Czapp Opinion Focus

Brazilian cane production was poor in 2021/22 due to drought. The country’s now struggling to satisfy record demand for anhydrous ethanol. Producers are importing at a loss to keep supply afloat.

Anhydrous Ethanol Demand Surges

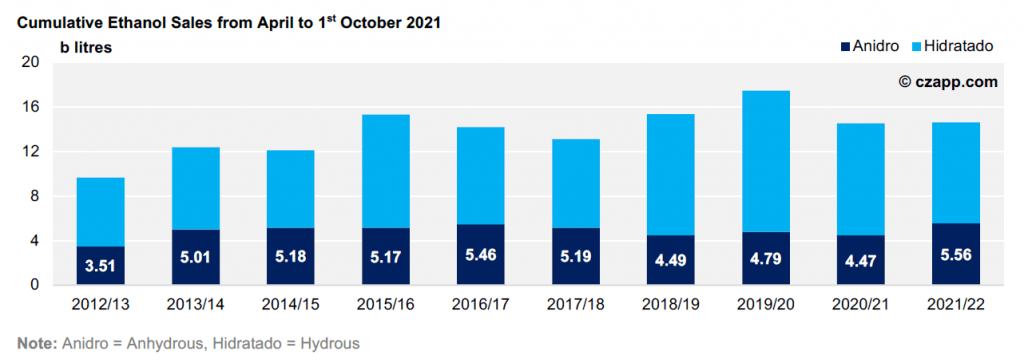

Brazilian motorists have two choices at the fuel pump: 100% hydrous ethanol or blended gasoline and anhydrous ethanol. Hydrous offers 70% of the mileage that anhydrous does, so consumers will only favour hydrous if it’s 30% cheaper. Hydrous prices have been above this level for most of the year, so it’s lost market share. With this, anhydrous demand has increased, and sales hit a record 5.56b liters to October this year.

Good News for the Mills…?

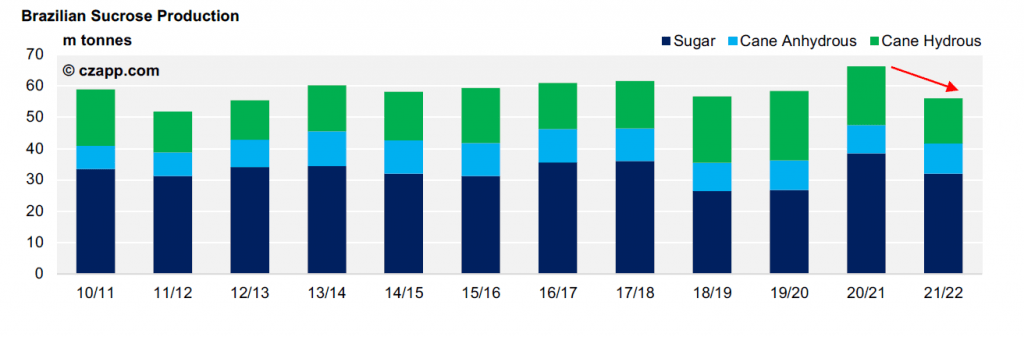

This should be good news for Brazil’s mills, but cane production was poor in 2021/22 following drought.

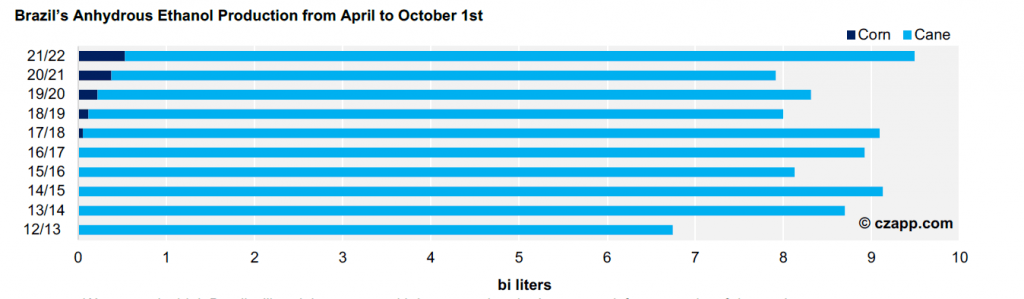

This hit the country’s ethanol production and it’s now unable to satisfy demand, even though it’s produced a record 9.5b litres of anhydrous so far this season.

We currently think Brazil will end the season with just enough anhydrous to satisfy two weeks of demand. This stock level sits well below that mandated by the Government, raising concerns around fuel supply.

Will the Government change the blend?

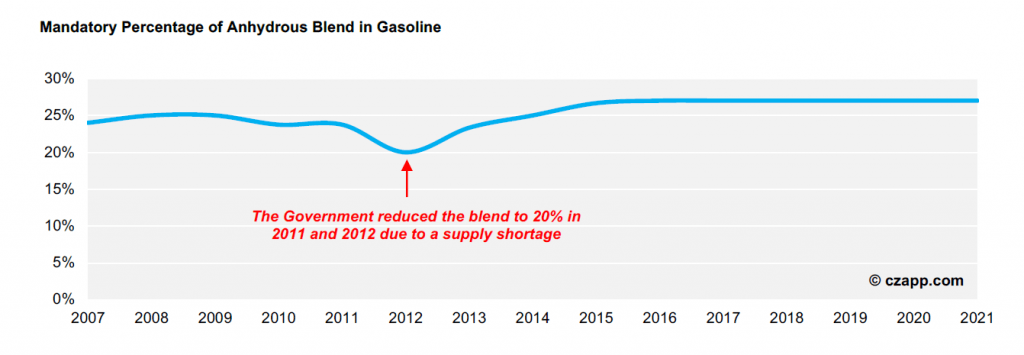

When anhydrous supply is tight, the Government can decrease the volume blended into gasoline; this happened in 2011 when stocks were at a similar level. The anhydrous blend is currently at 27% but this could drop to 18% if the Government decides to reduce it. The cane milling sector’s keen to avoid a reduction; after years of campaigning, the upper limit was raised from 25% to 27.5% in 2015.

A blend reduction could mean reduced anhydrous ethanol sales going forward, impacting long term profitability.

Producers Import to Boost Supply

Brazil’s ethanol producers are importing anhydrous ethanol from the world market at unprofitable levels. They seem to think this loss is worthwhile if it means the blend rate stays where it is. All in all, we think they’ll import around 600m liters across the next six months. If they do, closing stocks will sit above the minimum level mandated by the Government when the new cane harvest begins in Apr’22.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.