Insight Focus

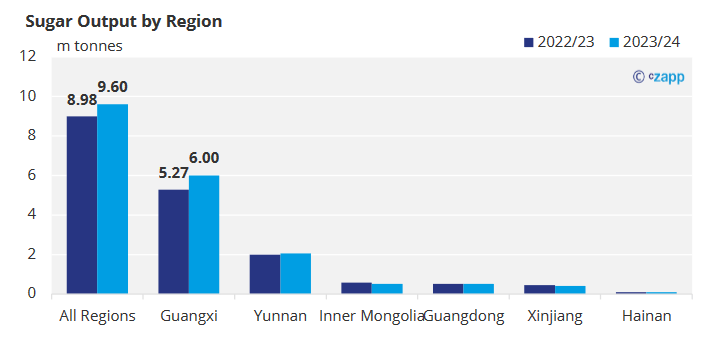

China could produce 9.6m tonnes of sugar in 2023/24. This comes from a recovery of both cane and beet yields. China will still need up to 6m tonnes of sugar imports.

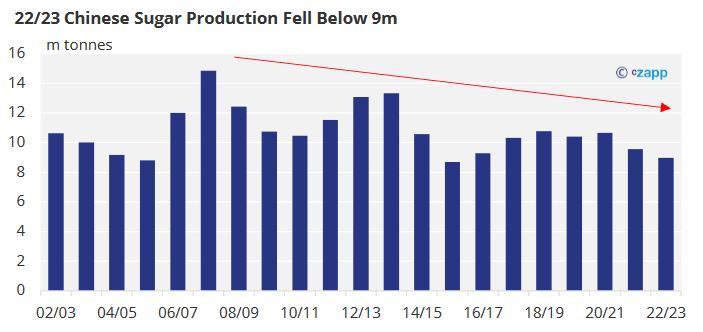

China is a sugar deficit country. Sugar production has trended downward since it peaked at 14.84m tonnes in 2007/08. Meanwhile, consumption has increased with population and economic growth. Today China consumes nearly 16m tonnes of sugar annually.

Source: CSA, Czapp

Source: CSA, Czapp

China therefore needs to import sugar each year. The amount of sugar is partly dependent on its level of sugar production.

22/23 At 9m Tonnes, 23/24 Outlook 9.6m Tonnes

The last sugar mill in Yunnan province closed on May 11th, bringing the 2022/23 season to an end. It was not a good season; only three times in the past 20 years has production gone below 9 million tonnes. The poor season meant the domestic production deficit was 6.5 million tonnes.

For 2023/24, we estimate that sugar production will be 9.6 million tonnes, an increase of 0.6 million tonnes compared with the 2022/23 season.

Source: Czapp

Source: Czapp

Sugarcane: Can High Sugar Prices Stimulate Production Growth?

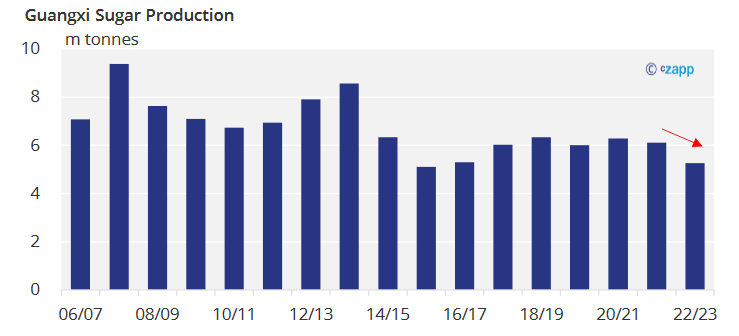

Sugarcane accounts for 90% of China’s sugar production, with Guangxi and Yunnan accounting for more than 90% of the country’s sugarcane.

Guangxi: Agricultural Yields are Key

Guangxi: Agricultural Yields are Key

Due to three consecutive years of drought, the sugar production in Guangxi fell again in 2022/23, with a reduction of 840k tonnes.

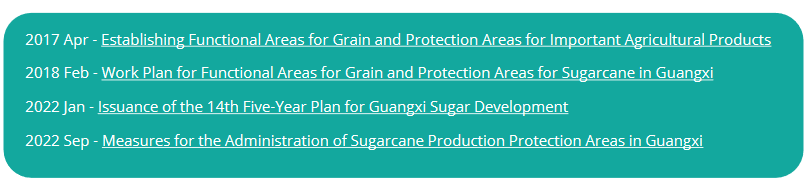

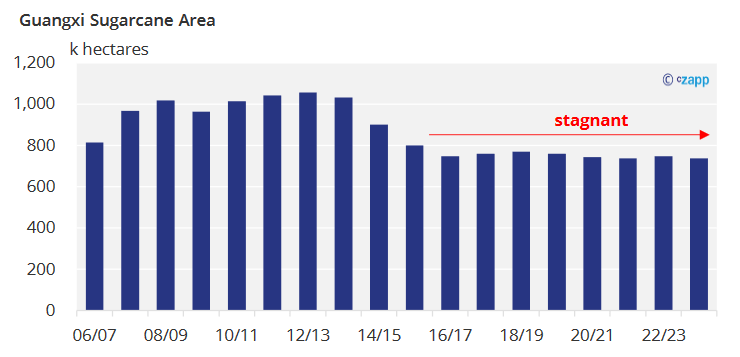

For 2023/24, Guangxi sugarcane area should maintain, with a recovery of cane yields. This is because China’s sugarcane area is partly policy-driven.

China has set a safety line for sugarcane area of 15 million mu (1 million hectares) of sugarcane production reserves. Among them, Guangxi covers 11.5 million mu (767K hectares).

Source: CSA, Czapp

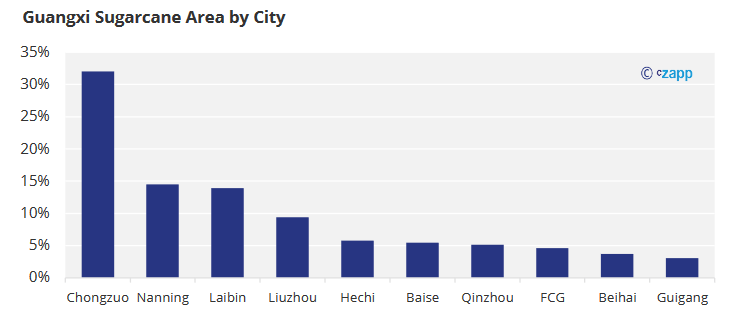

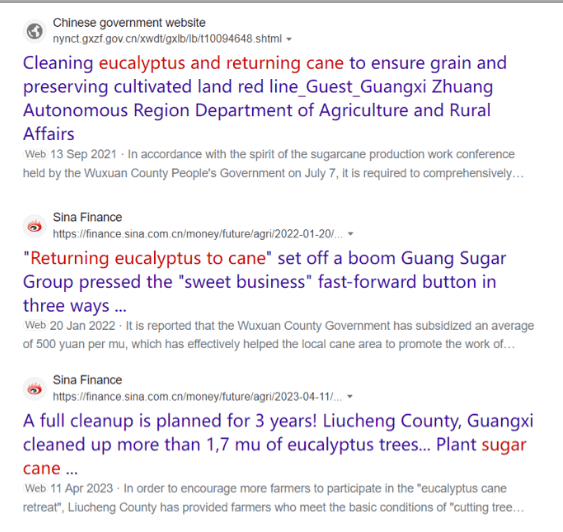

One of the core tasks is to reduce the area of eucalyptus and increase the area of sugar cane. In the sugarcane protection area in Guangxi, eucalyptus and other woodlands accounts for 11%. We discussed last year about China converting eucalyptus to sugar cane.

By 2024, Guangxi has set a target of reducing the area of eucalyptus by 1 million mu. Ten major sugarcane producing cities in Guangxi are speeding up their action plans. For those who switch from eucalyptus to sugarcane, the maximum subsidy is around 1500 yuan/mu. It means double the planting income for farmers basis the 3-year sugarcane cycle.

Source: NBSC

We continue to see Guangxi’s efforts to increase sugarcane acreage in the news stream.

Source: Bing Search, Auto-Translation

As discussed, however, with the fertility of these soils likely to have declined, and the small conversion of sugarcane acreage to other competitive crops, sugarcane acreage will remain at current levels rather than increase significantly.

Source: NBSC

Source: NBSC

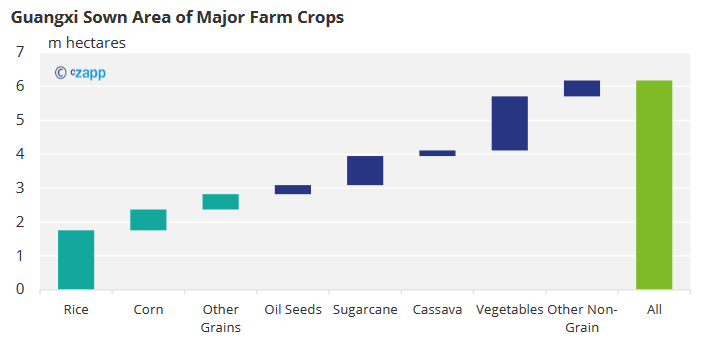

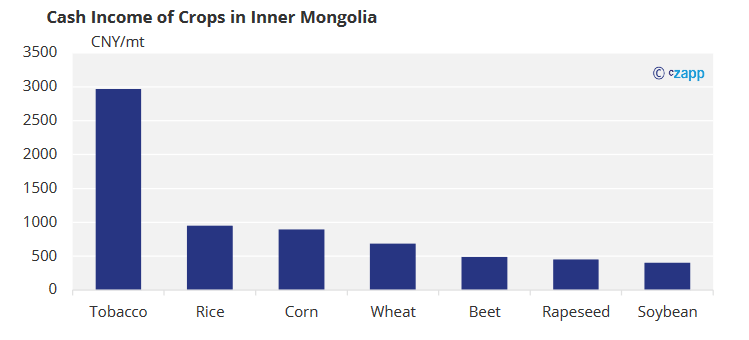

This is because sugarcane is in an awkward position. In terms of economic benefits, sugarcane is not as good as vegetable and fruits, and in terms of food security, it is not as important as grain crops.

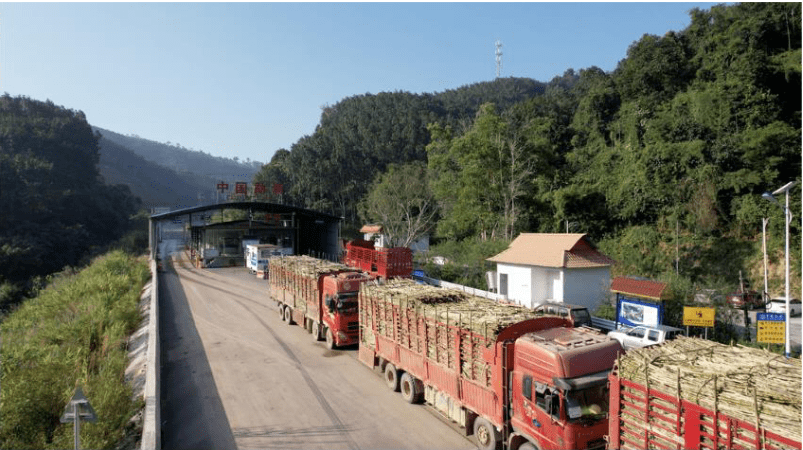

Yunnan: Cross-Border Sugarcane Is Key

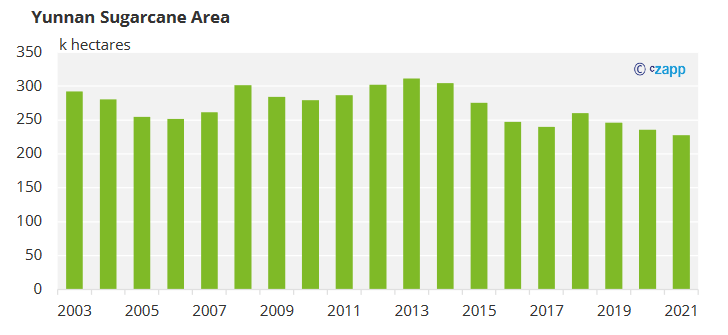

This brings us to Yunnan. Cash crops such as vegetables and fruits require sophisticated logistics. As logistics infrastructure continues to improve, sugarcane acreage in Yunnan is slowly declining. Yunnan also has the policy task of securing 233k ha of sugarcane, which has fallen from 311.16k ha in 2013 to 227.84k ha in 2021, hitting the warning line.

Source: NBSC

Source: NBSC

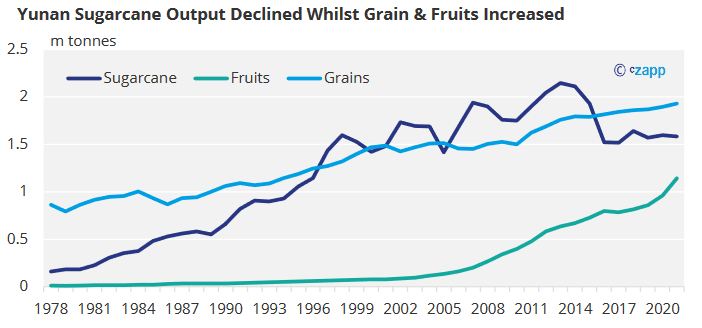

Yunnan’s 3-year Action Plan for Agricultural Modernization (2022-2024) defines the priority of grain and oil crops. In addition, Yunnan has put forward an ambitious plan to build a major national “vegetable basket” supply base. As a supporting system, it puts forward the “14th Five-Year” modern logistics industry development plan. Yunnan is also an important production base for cash crops such as flowers and coffee.

In the face of these powerful opponents, sugarcane seems to be defeated.

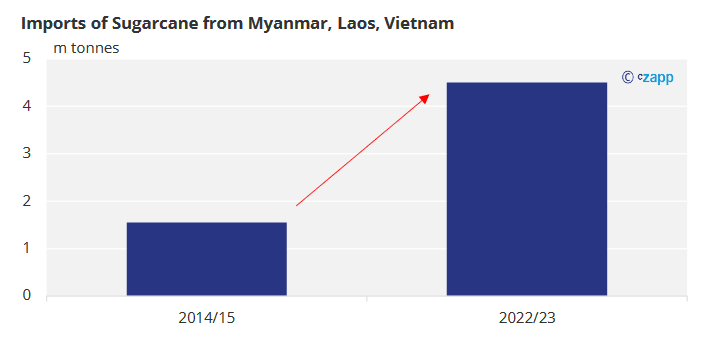

At least one aspect of Yunnan’s planning is good for the sugarcane industry. That is to increase cross-border agricultural cooperation, so cross-border sugarcane may be a future growth point. It has increased from 1.55m tonnes in 2014/15 season to around 4.5m tonnes in 2022/23 season.

Last season, due to the COVID controls, cross-border sugarcane transportation was restricted. In 2022/23 sugarcane import resumed after the measures were lifted.

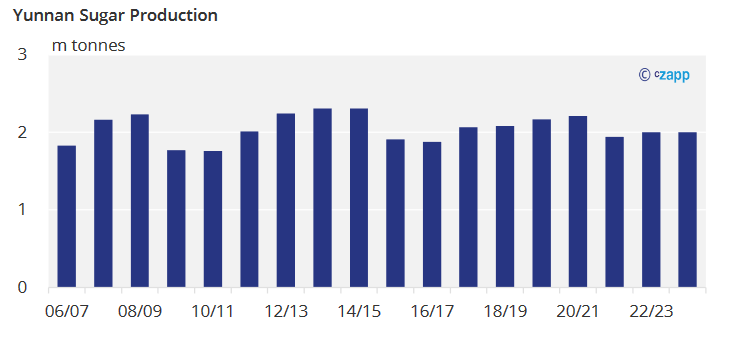

The increase in cross-border sugarcane should offset the decline in Yunnan’s area. We think sugar production in Yunnan should be around 2~2.2 million tonnes. Further growth remains to be seen.

Sugarbeet: Lost the Game to Grains

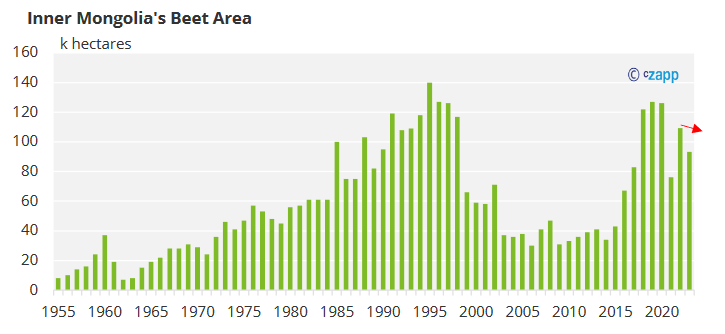

Sugar beet production accounts for 10% of Chinese sugar output. It’s unlikely to increase in 2023/24. This is because beet acreage is facing challenges in 2023, despite the high sugar prices.

Sugarbeet acreage in Xinjiang could decrease by 10% and Inner Mongolia by 20%. In Inner Mongolia, grain prices including corn remain strong in early 2023, beet returns are less competitive.

Besides, the cost of growing sugar beets has risen while the yield has fallen. Last year, due to the lack of soil fertility and adverse weather, the average yield of sugar beet decreased by 24%. It’s been a blow to farmers’ confidence.

Conclusion: China Still Needs 6M Tonnes of Imports

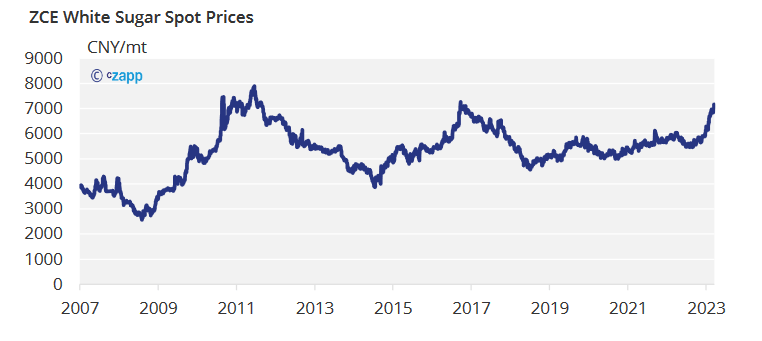

Despite the above, with sugar prices at a six-year high, we believe sugar mills are willing to increase their support to farmers.

For 23/24, we expect that sugar output may recover to 9.6 million tonnes, which may benefit from the increase of cross-border sugarcane, the decrease of fertilizer price and the increase of cane field inputs.

That means China still needs up to 6 million tonnes of sugar imports.

El Nino Risk to Watch

The effects of El Nino events are difficult to pinpoint because they vary in time and intensity. In general, S Brazil is likely to experience warm and wet weather, while Thailand and India are likely to face dry weather.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.