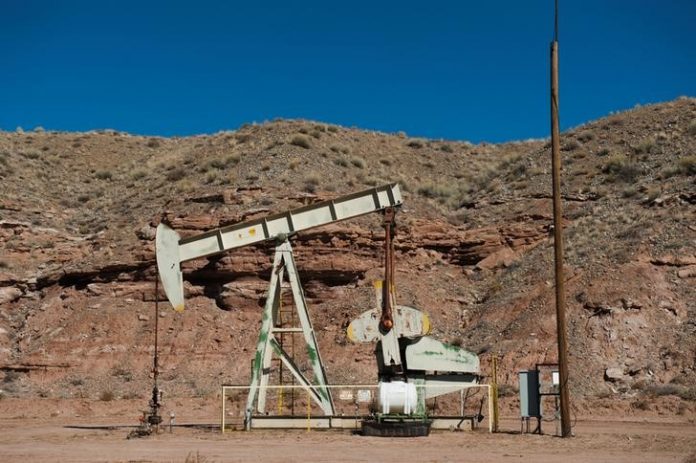

US crude oil production last week hit 11 million barrels per day (bpd) for the first time in the nation’s history, the Energy Department said on Wednesday, as the ongoing boom in shale production continues to drive output.

The gains represent a rapid increase in output, as the data, if confirmed by monthly figures, puts the United States as the second largest producer of crude oil, just behind Russia, which was producing 11.2 million bpd in early July, according to sources.

“Eleven million would have made us the biggest producer in the world; but actually Russian production in June was above 11 million. So, this is kind of like the space race,” said Sandy Fielden, director of research in commodities and energy at Morningstar.

The United States has added nearly 1 million bpd in production since November, thanks to rapid increases in shale drilling.

“I don’t think production is plateauing at 11. It’s fully expected to grow beyond 11 – we won’t be topping out there,” said Scott Shelton, a broker at ICAP in Durham, North Carolina.

Crude inventories increased 5.8 million barrels in the week to July 13, compared with analysts’ expectations for a decrease of 3.6 million barrels.

Crude futures edged down on the data. US crude was down 55 cents to $67.51 a barrel, while Brent dropped 39 cents to $71.77 a barrel. The benchmarks have gained steadily since bottoming out below $30 a barrel in early 2016; US crude is up nearly 12 percent this year.

Weekly production figures from the US Energy Information Administration are notorious for revisions, as monthly data, released on a lag, shows US production at 10.5 million bpd as of April.

In the last several weeks, the EIA has rounded off US production to the nearest hundred thousand barrels, so that figure had been stuck at 10.9 million bpd for over a month.

This report comes amidst worries that infrastructure bottlenecks, which make it difficult for producers to get their oil to market, could soon start curtailing output.

Morgan Stanley analysts said recently that pipeline constraints could cap 2019 growth in west Texas. They said the Permian shale play has about 3.56 million bpd of pipeline capacity, about what is being produced there now.

Even as production ramps up, the United States, the world’s top oil consumer, still depends on imports. Net US crude imports rose last week by 2.2 million bpd to about 9 million bpd.

Gasoline stocks fell by 3.2 million barrels, compared with analysts’ expectations for a 44,000-barrel drop.

Distillate stockpiles, which include diesel and heating oil, fell by 371,000 barrels, versus expectations for a 873,000-barrel increase.