Insight Focus

The sugar surplus in 2022/23 has grown. We have reduced production forecasts for several key regions. However, we’ve reduced Chinese consumption owing to previous Covid lockdowns.

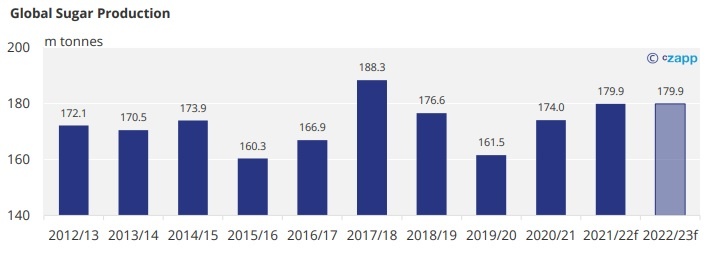

Global Sugar Production

The world will produce 179.9m tonnes of sugar in 2022/23, this is the same as in 2021/22 and the joint second largest on record. This represents a 400k tonne reduction in sugar production since the September update.

Mexico, Thailand, and the EU have all suffered worse than normal weather during their cane growing seasons. Collectively this will wipe almost 1m tonnes of sugar from global production in 2022/23.

This is countered by upwards revisions to Russia and a handful of other minor sugar producers.

Global Sugar Consumption

In 2022/23 we will consume over 3m tonnes more sugar year-on-year than in 2021/22. This is in part due to more economies returning to pre-Covid consumption and through an increase in population.

We have reduced our forecast for Chinese sugar consumption in 2022/23 thanks to previous Covid lockdowns.

This will reduce global consumption by 1m tonnes compared to the previous update.

Small Sugar Production Surplus

We expect a small surplus of 3.6m tonnes to develop in 2022/23, a 600k increase since last month. To see how this fits with current tightness in the raw and refined sugar markets, here is a recent Ask the Analyst we wrote to explain.

Growth in consumption since 2021/22 means this is around half the size of the surplus observed in 2021/22, despite similar production.

Australia Sugar Production Update

We think that Australia will produce up to 4.2m tonnes of sugar in the ongoing 2022/23 season, this represents a 100k uplift from the 2021/22 crop.

However, heavy rain during the harvest has contributed to delays in recent weeks. This could put some cane at risk of being stood over once the country enters the rainier season later this year if the harvest continues to be slowed down.

Alongside Thailand, Australia is a key sugar supplier to southeast Asia, a traditionally tighter region for sugar. Stood over cane would likely have a larger effect on physical values in the region.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.