Insight Focus

- Imports of liquid sugar and premix powder remained high in October.

- But import margins have been squeezed further.

- With the start of the 2023/24 cane crushing, China does not need to rush to import.

Record October Liquid Sugar & Premix Imports

China is one of the world’s largest sugar importers. However, some buyers have struggled with high raw sugar prices in recent months. This has opened an opportunity for unconventional sugar imports.

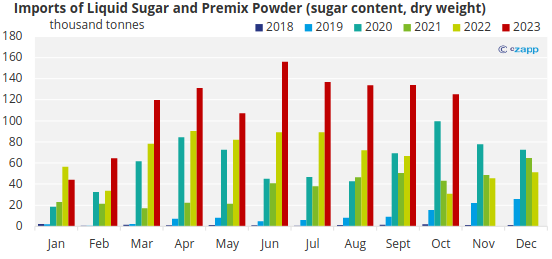

China imported a record 1.4m tonnes of white sugar, liquid sugar and premix powders in 2022/23. This trend has continued in October 2023, with liquid sugar and premix imports reaching 164k tonnes, the equivalent of 125k tonnes sugar. This was the fourth straight month of declining liquid/premix imports, but still the strongest ever October arrivals.

Source: China Customs, Czapp

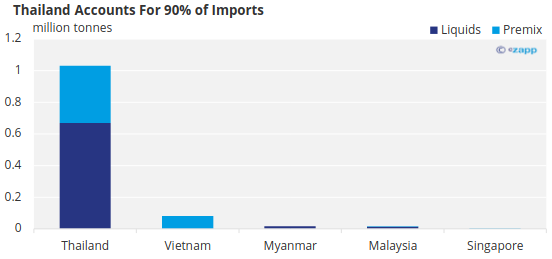

We believe that producers use mainly white sugar to make liquid and premix. This may help explain the strong performance of world market white sugar futures this year. Thailand accounts for 90% of China’s direct imports of liquid sugar and premixes. This year China has consumed more than 1m tonnes of Thai sugar through liquids and premixes, 13.5% of Thailand’s projected exports for 2023.

Source: China Customs, Czapp

White Sugar Imports Remain Strong

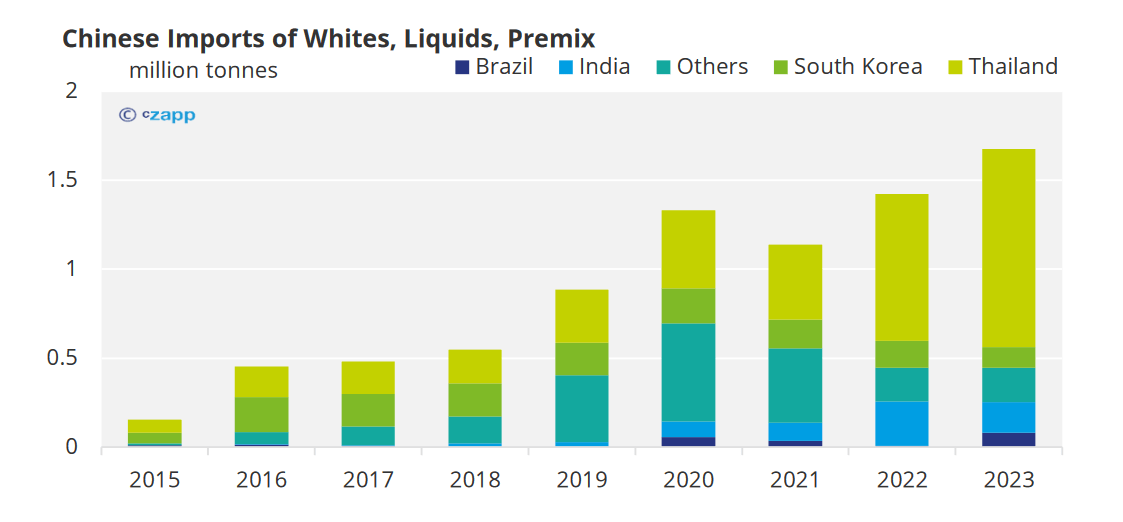

China imported 69k tonnes of white sugar in October, making it the second busiest month for imports this year. This probably dispels rumours that Chinese customs would restrict the import of white sugar into comprehensive bonded zones (CBZ) for use in the production of premix powder. January to October white sugar imports have reached 522k tonnes, a similar level to Jan-Oct 2022.

Source: China Customs, Czapp

Brazilian white sugar has emerged as a replacement for Indian white sugar, which is no longer available. This means that China’s demand for all white sugar (whites, liquids, premixes) from the world market has reached 1.7m tonnes by the end of October, 254k tonnes more than the whole of 2022.

Supply will be harder to find next year. Thailand will have less white sugar for export thanks for poor cane development. India may not export any sugar at all for the same reason. Will China need to compete for Thai sugar at higher prices? Or will it need to turn to other suppliers?

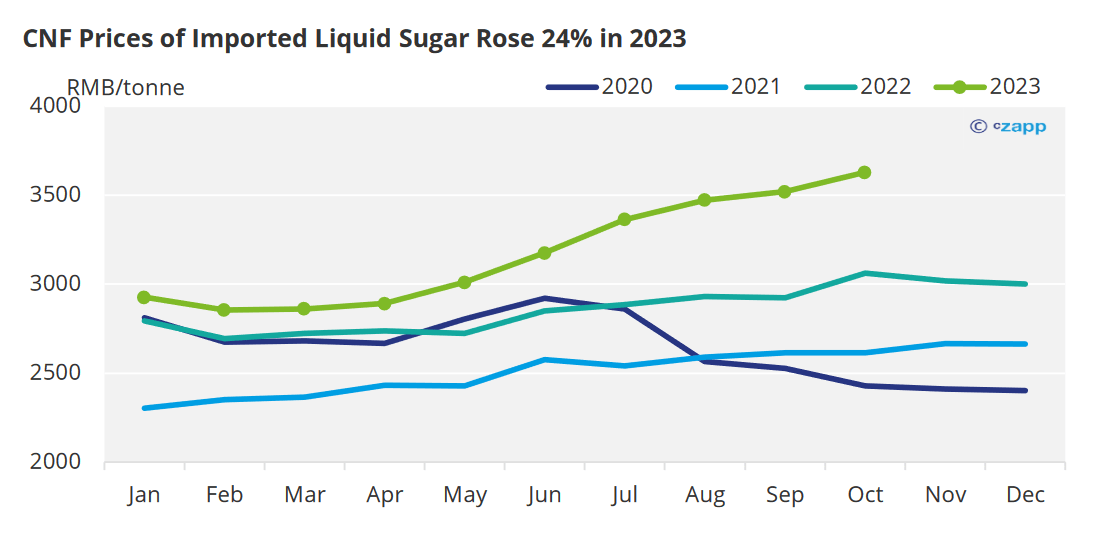

Import Margins Reduce

The Sword of Damocles still hangs over the market in the form of policy risk, but perhaps prices are doing their job. Import prices continue to climb. In October, the CNF price of liquid sugar reached RMB 3,659/mt, up 24% since the start of the year. Its import cost is now RMB 6,349/mt in sugar equivalent terms, while the domestic white sugar price is above RMB 7,000/mt.

Source: China Customs, Czapp

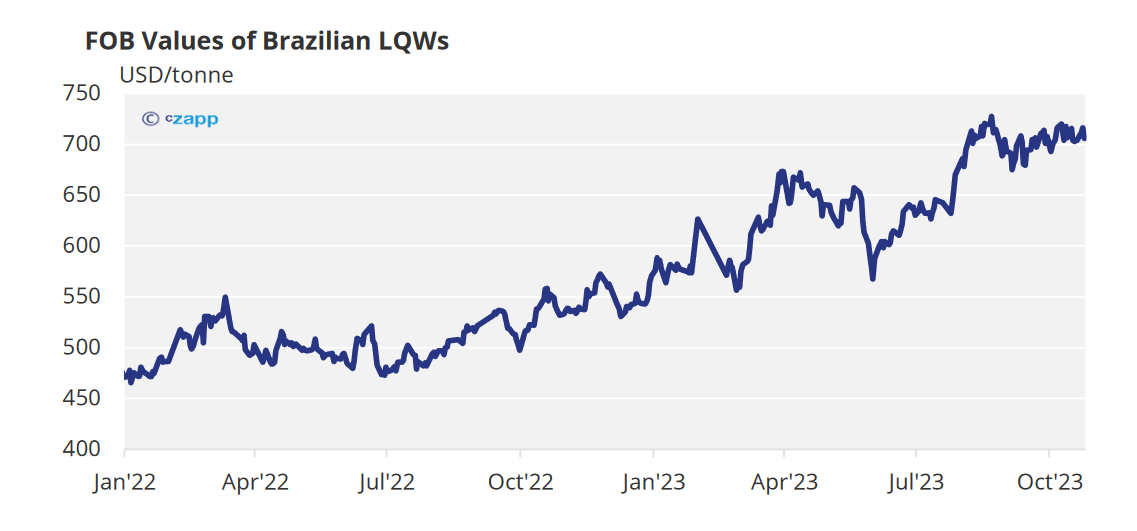

We’ve been hearing complaints from importers about their narrowing profit margins for liquid sugar and premixes. The price of high-colour white sugar in Brazil is now more than $700/mt FOB. At this price the cost of purchasing Brazilian white sugar, shipping it to a comprehensive protection zone to produce a premix powder, then finally exporting it to the Chinese market is close to RMB 7,000/mt, an unfeasible level.

Source: Czapp

Do Chinese Sugar Prices Need to Rise?

In the short term the Chinese market doesn’t need to worry about sugar supply. Domestic production from cane and beet will rise by almost 1m tonnes this year and average monthly production in the next three months will reach 2.4m tonnes.

Sugar prices therefore don’t need to rise to stimulate liquid sugar or premix imports in the short term. Interestingly, domestic sugar, which was once the most expensive sugar on the Chinese market, is now one of the cheapest. Sugar mills might achieve a sales margin of more than 16% based on today’s sugar prices.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.